South Korea is moving forward with reforming its national health insurance system to improve patients’ access to healthcare support under the Second Stage Comprehensive Insurance Plan, for the period 2024-28.

Ensuring the distribution of essential healthcare services and enhancing the financial sustainability of the national health insurance scheme has been the main goal of this new reform.

Despite positive changes in the healthcare and pharmaceutical industry led by the government proposal, South Korea is still experiencing difficulties in maintaining daily healthcare distributions, mainly driven by the doctor strike started at the end of February against the government’s new proposal to increase the annual medical student quota in 2024-25.

While the government claimed that the new proposal would strengthen the human forces in essential healthcare, doctor groups claimed that the current medical schools do not have sufficient resources to accept more students.

The doctor groups also urged the government to improve the work environment, especially in the essential care sectors instead of increasing the number of medical students.

Since the strike has lasted more than three months, hospitals have been forced to postpone the delivery of non-urgent healthcare services due to staff shortages.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe National Health Insurance Service (NHIS) agreed to increase the reimbursement rate for medical and healthcare services in 2025, hoping to improve the working environment in the public healthcare sector.

Unfortunately, increasing the reimbursement rate for healthcare services appears to not have solved the major controversy around the strike against the medical student quota.

In parallel, pharmacies reported concerns over decreasing incomes as patients have not been able to receive prescriptions in a timely manner.

In fact, patient groups have complained of difficulties in accessing needed treatments even before the doctor strikes.

Patient access to medical treatments has also been further hindered by delayed reimbursement decision-making.

Leading data and analytics company GlobalData‘s previous research showed that from local approval to time reimbursement for a branded drug in South Korea was reduced by 714 days, from 1,334 days in 2013 to 620 days in 2022.

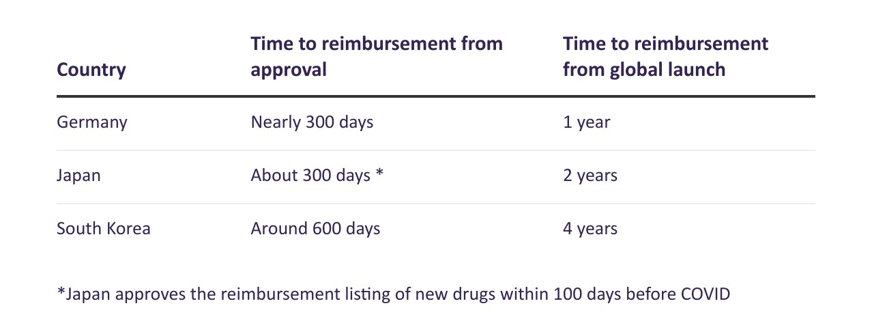

Despite this significant improvement in shortening its reimbursement review period, the waiting time between the global launch in South Korea for an innovative drug and being reimbursed in the country is still significantly longer than in other advanced markets such as Japan and Germany.

The Korean Research-based Pharma Industry Association recently reported that the average time for South Korean patients to receive globally launched drugs is four years while the average waiting time in Germany and Japan is a quarter and a half, respectively, of the time in South Korea.

The government has promised to further accelerate the review period for reimbursement applications with high clinical needs.

One notable strategy is the establishment of the ‘approval-evaluation-negotiation linkage system’, which was rolled out as a pilot programme last year.

Although the full guideline for the linkage system has not been released to the public, the Korean Ministry of Health and Welfare designated Recordati’s (Italy) Qarziba and Ipsen’s (France) Bylvay as the first two drugs to be eligible for the pilot programme.

Under the linkage system, a drug is able to be reviewed by the Health Insurance Review and Assessment Service (HIRA) and undergo price negotiation with the NHIS at the same time.

Based on the currently available information, a drug will be eligible for the new linkage system should it obtain a Global Innovative Products on Fast Track designation.

In the latest panel meeting held at the end of May 2024, the Cancer Disease Deliberation Committee (CDDC) of the HIRA approved the beneficial standard of Qarziba to be eligible for reimbursement in the indication of neuroblastoma, even though Qarziba has not received official approval in South Korea.

The CDDC approval is the first step towards reimbursement for a cancer treatment.

Drugs that passed the CDDC review will also need to be reviewed by the Drug Reimbursement Evaluation Committee of the HIRA and the NHIS before official listing.

This reimbursement review of Qarziba could provide a possible outlook on the implication of the new linkage since it is the first drug to pass first-stage HIRA review before receiving official approval while the influence of the new linkage system has been otherwise ambiguous due to lack of publicly available information.

In the same meeting, the CDDC panel began to review the funding requests for three patent-protected branded drugs with additional comments from hospitals and medical associations.

These drugs passed the CDDC review with recommendations from the medical society.

However, the CDDC currently only reviews additional indication applications with the comments advised by the medical society.

The comments provided by the medical society could serve as evidence regarding the clinical needs of those additional indication funding requests.

This article is produced as part of GlobalData’s Price Intelligence service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitors P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.