Eli Lilly (Indianapolis, IN, US) and Novo Nordisk (Bagsvaerd, Denmark) have announced that the supply of their GLP-1 weight loss drugs has improved, with the FDA shortages database now reporting increased availability of some doses of Zepbound, Mounjaro, Wegovy, and the diabetes drug Trulicity.

The situation is improving for GLP-1 receptor agonist supply, particularly for Lilly’s tirzepatide products, Zepbound and Mounjaro. However, it is too early to tell if the supply and demand dynamics have become more balanced in the long term. Fluctuating demand may still result in periodic supply tightness for certain presentations and dose levels as Lilly and Novo continue to expand drug production.

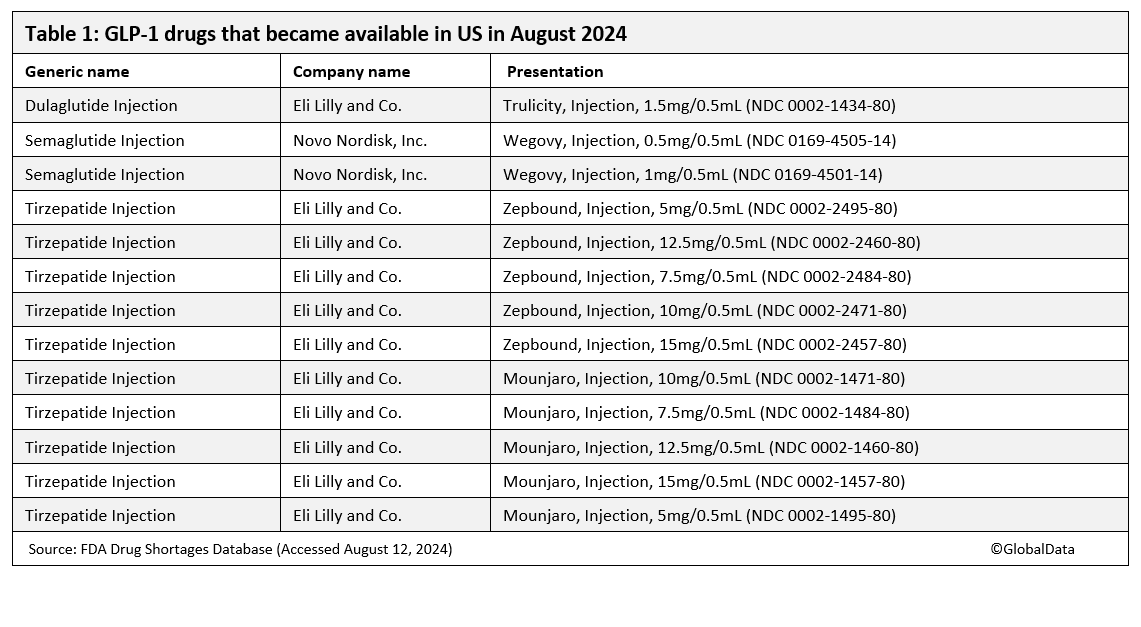

Most versions of Mounjaro and Zepbound injections are now available, Lilly reported to the FDA on 2 August, after a long period of limited availability. On the same date, Novo declared the availability of two versions of Wegovy (semaglutide) (0.5mg/0.5mL and 1mg/0.5mL). All versions of Ozempic (semaglutide) and most versions of Wegovy are now available in the US market. Lilly’s Trulicity (dulaglutide), approved for diabetes, also became classed as available for 1.5mg/0.5mL doses, although half the dosage concentrations in the US are still classed as limited availability. Three starter doses of Novo’s Wegovy (semaglutide) are still listed as having limited availability, with the estimated duration of shortage “to be determined”.

In other geographies, there are still supply issues. In Australia, Novo Nordisk has recently advised the TGA and the Ozempic Medicine Shortage Action Group (MSAG) that supply will remain limited for the rest of 2024. “There may be intermittent availability to continue in the short term,” Martin Havtorn Petersen, global media relations lead at Novo Nordisk, told GlobalData PharmSource. However, Wegovy is in “stable supply” in Australia, he said. Mounjaro and Trulicity are also in shortage or limited availability in Australia. EU shortages also exist for Novo’s Saxenda (liraglutide), Victoza (liraglutide), and Ozempic, and Lilly’s Trulicity.

Petersen elaborated on the supply situation: “Novo Nordisk continues to supply all Wegovy dose strengths to the US market. We have been running our facilities 24 hours a day, seven days a week and have doubled our investment to build new manufacturing sites to increase our production capacity. Based on this, we are making progress and continue to increase supply.”

He continued: “Four of the five dose strengths (0.5mg, 1mg, 1.7mg and 2.4mg) are now available, but we will continue to manage shipments of the 0.25mg starting dose of Wegovy, to responsibly initiate patients on treatment consistent with our commitment to patients and focus on continuity of care.” To ease the shortages, Lilly has also told doctors not to start new patients on some doses of its drugs.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHow have shortages been resolved?

Lilly has been expanding its manufacturing capacity for tirzepatide by opening production at its existing facilities, buying factories, and building new ones. Dave Ricks, CEO of Eli Lilly, discussed plans to enhance production in a Q2 2024 earnings call on 8 August 2024, stating that “our top priority remains executing on our ambitious manufacturing expansion agenda. In May, we announced plans to invest an additional $5.3bn in our Lebanon, Indiana, manufacturing sites….Importantly, this expansion will enhance the capacity to manufacture active pharmaceutical ingredients for Zepbound and Mounjaro. Since 2020, we have committed more than $18bn to build, upgrade, or acquire facilities in the US and Europe, and we began to see the benefit of these investments.”

He continued: “We are making near-term progress to ramp production, including at new sites like Research Triangle Park, existing Lilly sites, and contract manufacturing organizations. Our Concord, North Carolina, site is progressing well. We’re in the process of running validation and expect this facility will initiate production by the end of 2024 with product available to ship in 2025.”

The pharmaceutical supply chain for GLP-1 medications is complex, as they require refrigeration (2°C to 8°C) and come in different doses. These factors will continue to play a role in the availability of these drugs at the pharmacy counter.

In the earnings call, Ricks noted that supply challenges will continue as demand increases for tirzepatide. “[B]ut product is flowing and it’s flowing at a pretty high rate. We’re shipping part of it, and you can see that in these results from the quarter. So, vials will add to that picture, but demand will increase as well. So, I think we’re doing well given the situation. But the end pharmacy experience will continue to be choppy. We point that out to the FDA.”

Eli Lilly announced on August 8, 2024, that it expects a significant increase in its full-year revenue projections by $3bn following an improvement in the supply of its diabetes and obesity medications leading to a stock bump. The company expressed “increased confidence” in its ability to ramp up production for the remainder of the year. Its GLP-1 portfolio, including Mounjaro, Zepbound, and Trulicity, contributed half of the company’s quarterly sales.

Meanwhile, Novo Nordisk underwhelmed investors despite reporting substantial growth. It reported a net profit at DKr20.05bn ($2.9bn) in the second quarter, but that was below forecasts, which indicated a projection of DKr20.9bn–DKr22.6bn ($3.1bn-$3.3bn). The chief financial officer for Novo Nordisk, Karsten Munk Knudsen, explained that pharmacy rebates were higher than expected, impacting sales of Wegovy in the second quarter, and described it as a “quarterly blip”.