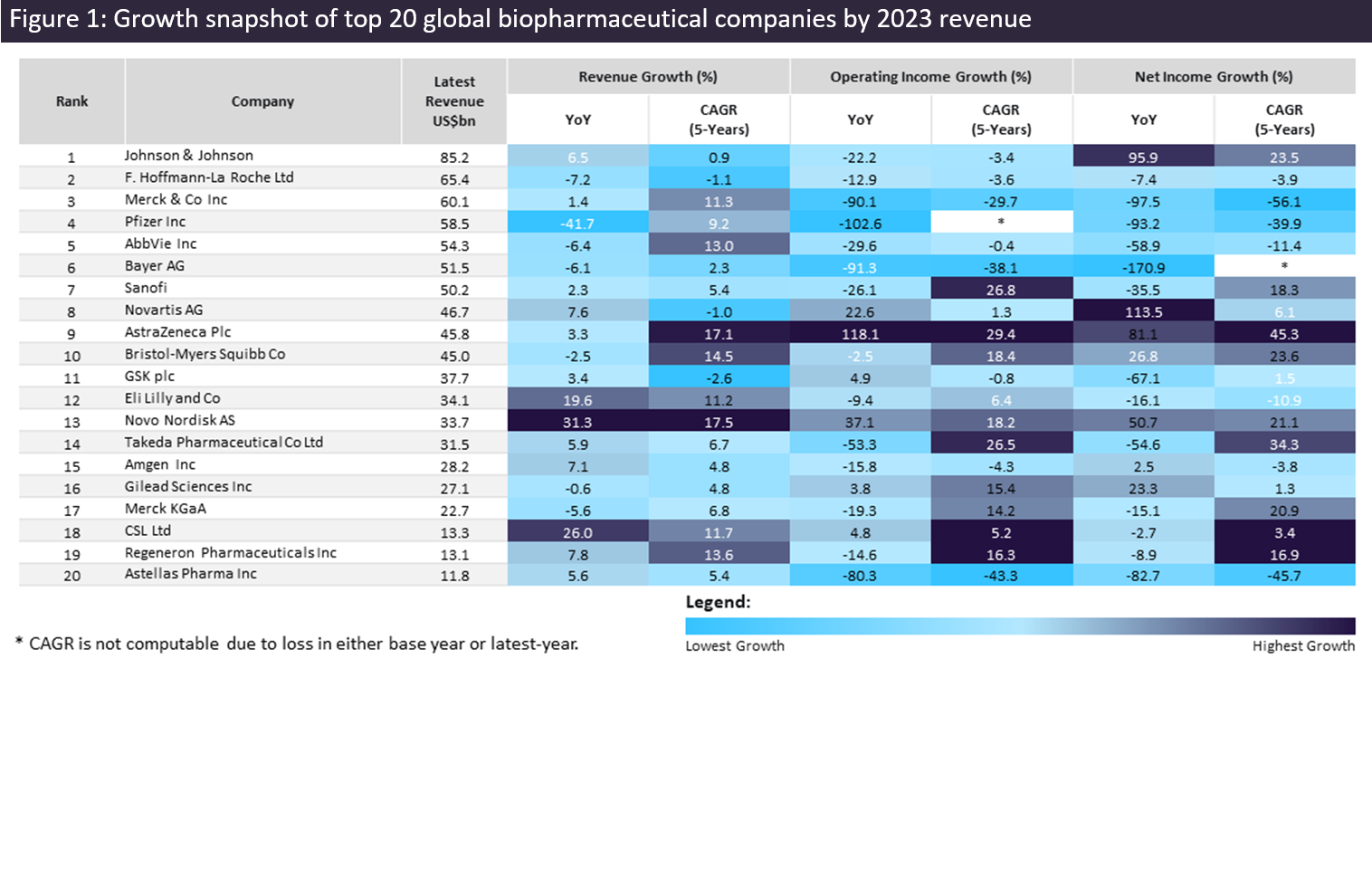

The biopharmaceutical industry experienced varied revenue shifts in 2023, with significant success for companies with obesity drugs. Over half (13) of the top 20 publicly traded global innovative biopharmaceutical companies witnessed revenue growth in 2023, with Novo Nordisk, CSL, and Eli Lilly reporting year-on-year (YoY) revenue growth of 31.3%, 26%, and 19.6%, respectively. Despite this, the fluctuations in revenue have resulted in an overall 1.6% decline in aggregate revenue to $816bn from 2022 to 2023, according to GlobalData, a leading data and analytics company.

Novo Nordisk experienced the highest revenue growth of 31.3% to $33.7bn, driven by the strong success of its obesity and diabetes blockbuster drugs Ozempic (off-label for obesity) and Wegovy, achieving global sales of $13.9bn and $4.6bn in 2023, respectively. Similar to Novo Nordisk, the success of Lilly’s obesity and diabetes drugs Mounjaro (off-label for obesity) and Zepbound fueled its revenue growth to $34.1bn, with combined global sales of $5.3bn reported in 2023.

Mounjaro, Zepbound, and Ozempic are expected to surpass MSD’s Keytruda in global analyst consensus sales by 2030, due to the surging demand for weight loss drugs. Projected sales for Mounjaro, Zepbound, and Ozempic are $27.4bn, $27.3bn, and $22.4bn, respectively, compared to $21.3bn for Keytruda, according to GlobalData’s Drugs Database.

Other blockbuster drugs that drove Lilly’s revenue growth were breast cancer drug Verzenio and diabetes drug Jardiance, which recorded global sales of $3.9bn and $2.7bn in 2023, respectively. Meanwhile, CSL’s immunoglobulin products Privigen and Hizentra contributed to 50% of its total revenue, achieving global sales of $4.7bn.

Pfizer recorded the largest revenue decline of 47.7% in 2023, due to waning demand for its Covid-19 products – Comirnaty and Paxlovid – which reported YoY decline in global sales of $26.4bn and $17.5bn, respectively. As a result of Pfizer’s revenue decline, Johnson & Johnson regained its frontrunner position on the list, delivering a revenue growth of 6.5% to $85.2bn in 2023.

Similar to Pfizer, MSD also experienced diminishing sales of its Covid-19 drug Lagevrio, which registered a 77% decline in global sales to $193m. However, the continued success of its blockbuster drug Keytruda facilitated its marginal revenue growth of 1.4% to $60.1bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSix out of the top 20 companies achieved YoY operating profit growth in 2023, with those reporting greater than 20% operating profit growth, including AstraZeneca (118.1%), Novo Nordisk (37.1%), and Novartis (22.6%). AstraZeneca’s operating profit growth was driven by a reduced impact from the unwinding of the inventory fair value uplift on the Alexion acquisition on its earnings before interest, taxes, depreciation, and amortization (EBITDA) compared to the previous year. The strong success of Novo Nordisk’s obesity and diabetes drugs facilitated its operating profit growth, while Novartis witnessed operating profit growth from higher net sales, lower restructuring charges, and income from legal matters. On the other hand, Pfizer (-102.6%), Bayer (-91.3%), MSD (-90.1%), Astellas (-80.3%), and Takeda (-53.3%) reported more than 50% decline in their operating profit in 2023.

Five players reported over 25% growth in net profit, with Novartis (113.5%), Johnson & Johnson (95.9%), AstraZeneca (81.1%), and Novo Nordisk (50.7%) reporting more than 50% growth. Novartis’s growth was driven by its operating income growth and non-recurring favourable tax impacts, with Johnson & Johnson’s growth due to spinning off its Consumer Health business, now known as Kenvue.

Meanwhile, 13 players reported YoY decline in profitability, with Merck & Co. (-97.5%), Pfizer (-93.2%), Astellas (-82.7%), GSK (-67.1%), AbbVie (-58.9%), and Takeda (-54.6%) reporting a more than 50% decline. Merck & Co.’s and Pfizer’s decrease in operating income (MSD: -90.1%; Pfizer: -102.6%) and net income (MSD: -97.5%; Pfizer: -93.2%) were attributed to increased R&D investment and plummeting sales of its Covid-19 products, respectively.

Following the decline in demand for Covid-19 products, the top biopharmaceutical companies that reaped success have shifted to those that have developed obesity drugs in 2023 such as Lilly and Novo Nordisk. Obesity drugs are poised for continued sales growth in 2024 onwards; however, this may be limited by supply chain issues due to the surging demand. In addition, the biopharmaceutical industry faces ongoing challenges from expected revenue declines following patent expirations and subsequent generic drug competition.