Mind-altering psychedelic drugs such as lysergic acid diethylamide (LSD) and ‘magic mushrooms’ are moving into the pharmaceutical mainstream and creating substantial opportunities for contract manufacturing organisations (CMOs) with controlled substance handling qualifications. Regulators have recently approved clinical trials and even marketing authorisations for these chemicals, as doctors incorporate them into regimens for widely prevalent indications such as post-traumatic stress disorder (PTSD). Physicians hope their use will help reduce opioid prescriptions to combat the addiction epidemic.

Psychedelics (also known as serotonergic hallucinogens) are compounds with appreciable serotonin 2A receptor agonist properties that can alter consciousness in a marked and novel way. Naturally occurring psychedelics are N, N-dimethyltryptamine (DMT), mescaline, psilocybin, Tetrahydrocannabinol (THC) and LSD. Synthetic psychedelics also exist. These substances tend to also be classed by their structure: tryptamines (structurally resembling serotonin), phenethylamines (structurally resembling epinephrine and norepinephrine), and ergolines (derived from ergot).

Amphetamine-based psychedelics such as Adderall (amphetamine aspartate + amphetamine sulfate + dextroamphetamine saccharate + dextroamphetamine sulfate) have long been used as therapeutics, and now researchers are exploring other psychedelics, either repurposing illicit drugs or by altering the chemical structures of marketed pharmaceuticals to produce safer and more predictable results.

In the latter category, the US Food and Drug Administration (FDA) and European Medicines Agency (EMA) approved Johnson & Johnson’s Spravato (esketamine) in 2019 for treatment-resistant depression, their first approval of a psychedelic treatment for a psychiatric disorder in both the US and EU. Esketamine is derived from the anesthetic ketamine. Similarly, the nontoxic and nonhallucinogenic chemical cousin of ibogaine, named DLX-7, has shown success in preclinical studies by Delix Therapeutics for anxiety, depression and addiction.

Drugs such as MDMA, psilocybin and LSD are traditionally considered to be recreational but are increasingly being used in medical research. GlobalData’s Clinical Trials database shows at least 51 trials were initiated for psilocybin, ten for MDMA and six for LSD from 2019 to 2021. The closest to market are Mind Medicine MindMed‘s LSD product in Phase II for major depressive disorder, attention deficit hyperactivity disorder (ADHD), cluster headache and anxiety disorders, and the Multidisciplinary Association for Psychedelic Studies’ MDMA product (midomafetamine) in Phase III for PTSD in the US and Canada. Psilocybin is the active constituent in what are commonly known as ‘magic mushrooms,’ a naturally occurring chemical compound that is increasingly seen as highly safe and effective in treating many forms of mental illness and substance use disorder. It is currently in Phase II trials for treatment-resistant depression and alcohol addiction for Braxia Scientific and Psychiatric Centre Copenhagen.

Psychedelics contracts and CMO opportunities

Imprisonment for psychedelic possession increased after 1986 when President Reagan signed the Anti-Drug Abuse Act. This allotted $1.7bn to the ‘War on Drugs’ and established mandatory minimum prison sentences for specific drug offences. Many of the strict legal and social stances formed against psychedelic drugs in the 1980s have begun to relax. On 11 January 2022, the International Therapeutic Psilocybin Rescheduling Initiative (ITPRI) was launched, a global coalition working to promote and secure a rescheduling of psilocybin under the 1971 United Nations Convention on Psychotropic Substances.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCMOs have already secured manufacturing agreements for marketed psychedelics such as Takeda Pharmaceuticals’ Mydayis ER (amphetamine aspartate + amphetamine sulfate + dextroamphetamine saccharate + dextroamphetamine sulfate), where Cambrex is producing the active pharmaceutical ingredient (API) and Patheon is manufacturing the finished dosage form.

Controlled substance capabilities include very strict security for the production and storage of the active substance, as well as vetting of the personnel involved in the active substance manufacture. Perimeter fencing, steel vaults and electronic monitoring are the kinds of requirements an API manufacturer of a Schedule II drug would need to provide. In the US, the Drug Enforcement Administration (DEA) classifies chemicals into five schedules depending upon the drug’s acceptable medical use and the drug’s abuse or dependency potential. The abuse rate is a determinate factor in the drug’s scheduling; for example, Schedule I drugs have a high potential for abuse and the potential to create severe psychological and/or physical dependence with no currently accepted medical use. Examples of Schedule I drugs include heroin, LSD, marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone and peyote. If any of these substances were to become FDA-approved, their associated DEA schedule would have to be lowered.

GlobalData’s Contract Service Provider database shows there are 254 dedicated CMOs (only contract manufacturing) and an associated 416 facilities worldwide permitted to handle DEA-scheduled products. Only 144 of these sites can carry out Schedule I manufacture, with 280 facilities able to produce Schedule II and III substances.

In an online Biotech Showcase conference session on 10 January called ‘Psychedelics: Once Stigmatized, Are Now the Newest Therapeutics on the Block for Mental Health’, industry experts said that even if these drugs are approved, their accessibility and the scalability of the regimen to all patients will be an issue and potentially reduce their use among any potential treatment population. For the greatest level of benefit, psychotherapy is also needed during trials and that creates an additional requirement that will limit scalability in the marketplace compared to traditional treatment models, which only require the patient to consume medicines. Walter Greenleaf, Neuroscientist and Medical Technology Developer at Stanford University, elaborated on the alternative approach: “It really does drive home the point that this is different to other pharmaceutical interventions in the field of mental health; this coupling of experience with the therapeutic process, and that added extra complexity.”

Speaking at the same conference, Adam Gazzaley, Professor at Neurology, UCSF Weill Institute for Neurosciences, stated: “The interesting thing is that we don’t have a lot of lab-generated data on the ideal setting of how patients interact with individual differences and dosage, so that’s an important area of research and development both within the academic and the industry and foundation level.”

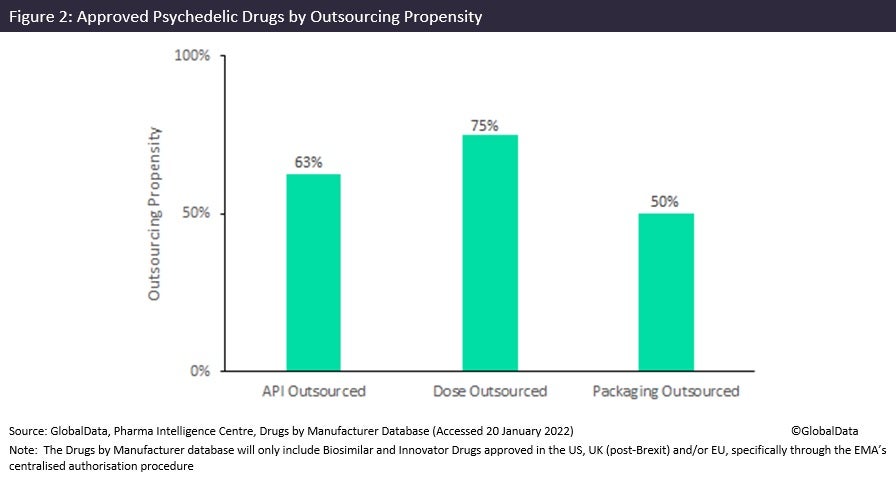

There are already 138 marketed psychedelic drugs worldwide, with four in late stages of development (Phase III and pre-registration) treating a range of indications such as attention deficit hyperactive disorder (ADHD), narcolepsy and major depressive disorder. The majority of marketed psychedelics are generic forms of a few unique drugs commonly used for pain relief and ADHD. The potential market for psychedelics is huge: according to GlobalData’s Epidemiology database, there are 29.2 million cases of PTSD and 116.6 million cases of ADHD in 2020 across the 16 major markets.

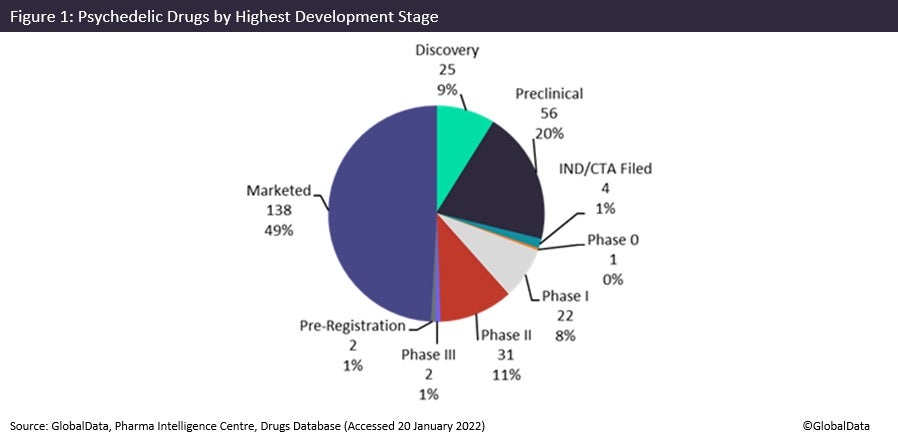

Controlled substance capabilities and facility requirements can be prohibitively expensive. Small-cap pharma companies are not able to possess or purchase these kinds of sites, so CMOs have a good chance to generate business by owning controlled substance capabilities. As observed in the figure above, a significant proportion of innovator psychedelic drugs approved in the US, UK (post-Brexit) and/or EU are outsourced, with dose manufacturers being outsourced for 75% of related drugs.