By 2029, respiratory syncytial virus (RSV) drugs are forecast to surpass $9bn in sales, a growth of over $8bn from 2023. This surge in sales can be attributed to recent developments in preventative measures. May 2023 saw the world’s first approval of two RSV vaccines: Arexvy by GSK and Abrysvo by Pfizer. However, they are not the only prophylactic treatments hoping to stake a claim in the market ahead of the RSV season in September, with Modernas’s mRNA-1345 and AstraZeneca’s Beyfortus also on the horizon.

RSV is a common infectious disease of the lungs and respiratory tract that can cause further health problems such as bronchiolitis and pneumonia. Although infections in healthy children and adults are less severe, certain patient groups, such as children with lung disease, the elderly, or the immunocompromised, may experience life-threatening symptoms, with RSV causing 14,000 deaths in the US per year. Until recently, there were no approved prophylactic treatments available. In 2023, the FDA approved the first two prophylactic vaccines within the same month: GSK’s Arexvy and Pfizer’s Abrysvo. These are both subunit vaccines indicated for the prevention of lower respiratory tract disease caused by RSV in individuals aged 60 and over.

However, these vaccines are not the only preventative measures looking to dominate the RSV market over the next seven years, with the top four highest-grossing treatments all indicated prophylactically.

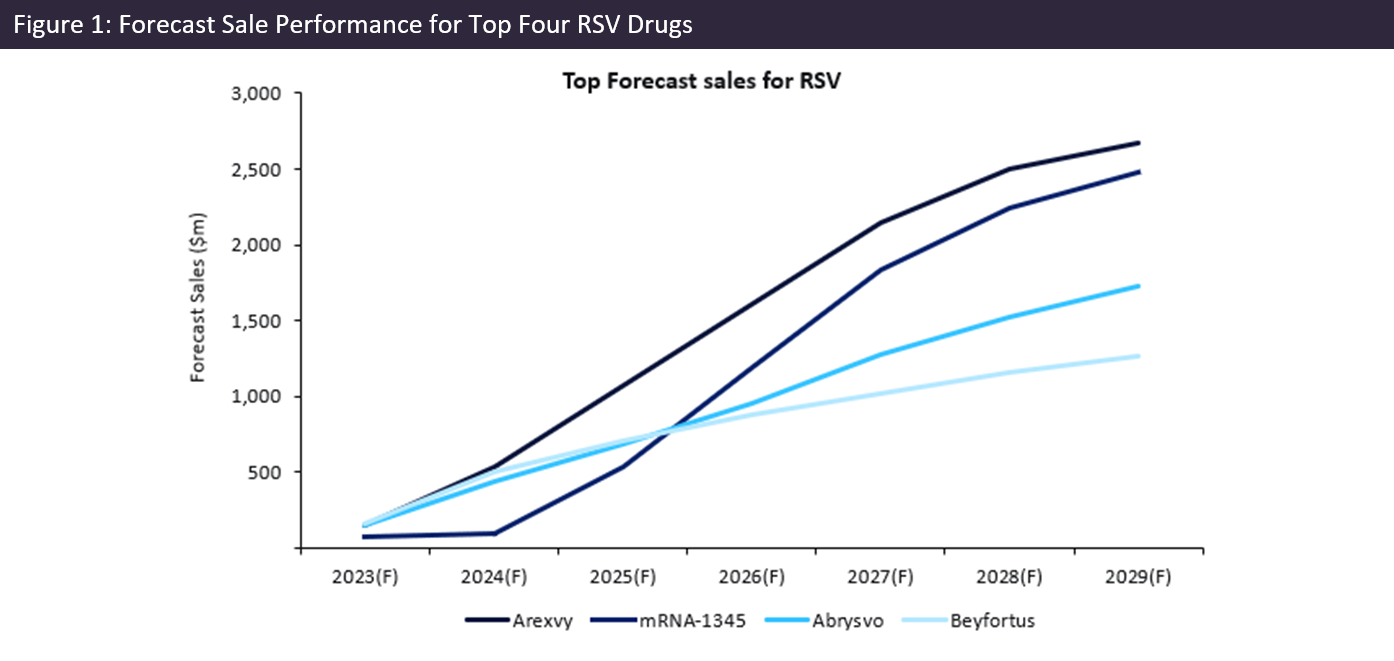

Following US and EU approval in May and June 2023, respectively, Arexvy is projected to climb steadily and emerge as a market leader, according to GlobaldData’s Sales and Forecast tool (Figure 1). This vaccine is forecast to retain the top spot over a seven-year forecast, ultimately generating more than a quarter of total global RSV market sales, with just over $2.5bn in 2029.

Despite also receiving US approval in May, Abrysvo is still awaiting EU approval. It is forecast to achieve sales of $1.7bn, securing third place, behind Moderna’s mRNA-1345.

Unlike the aforementioned subunit vaccines, mRNA-1345 is an mRNA-based vaccine that is currently awaiting approval in Australia and the EU for children and adults. As displayed in the figure, this drug is expected to launch in 2024 and experience exponential growth, reaching sales of $2.4bnin 2029.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAfter receiving EU approval late last year and US approval on July 17, 2023, Astrazeneca’s Beyfortus is set to reach global sales of $1.27bn. This recombinant monoclonal antibody is the world’s first treatment indicated for disease prevention in infants during their first RSV season.

These four therapies make up 90% of total forecast sales in 2029 and are the main drivers of the significant increase in the global RSV market, which is expected to rise from $781 million in 2023 to $9.09 billion in 2029.

With the leading four RSV treatments, all indicated prophylactically and eager to establish themselves before the start of the fall season, the RSV market is poised to become a major pharmaceutical battleground over the next seven years. Fierce rivalry is to be expected, and the prospect of additional drug approvals, including geographical and maternal vaccinations, will grant treatments a competitive edge and a favourable position in the market.