In recent years, GLP-1 receptor (GLP-1R) products have gained immense popularity. Currently, four innovative GLP-1Rs are approved worldwide for obesity, all of which are injectables. This leaves a gap in the obesity market for an oral GLP-1R product. 63 drugs are in active development, with four Phase III products racing to earn the inaugural approval in this untapped market.

Obesity, defined as excessive fat accumulation resulting from an imbalance between energy intake (diet) and expenditure (physical activity), has reached epidemic proportions. By 2030, half of all US adults are predicted to be obese, according to the New England Journal of Medicine. This alarming trend presents a lucrative opportunity for drugmakers.

The success of GLP-1R-targeting drugs highlights their viability as a treatment approach. Currently, there are four innovative GLP-1Rs approved for obesity: Novo Nordisk‘s two blockbusters Wegovy and Saxenda, Eli Lilly’s Zepbound and Shanghai Benemae Pharmaceutical’s Yishengtai. However, all four are approved as injectables.

Novo Nordisk is leading the pack

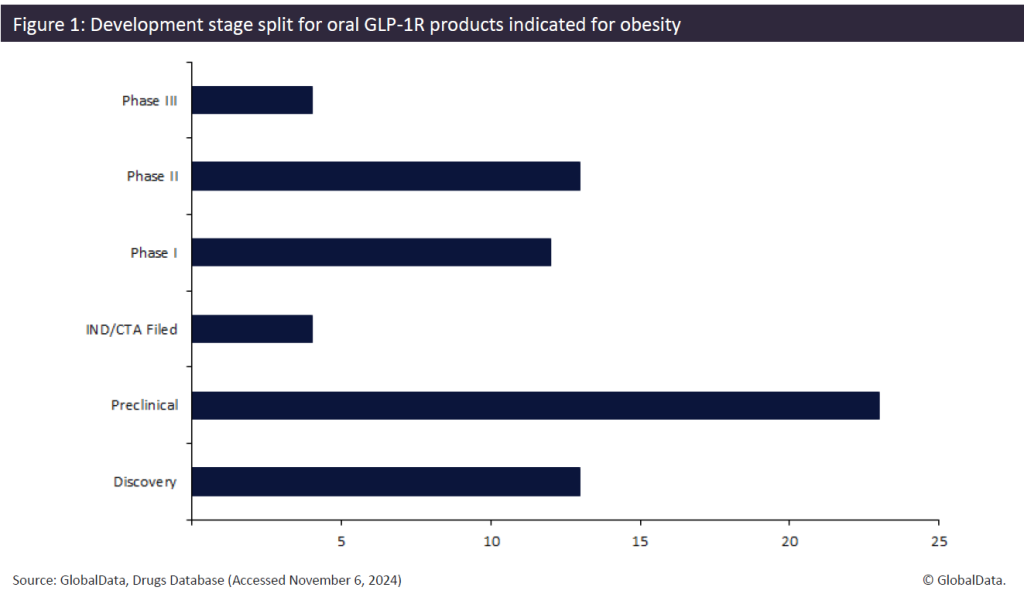

This route of administration is associated with negative attributes, such as the requirement to attend a professional clinic, highlighting the appeal of oral alternatives that offer convenience, lower development costs, and simpler marketing. Companies are therefore developing oral drugs to enter this untapped market. This pipeline is gaining momentum, with 63 active GLP-1Rs. This includes four Phase III drugs striving to become the first oral therapy approved for obesity (Figure 1).

Novo Nordisk and Eli Lilly, respectively the developers of Wegovy and Zepbound, are looking to expand their GLP-1R portfolios and cement their positions as frontrunners within this category. Novo Nordisk is leading the pack with four separate products – two apiece in Phase III and Phase II. Their Phase III product Rybelsus, already US Food and Drug Administration-approved for cardiovascular risk factors and type 2 diabetes, is being positioned for a label expansion to include obesity.

Novo Nordisk’s novel Phase III candidate, NN-9932, which has an expected launch by the end of 2025, has the highest probability of success among all drugs in this category, with a 35% likelihood of approval. Eli Lilly’s lone Phase III candidate, orforglipron calcium, has two firsts as the initial oral GLP-1R approved for obesity and gaining the first GLP-1R approval for a small molecule. With a projected launch in 2026, it represents Eli Lilly’s bid to expand the company’s dominance in the GLP-1R category.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataOral therapies will reshape the landscape

China-based Jiangsu Hengrui’s HRS-9531 is the final Phase III contender and the only one not being developed by pharma giants Novo Nordisk or Eli Lilly. This highlights the increasing interest from global players in entering the competitive oral GLP-1R market.

With expected drug sales for GLP1Rs in obesity estimated to surpass $126 billion by 2030, this drug category presents a lucrative market for drug developers. Novo Nordisk and Eli Lilly have already reaped substantial rewards in the injectable segment. However, the emergence of oral therapies is reshaping the landscape. With 63 active products in the pipeline, the race for the first approval is intensifying.

Nevertheless, Novo Nordisk and Eli Lilly are positioned at the forefront,

striving to capitalise on their already successful GLP-1R portfolios and solidify their dominance in the market.