An analysis of GlobalData’s analyst consensus sales and forecast database reveals that three out of 12 novel oncology brands that launched globally from November 2022 to December 2023 have the potential to reach blockbuster sales.

These drugs are Eli Lilly’s Bruton’s tyrosine kinase inhibitor Jaypirca for chronic lymphocytic leukaemia (CLL), Genmab/AbbVie’s anti-CD3/CD20 bispecific antibody Epkinly/Tepkinly for B-cell non-Hodgkin’s lymphoma (B-NHL), and Johnson & Johnson’s (J&J’s) anti-CD3/GPRC5D bispecific antibody Talvey for multiple myeloma (MM).

This analysis only includes brands with the first reported/forecasted 2023 sales values.

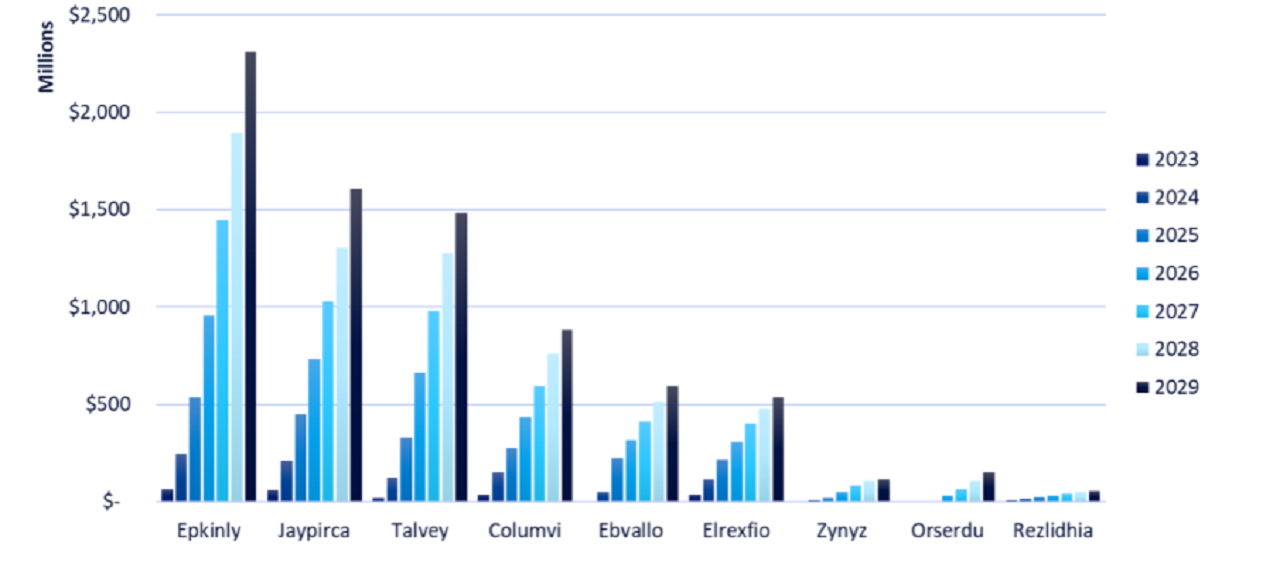

The brands with the strongest 2023 launches are Epkinly with $65m and Jaypirca with $61m.

Other notable 2023 launches include Roche’s Columvi, a CD3/CD20 competitor to Epkinly, with $37m; Pfizer’s Elrexfio, a CD3/BCMA bispecific for MM, with $35m, and Forma Therapeutics’ Rezlidhia, an isocitrate dehydrogenase 1 inhibitor, for relapsed/refractory acute myeloid leukaemia.

In 2029, Epkinly is projected to grow to sales of $2.3bn and Jaypirca is projected to grow to sales of $1.6bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWhile Talvey had a weaker 2023 with sales of $18m, having launched later in the year (August), it is projected to reach sales of $1.5bn in 2029.

All these potential blockbusters are marketed for haematological malignancies.

CLL, MM, and B-NHL are all huge markets that have been known to unlock billions in revenue for drugs that offer adequate efficacy.

J&J’s CEO has reported that the company’s aim for Talvey is to double the Wall Street forecasts for 2027, which would put Talvey close to $2bn in sales by 2027.

Also, given the completely novel target that allows patients refractory to other classes of drugs to still respond to Talvey, it would not be surprising to exceed Wall Street expectations.

Epkinly and Columvi will compete fiercely for the same indications, and Epkinly’s one-month first-mover advantage in the US market for diffuse-large B-cell lymphoma is not enough to justify a peak forecast that is nearly three times larger, with sales of $883m for Columvi versus $2.3bn for Epkinly.

The difference in these therapies lies in other attributes, the different clinical trial strategies to support label expansions in various B-NHL settings, and the route of administration, which is subcutaneous for Epkinly and intravenous for Columvi.