Pfizer (New York, New York) and Moderna’s (Cambridge, Massachusetts) Omicron-specific Covid-19 vaccines are in late-stage development, have demonstrated good efficacy against the variant and will likely be available to the public later this year to provide an additional booster and increase demand for injectable manufacturing.

Despite the advanced stage of Covid-19 vaccination programmes in richer countries, which would suggest an approaching drop-off in contract manufacturing demand, there is still a considerable need for variant-specific boosters. Once new vaccines for the Omicron variant are approved, they will partly make up for the waning interest in older Covid boosters in developed markets.

The Omicron variant spreads more easily than earlier variants of the virus that cause Covid-19, including the Delta variant, and also has the ability to sometimes evade immunity from vaccines, previous infection, or both. The first case of Omicron was announced on 24 November last year in South Africa, with the first positive sample dating back to 9 November. Vaccines were developed from the original SARS-CoV-2 strain but the variants that exist today are very different from this original strain.

Pfizer’s Omicron vaccine aiming for autumn boosters

On 25 June, Pfizer and BioNTech (Mainz, Germany) reported pivotal Phase II/III data demonstrating the safety, tolerability and immunogenicity of two Omicron-adapted vaccine candidates. This data has been shared with regulators, including the US Food and Drug Administration (FDA), and a request for US Emergency Use Authorisation (EUA) is planned.

Pfizer completed a submission to the European Medicines Agency (EMA) for an Omicron-adapted bivalent Covid-19 vaccine candidate, based on the BA.1 sub-lineage on 19 July.

Mikael Dolsten, Pfizer’s chief scientific officer, told Goldman Sachs’ 43rd Annual Global Healthcare Conference on 15 June: “The upgraded vaccine is about two weeks from now. There will be another impact that we want to discuss and that would be what should be the schedule for this fall. And we are very prepared and have data that will answer those questions, what would be the advantage of shifting to an Omicron-containing vaccine, whether it’s monovalent or bivalent.” Bivalent vaccines work by stimulating an immune response against two different antigens, whereas monovalent vaccines only target one antigen. Currently approved Covid-19 vaccines are monovalent.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataDolsten continued: “We think most experts in the field at the moment tend to believe that going to a bivalent will address the fundamental request to protect against the previous and the current existing strains and to the evolving, rapidly growing Omicron substrains.”

Two Pfizer vaccines that specifically target the Omicron variant have been granted ‘provisional determination’ by Australia’s drugs regulator, the first step in the process of getting the vaccines approved for use.

Moderna ready to compete with Pfizer for new variant business

On 11 July, Moderna announced Phase II/III clinical data for its bivalent Omicron booster candidate, mRNA 1273.214, which is an adapted version of Moderna’s approved Spikevax vaccine. The booster dose elicited a significantly higher neutralising antibody response against Omicron subvariants BA.4 and BA.5 compared with the currently authorised Moderna booster, regardless of prior infection status or age.

The EMA started a rolling review for this Omicron-adapted vaccine on 27 June and the FDA plans to review the vaccine for EUA.

Regulators are well-disposed to these boosters. Pierre Delsaux, director of the EU’s Health Emergency Preparedness and Response Authority, told a European Parliament hearing on 13 July that no matter which bivalent vaccine is eventually chosen, it will provide better protection against BA.4 and BA.5 Omicron subvariants than currently available shots. Similarly, last month, the FDA recommended that vaccine manufacturers add Omicron BA.4 and BA.5 spike protein components to their current vaccine compositions to create a two-component booster, so that the modified vaccines can potentially be used from later this year.

Australia’s Therapeutic Goods Administration (TGA) granted a provisional determination in April to Moderna’s Omicron jab, and in July to Pfizer’s Omicron jab. Receipt of a provisional determination is a prerequisite of the provisional approval pathway but does not guarantee acceptance of the submission for registration or successful provisional registration. Australia could become one of the first countries to administer an Omicron-specific vaccine.

Injectables and their packaging requirements have never been more important to marketed treatments, given the volume of vaccines being packaged that are required to tackle the Covid-19 pandemic, as well as the rising presence of biologics in pipelines and their marketed approvals.

Commercial dose manufacturing

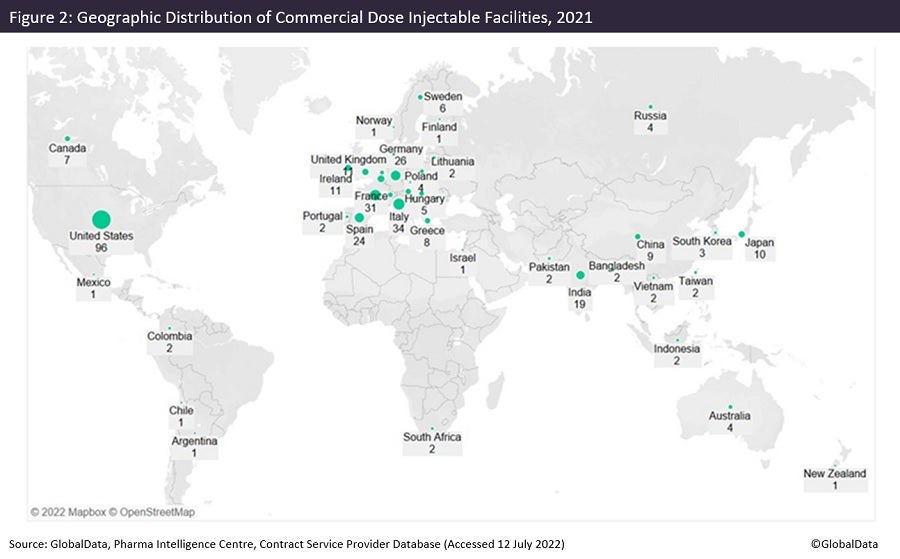

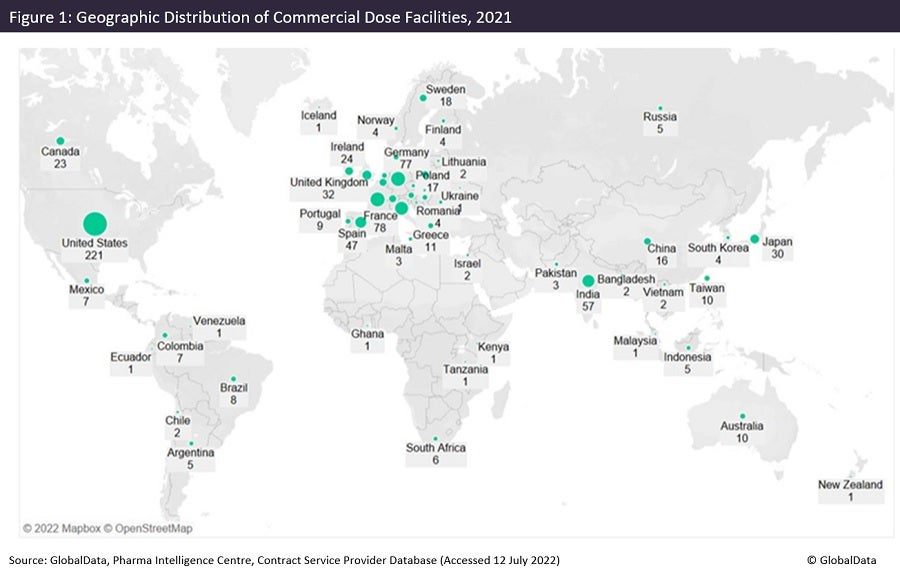

Figures 1 and 2 are taken from an upcoming GlobalData publication entitled Contract Pharmaceutical Dose Manufacturing Industry: Composition, Size, Market Share and Outlook – 2022 Edition. They show that commercial dose contract manufacturing organisations (CMOs) that manufacture a client’s pharmaceutical finished dosage form to supply to the highly regulated markets of the US, Canada, the EU and Japan have their manufacturing sites focused primarily in the US and Europe.

The US has the largest number of associated commercial dose facilities, while Pfizer has the most commercial dose facilities in the US. Approximately 36% of US commercial dose manufacturing facilities have containment capabilities, suggesting a high level of specialisation; the country has a similar proportion of containment facilities as India and Germany. Although the UK has fewer facilities, around 70% of those offer dose manufacturing with containment.

Injectable sites receiving investment now and in the future

Of all contract dose manufacturing facilities in the US, 43% offer injectable manufacture. Investment into injectable facilities has continued into this year. Jubilant HollisterStier (Spokane, Washington) has signed an agreement for $149.6m with BARDA (Washington DC). Jubilant will double its injectable filling capacity in Spokane at a cost of $193m, to be completed by 2025. Panpharma (Luitre, France) will invest more than €17m ($18m) in an automated vial line that will double production capacity at its plant in Trittau, Germany. The expansion will be operational in 2024.

Hanns-Christian Mahler, CEO of ten23 health (Basel, Switzerland), elaborated on future considerations for injectable manufacturers in a presentation during the Small Volume Parenteral Packaging from an Extractable & Leachable Perspective virtual symposium on 31 March. He stated: “Therapeutic modalities are becoming more and more diverse and will require different solutions for primary packaging, so we are looking at complex proteins, gene therapy, oligonucleotides, cell therapy, and exosomes, just to list a few.” In the talk, named Primary Packaging Considerations from a Biologics Product Development Perspective, Mahler continued: “There will be more focus on patient and healthcare professionals regarding delivery and usability, so drug device combinations like autoinjectors will become more common.”

These factors will no doubt influence investment in specialities and equipment in injectable manufacturing facilities, which will require further funding and development to accommodate changing demand.