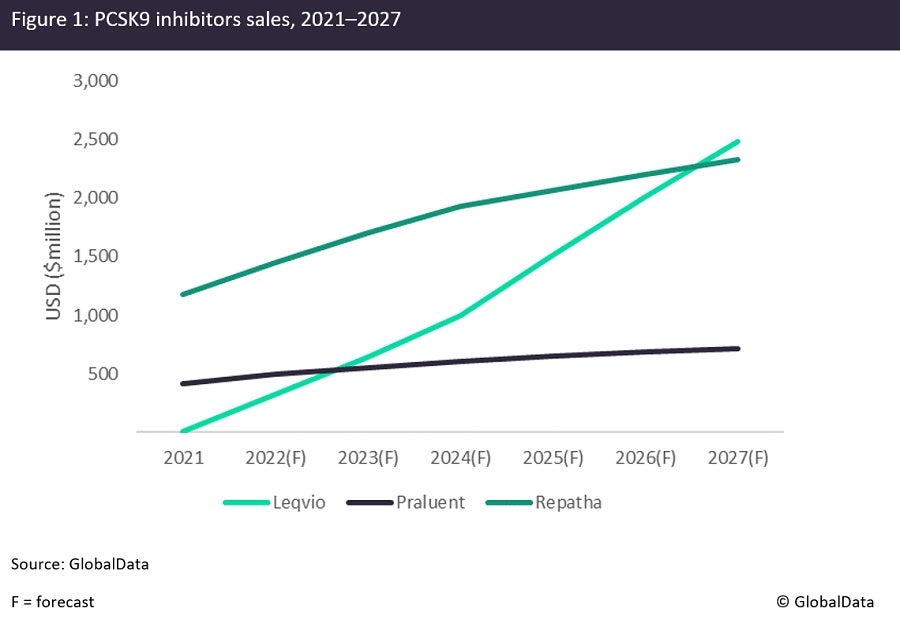

According to the analyst consensus forecasts from GlobalData’s Pharma Intelligence Centre, the third-to-market proprotein Convertase Subtilisin/kexin type 9 (PCSK 9) inhibitor, Novartis’s Leqvio (inclisiran), which launched in the US in December last year, is poised to surpass the sales of two veterans from this class, Sanofi/Regeneron’s Repatha (evolocumab) and Amgen’s Praluent (alirocumab), by 2027 (see Figure 1). GlobalData believes that one of the main reasons behind the analysts’ optimism is that Leqvio is injected twice per year and may, therefore, prove more convenient than the competitor drugs, both of which are injected twice a month. In addition, Novartis’ experience in the cardiovascular space and physicians’ familiarity with the company’s heart failure drug Entresto (sacubitril + valsartan) may offer Novartis the edge in this space. Despite this, the absence of a long safety record and the hefty price of around $6,500 a year, which is slightly higher than Repatha’s and Praluent’s current prices, might still present barriers to the drug’s uptake.

All three cholesterol-lowering drugs target PCSK9, although Leqvio does so in a different manner, by degrading the mRNA molecules used to translate genetic instructions into proteins, while Repatha and Praluent are monoclonal antibodies that inhibit PCK9 activity. Each drug is approved for people with heart disease who cannot control their cholesterol levels with statins and for patients with genetic disorders that lead to high levels of cholesterol.

Novartis acquired The Medicines Company for $9.7bn in November 2019, mainly because it saw Leqvio as a potentially transformational medicine for the treatment of atherosclerotic heart disease and familial hypercholesterolaemia. Nucleic acid-based therapies have, until recently, primarily targeted rare diseases caused by certain gene mutations. This is one of the first examples where broader patient populations in the cardiovascular and metabolic disease space are targeted with such a therapy.

Originally upon launch in 2015, Sanofi priced Praluent at $14,600 a year, while Amgen launched Repatha in 2016 at $14,100. This turned out to be a gross miscalculation and companies faced big obstacles with pharmacy benefit managers, leading the companies to slash the prices to less than $6,000 in 2018. Leqvio might be in a better position because it is administered by a healthcare professional, while Praluent and Repatha are injections that patients can give themselves at home; therefore, Leqvio’s reimbursement will be routed through the medical benefit pathway, meaning the majority of patients would be eligible for Leqvio with no copays at launch.

GlobalData believes that Leqvio may surpass the success of Repatha and Praluent due to its administration convenience coupled with Novartis’ strong relationship with cardiovascular specialists. The next few months will, however, give a hint as to whether the company got the pricing right, given that it is still unknown whether the drug will improve cardiovascular outcomes for patients more drastically than Repatha and Praluent do. Novartis is awaiting results from the ongoing ORION-4 cardiovascular outcomes study, which should show an association of lower cholesterol levels with improved cardiovascular outcomes. The study’s primary completion date is estimated for July 2026.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData