Mergers and acquisitions (M&As) in the biopharmaceutical industry involving companies developing drugs showed a 20% increase in total deal volume in the first quarter (Q1) of 2024 compared to Q1 2023, according to leading data and analytics company GlobalData’s Pharma Intelligence Center Deals Database.

In Q1 2024 alone, the total deal value for M&A deals reached $43.5bn, with a 71% increase in megadeals that were valued at $1bn or more.

Despite the US Department of Justice and the Federal Trade Commission (FTC) releasing stricter guidelines about regulating M&As in December 2023, the recent trend signals a return in dealmaking confidence as big pharma companies also look to mitigate challenges such as the Inflation Reduction Act and steep patent cliffs.

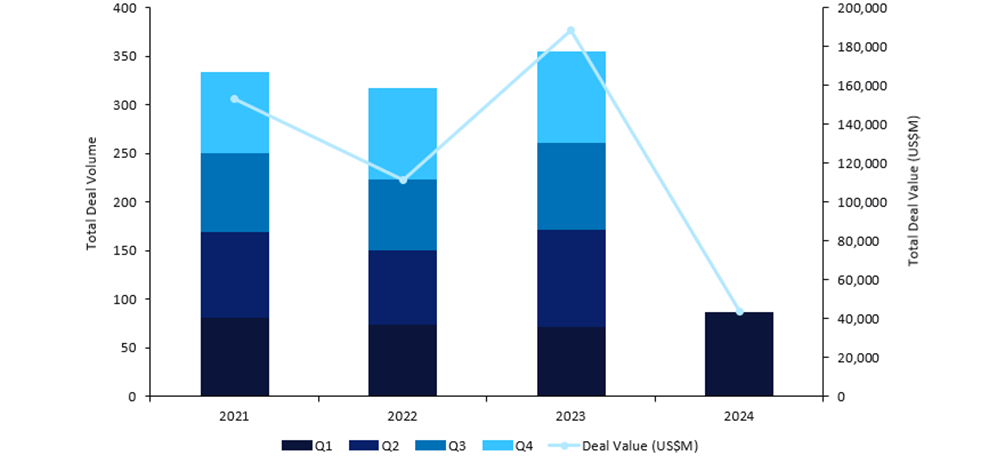

The rebound in biopharmaceutical M&A deals was also seen in total deal value from 2022 to 2023, with an increase of $76.9bn, as shown in Figure 1.

GlobalData’s recent State of the Biopharmaceutical Industry 2024 report also revealed that the surveyed healthcare industry professionals expected mega M&A deals to be one of the factors to have the greatest positive impact on the pharmaceutical industry in 2024.

The largest M&A transaction reported in Q1 2024 was Novo Holdings’ acquisition of US-based contract development and manufacturing organization Catalent for $16.5bn, which was announced in February 2024.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNovo Holdings is Novo Nordisk’s holding and investment company.

Other notable M&As include Gilead Sciences’ $4.3bn acquisition of US-based company CymaBay Therapeutics, which was completed in March 2024, and Novartis’ $2.9bn acquisition of German oncology-focused biopharmaceutical company MorphoSys, which was announced in February 2024.

Companies developing antibody-drug conjugates (ADCs) and radiopharmaceuticals attracted a high flow of M&A investment continuing into Q1 2024, with large pharmaceutical companies seeking to replenish portfolios with those sought-after drug classes.

Examples include Johnson & Johnson’s $2bn acquisition of US-based ADC company Ambrx Biopharma, which was completed in March 2024, and AstraZeneca’s $2bn acquisition of US-based radiopharmaceutical company Fusion Pharmaceuticals, which was announced in the same month.

Oncology was the top therapy area for M&A deals in Q1 2024, with a total deal value of $29bn.

However, immunology-focused M&As had the largest growth in deal activity compared to Q1 2023, with a 314% surge in deal value in Q1 2024 totalling $14bn.

Q1 2024 has had an increase in billion-dollar M&A transactions involving large biopharmaceutical companies such as Gilead and Novartis.

Given that the biopharmaceutical industry can overcome challenges imposed by the FTC, the remainder of 2024 is poised for continued M&A investment from large biopharmaceutical companies, which could accelerate research and development and the launch of innovative drugs.