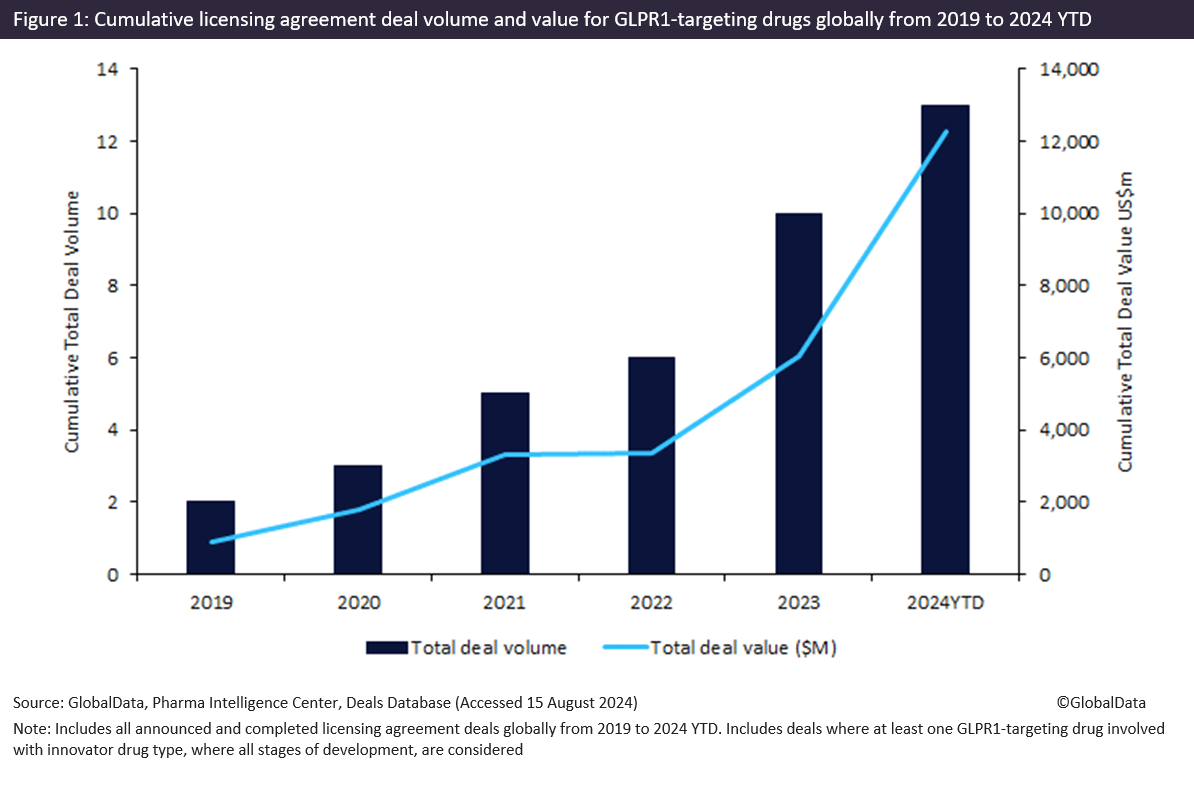

Innovator drugs targeting glucagon-like peptide-1 receptor (GLP1R) witnessed a 595% increase in total licensing agreement deal value from 2019 to 2024 year-to-date (YTD), with more than $6.2bn forged in 2024 YTD, according to GlobalData’s Pharma Intelligence Center Deals Database.

GLP1R agonists are currently used for the treatment of type 2 diabetes (T2D) and obesity to stimulate insulin secretion and inhibit glucagon release, resulting in lowered blood glucose levels. In addition, GLP-1R agonists activate neurons expressing GLP1R that promote satiety, resulting in reduced food intake and subsequent weight loss. Novo Nordisk’s GLP1R agonists Wegovy and Ozempic (both semaglutide), and Eli Lilly’s dual GLP-1R/GIPR agonists Mounjaro and Zepbound (both tirzepatide)—both injectables—have dominated the market over the past few years, achieving combined global drug sales of $47.6bn in 2023, according to GlobalData’s Pharma Intelligence Center Drugs Database. The success of these marketed drugs has sparked enthusiasm among biopharmaceutical companies that are looking to challenge Novo Nordisk and Lilly’s market positions, with over 120 GLPR1 drugs in clinical trials and 150 in preclinical and discovery stages. Drugmakers developing new GLP1R drugs aim to enhance efficacy, extend dosing intervals, target multiple indications other than T2D and obesity, and improve dosage via oral form. Pharmaceutical companies with GLPR1 drug candidates in clinical development include Pfizer’s Phase I once-daily oral GLPR1 agonist danuglipron, Amgen’s once-monthly injectable Phase II GLP1R/GIPR bispecific maridebart cafraglutide and MSD’s injectable GLPR1/GCGR dual agonist efinopegdutide currently in Phase II trials for metabolic dysfunction-associated steatohepatitis (MASH).

According to GlobalData’s Pharma Intelligence Center Deals Database, licensing agreements for innovator drugs targeting GLP1R secured a cumulative total deal value of $12.2bn from 2019 to 2024 YTD, with approximately two-thirds in Phase I to III clinical trials and a third in early-stage preclinical and discovery.

Metabolic disorders were the top therapy area for licensing agreements involving GLP1R-targeting drugs, with a total deal value of $10.5bn from 2019 to 2024 YTD. This was followed by cardiovascular with $6bn in total licensing agreement deal value and gastrointestinal with $4.5bn, demonstrating the expansion of the GLP1R drug class for indications beyond T2D and obesity.

Of note, licensing agreements for innovator drugs targeting GLP1R witnessed a resurgence in activity of over $6bn in total deal value from 2022 to 2024 YTD (shown in Figure 1 above), where 2024 YTD has already achieved the highest total deal value in a year, signalling a renewed interest in the GLPR1 drug class.

In May 2024, Chinese pharmaceutical giant Jiangsu Hengrui Medicine Co. out-licensed ex-China rights for its portfolio of GLPR1 drugs to newly established biotech Hercules CM NewCo based in the US. This portfolio included HRS-9531, a GLRP1/GIP dual agonist that is currently in Phase III and II trials for obesity, T2D, and diastolic heart failure, and is being developed in oral and subcutaneous formulations. The companies’ collaboration is valued at up to $6bn, representing the largest licensing agreement involving GLPR1 drugs of all time.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn November 2023, biotech Eccogene, based in China, signed a licensing agreement with AstraZeneca worth over $2bn. AstraZeneca will gain ex-China rights to Eccogene’s oral GLPR1 agonist ECC-5004, which is currently in Phase I trials for obesity and T2D and also in preclinical testing for MASH. Under the agreement, AstraZeneca will also co-develop and co-commercialize ECC-5004 in China alongside Eccogene.

In light of market leaders Ozempic and Mounjaro, there has been a recent increase in licensing agreements involving innovator drugs targeting GLP1R, particularly mega-deals worth billions of dollars. This trend may drive innovation, particularly in the development of dual or tri-agonists which have demonstrated increased efficacy by targeting other novel targets involved in the disease pathways alongside GLP1R, leading to additive therapeutic effects. With several GLP1Rs currently in clinical trials, the priority for success will include being the first to bring an oral GLPR1 agonist to market and to exceed the safety and efficacy benchmark established by Novo Nordisk and Eli Lilly.