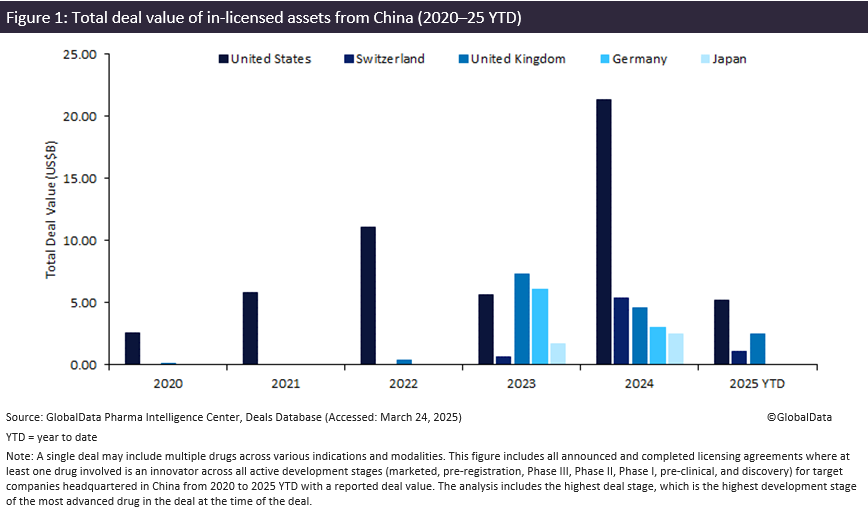

Licensing agreements for Chinese drug candidates have surged, with large pharma in-licensing 28% of innovator drugs from Chinese biopharma companies in 2024. The total deal value of innovator drug licensing agreements involving Chinese biopharma licensors has surged 66%, from $16.6 billion in 2023 to $41.5 billion in 2024, reaching a five-year high, according to GlobalData’s Pharma Intelligence Center Deals Database. Increased Chinese government investments in biopharma innovation, faster and more affordable clinical trials and improved drug quality all make licensing from China more efficient and cost-effective. Biopharma companies globally have turned to licensing agreements as a strategy to access innovative drugs and strengthen pipelines as merger and acquisition investment declined in 2024.

However, the proposed US BIOSECURE Act (potentially to be enacted in 2025) would prohibit federal funding for US biotech using Chinese biotech services. Additionally, the America First Investment Policy (announced on 21 February 2025) aims to restrict Chinese investments in the US biotech sector and proposes tariffs on China that could further strain supply chains and increase costs. These measures could increase geopolitical tensions, limiting Chinese biopharma’s access to US funding, partnerships and market opportunities.

US licensing of innovator drug candidates from Chinese biopharma companies has grown since 2020, with total deal value for these agreements surging 280%, up from $15.7 billion in 2023 to $21.3 billion in 2024. The top three therapy areas involving innovator drug licensing were oncology, immunology and metabolic disorders in 2024 (totalling $22.2 billion), according to GlobalData’s Pharma Intelligence Center Deals Database.

In December 2024, Merck expanded its oncology pipeline, licensing LM-299, a Phase II PD-1/VEGF bispecific antibody, from LaNova Medicines in a deal worth up to $3.28 billion. Biopharmaceutical companies increasingly focus on licensing monoclonal antibodies and antibody-drug conjugates (ADCs), expanding their portfolios with advanced targeted therapies. Monoclonal antibody licensing from China rose 43% to $11.3 billion, while ADC licensing grew 10% to $10 billion in 2024. In January 2024, Novartis signed a $4.35 billion deal with Shanghai Argo Biopharmaceutical, securing an exclusive licence outside Greater China for a Phase I/IIa cardiovascular asset and a global licence for another Phase I asset, with options for two more. The agreement reflects large pharma leveraging small interfering RNA (siRNA) and RNA technology for targeted therapeutics.

US biopharma companies may face restrictions on acquiring Chinese drug candidates if drug licensing is part of the America First investment policy, potentially slowing innovation within US pipelines. Meanwhile, rising trade barriers, including a 20% tariff on Chinese goods and a potential 25% tariff on pharmaceuticals, could further increase costs, ultimately leading to higher drug prices. While China remains a hub for biopharma innovation, regulatory shifts may disrupt cross-border partnerships and reshape how US companies access Chinese drug candidates.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData