Bispecific T-cell engagers (BiTEs) are a rapidly emerging new therapeutic.

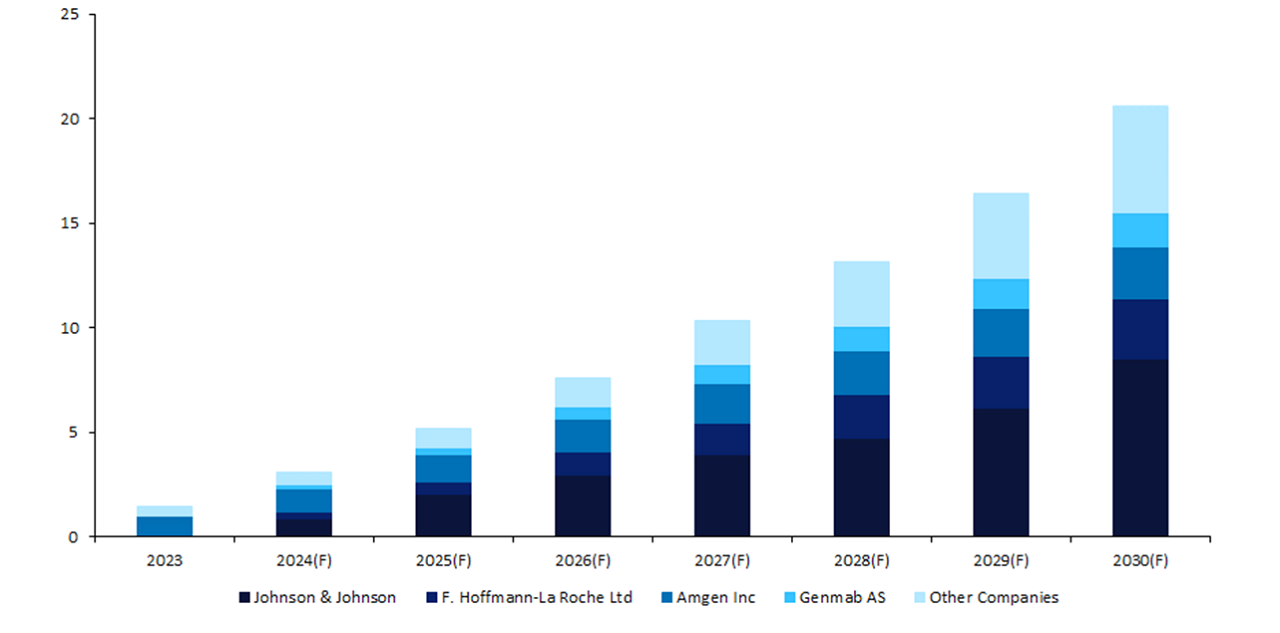

By 2030, this drug category is forecast to generate $20.6bn, an increase of 1,320% from 2023.

Pharma giant Johnson & Johnson (J&J) is predicted to dominate this market, as its products, Tecvayli and Talvey, are forecast to become the two top-selling BiTEs by 2030, encompassing 40% of all sales in this category.

BiTEs are a novel class of cancer therapeutics, which simultaneously bind to a distinct antigen on tumour cells and a surface molecule on T-cells, crosslinking these different cell types.

Via T-cell engagement, BiTEs activate the immune system, resulting in the death of a tumour cell.

Currently, there are nine approved BiTEs globally.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEight of these drugs received their first approval in 2022, highlighting the very recent acceptance of this molecule type.

Amgen’s Blincyto, which received US Food and Drug Administration (FDA) approval for B-cell lymphoblastic leukaemia in 2014, was the highest-selling BiTE in 2023, with $897bn.

In 2023, BiTEs collectively generated $1.45bn in global sales.

By 2030, this value is expected to increase 13-fold, where BiTEs are forecast to generate $20.6bn, as mentioned above (Figure 1).

Tecvayli and Talvey are both monoclonal antibodies approved for multiple myeloma.

Tecvayli’s first approval was from the FDA, in August 2022. Talvey’s first approval came 12 months later, also by the FDA.

These products both interact with cluster of differentiation 3-positive T cells to activate the immune system.

Tecvayli redirects the T cells to cancer cells expressing the B-cell maturation antigen, whereas Talvey interacts with G protein-coupled receptor, class C, group 5, member D-positive cancer cells.

This redirection of the T-cells induces the death of the respective tumour cells.

Leading data and analytics company GlobalData’s sales and forecast tool estimates Tecvayli and Talvey to begin generating revenue in 2024, and to collectively generate $890m.

By 2030, Tecvayli is forecast to be the top-selling BiTE, with $6.4bn in global sales. Talvey is estimated to become the second top-selling BiTE, with $2bn.

These two top-selling BiTEs are forecast to collectively generate $8.4bn for J&J, an 854% increase from the forecast values of 2024.

As such, J&J’s BiTE portfolio is estimated to dominate total BiTE sales, ultimately encompassing 40% of the $20.6bn market.

Roche is predicted to be the second top company in the 2030 BiTE market, with three products generating $2.9bn.

Its top product, Columnvi, is forecast to generate $1.7bn, becoming the third top-selling BiTE behind Tecvayli and Talvey.

Despite marketing three drugs compared to J&J’s two, Roche’s total BiTE portfolio is forecast to be one-third the value of J&J’s portfolio, highlighting the dominance and estimated success of Tecvayli and Talvey.

With an expected total sales growth of 1,320% from 2023 to 2030, BiTEs are a rapidly growing drug type.

J&J is estimated to dominate this drug category, with the two top-selling BiTEs, Tecvayli and Talvey, encompassing 40% of the total market.