International reference pricing (IRP), also known as external reference pricing (ERP), is one element commonly used when setting the price of medicines in different markets. Some countries will also use IRP to help determine the eligibility of certain products for reimbursement. There is a growing awareness, however, of the repercussions of IRP, including drug shortages, market prioritisation, launch delays and smaller markets risking higher prices than what is sustainable. As concerns around IRP continue, it is apparent IRP is not disappearing but instead adapting based to current market forces. As such, IRP policies are constantly going through new iterations. GlobalData therefore continues to review these changes and has highlighted several key features from IRP trends in 2024. This also includes an archetype and segmentation analysis of global IRP policy trends.

In 2024, IRP continued to adapt. Most recent iterations of IRP in different markets are looking to address the current themes of drug shortages by introducing greater flexibility within the pricing mechanism. These adjustments, however, have been balanced in the last year with the tightening of other cost-containment policies. IRP has also been implicated in the rolling out of universal health insurance in new markets in 2024.

GlobalData identified 40 IRP-related developments during the year. Common themes seen in IRP reforms included reforms to protect against the worst impacts of IRP and also incorporate best practices. Only one market in 2024 introduced IRP as part of its pricing mechanism – Panama, which introduced it with a basket size of 10 markets. Bulgaria looked to expand its IRP practices, introducing it for non-reimbursed infectious disease medicines. Other markets have removed IRP. For example, Germany passed the Medical Research Act in 2024, a consequence of which was the removal of IRP from price negotiations following benefit assessment for eligible drugs. These are events that influenced IRP procedures and have changed the archetype dynamic of IRP in the last year. To gain a greater insight into the dynamics of IRP, GlobalData has covered several archetype scenarios below.

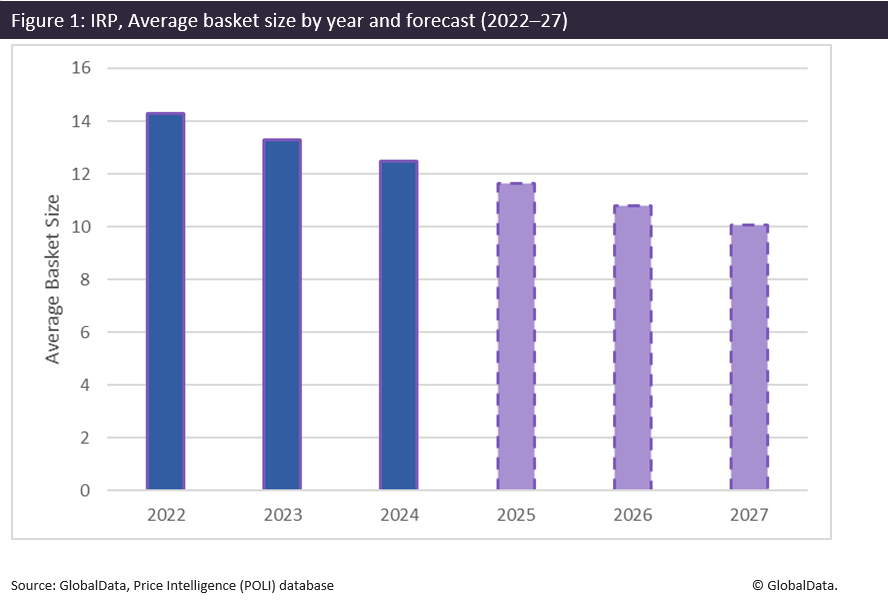

GlobalData currently monitors more than 75 markets that use IRP to set medicine prices. With this coverage, changes in certain trends in basket size, formula, frequency of IRP application and types of drugs impacted by IRP are identifiable. One key trend seen not just in 2024 but over the last few years is the simplification of basket sizes, as many countries look to streamline and simplify the basket of markets used for IRP. This was the case for Oman in 2024, which reduced its basket size from 31 markets down to 18 to improve efficiency, and is one of several markets to do so over the last few years. In 2022, the average basket size was 14.3, declining to 13.3 in 2023 and 12.49 in 2024. The graph below provides estimates of the average basket size between 2025 and 2027 if this average reduction in basket size continues at the assumed erosion rate.

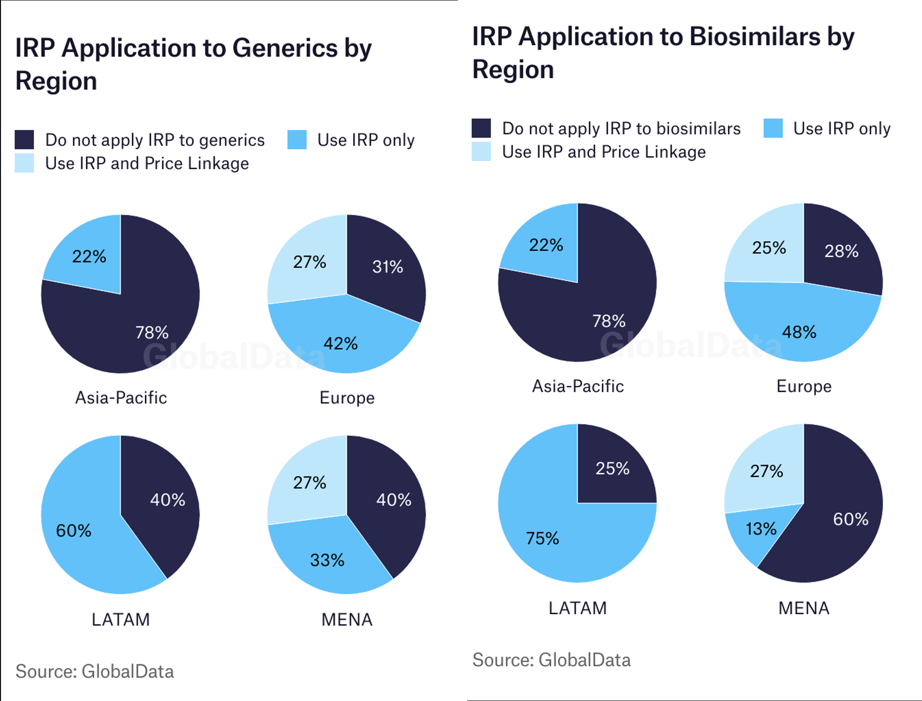

Another theme has been the expansion of IRP applications to generic and biosimilar products. There has been a notable increase in the number of markets using IRP for these drug types as a method of cost-containment to further drive the price of cheaper generics and biosimilars down. On a regional basis, the Asia-Pacific region is less likely to subject generic and biosimilar products to IRP. However, it is worth noting that these trends can vary within a region as well and are likely dictated by income cluster, with higher-income markets less likely to apply IRP to generic medicines while lower-income markets will tend to use IRP to contain costs.

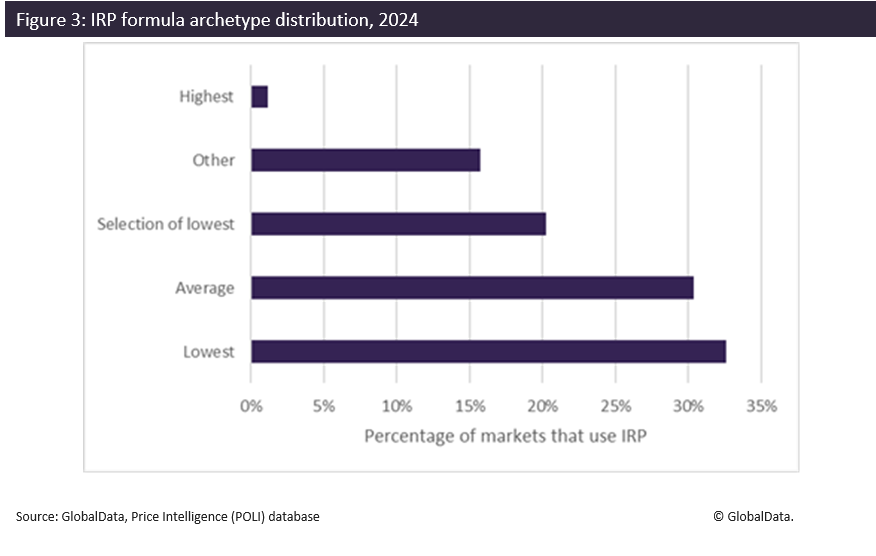

Another crucial element within a complex IRP system is the IRP formula. In 2024, while markets looked to simplify their baskets and extend the use of IRP to a larger number of product types, further modifications to IRP formulas were made with more countries opting for intricate formulas. Countries have often been criticised for referencing the lowest price in a country basket. While this remains a popular approach, the percentage of markets choosing to take the lowest price reduced from 40% in 2023 down to 33% in 2024. There is a greater variety in the formulas being applied, with a greater share of markets choosing to reference an average or median price from the basket or add greater complexity through dual formulas or variations in formulae depending on drug type (as mirrored by the category “other” in the graph below).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Over the last year, global IRP policy amendments have been made to help mitigate the negative impact of IRP. The agenda for IRP has changed. While IRP has traditionally been used to drive prices down, countries are no longer focused on always securing the lowest possible price. Due to current drug shortages, policies have had to be adapted to include greater flexibility as part of price setting through IRP. This is reflected by the shift in approach to IRP formulas, with fewer markets establishing their IRP formula based on the lowest price. The easing of IRP restrictions is also apparent, since many countries favour a reduction in basket size, better streamlining the process, and this is mirrored by the linear trend reduction seen in the average basket from 2022 onwards. IRP remains in constant flux; however, it will clearly remain essential even during turbulent economic times.