The Medicines Company (MedCo) and Alnylam Pharmaceuticals will need a clearer inclisiran post-approval plan in hypercholesteremia if they are to improve its market uptake potential.

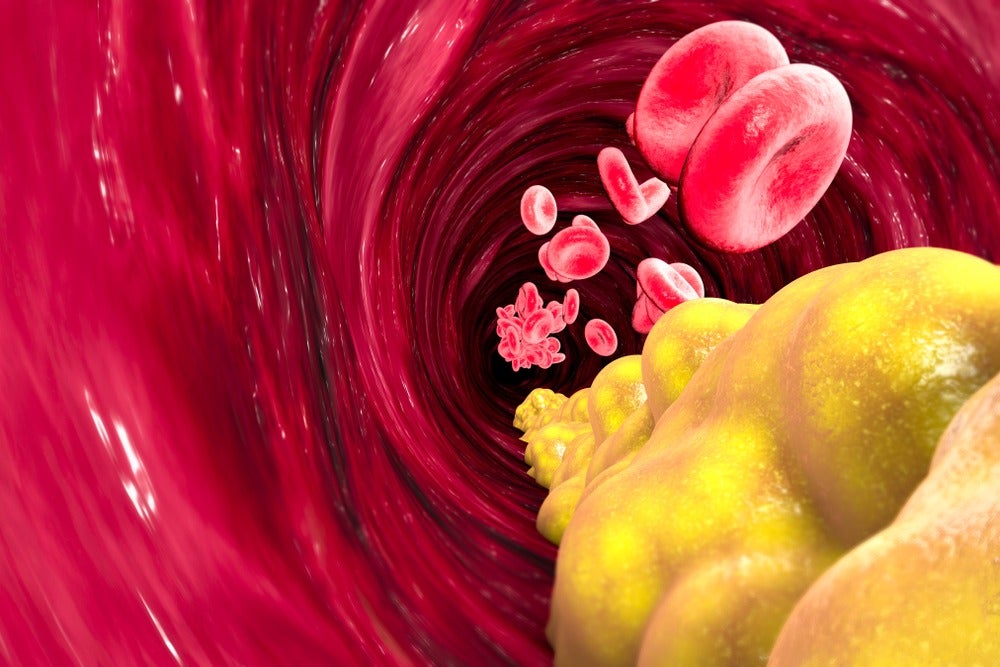

Hypercholesterolemia treatment

Even if inclisiran has a clear dosing advantage, the way it fits into the treatment paradigm could either lead to clinician pushback or poor patient compliance. Also, inclisiran should be at least $1,000 cheaper than already available PCSK9-based therapies for it to have a noticeable prior authorisation and copayment advantage. Studies suggest that the PCSK9 protein helps control blood cholesterol levels.

According to an analyst report, inclisiran’s dosing schedule aligns with physician visits, administered on Day 1, Day 90 and every six months.

However, some patients will likely administer inclisiran themselves, as with other PCSK9 therapies such as Amgen’s Repatha (evolocumab) and Sanofi and Regeneron Pharmaceuticals’ Praluent (alirocumab), due to clinician resistance and the cost ramifications of clinic visits, experts said. However, if patients self-administer inclisiran, there is a risk of forgetting the treatment due to the fact it is only used a few times per year for an asymptomatic indication when low-density lipoprotein cholesterol (LDL-C) is managed, some noted. A second analyst report noted poor Repatha and Praluent compliance has been impacting sales.

The report stated a more affordable inclisiran price would make it competitive. However, some experts said a minimum $1,000 price differential from competitors is needed to drive its growth, as well as an inclisiran information campaign for clinicians to ease reimbursement bumps seen with Repatha and Praluent.

Repatha, Praluent and inclisiran have comparable efficacy/safety data so far, supporting inclisiran Phase III success and US Food and Drug Administration (FDA) approval, experts agreed. However, some noted potential blind spots related to inclisiran having less safety data, which are relevant due to its longer-lasting effect. Also, both Repatha and Praluent have mechanism differences compared with inclisiran, which may be relevant to efficacy, others noted.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataInclisiran is in three placebo-controlled, double-blind Phase III trials with a primary endpoint looking into LDL-C per cent changes. Data from the 1,617-patient ORION-11 trial (NCT03400800) enrolling atherosclerotic cardiovascular disease (ASCVD) patients are expected mid-2019. Topline data from the 482-patient, ORION-9 trial (NCT03397121) enrolling heterozygous familial hypercholesterolemia patients, as well as the 1,561-patient, ORION-10 trial (NCT03399370) also recruiting ASCVD patients, are expected in the second-half of 2019. Analysts expect inclisiran to reach $1.6 billion to 1.7 billion in peak sales by 2030. The Medicines Company has a market capitalisation of $2.1 billion, while Alnylam’s market capitalisation is $9.5 billion.

Real-world use may have road bumps

Despite inclisiran’s clear longer-acting advantage to Repatha or Praluent, which are administered once or twice monthly, clarity is needed regarding whether inclisiran is better administered by the clinician or the patient, said Dr James Underberg, director of the Bellevue Hospital Lipid Clinic in New York, US, and Dr Matthew Budoff, professor of medicine at the David Geffen School of Medicine in Los Angeles, California.

In April 2017 it was reported that inclisiran has a biannual dosing potential advantage and even a potential annual administration in certain patients. Clinicians may not be open to administering inclisiran as it would take up clinic time, Underberg said. Also, there are cost ramifications of outpatient administration, he noted. It is unclear whether the patient would bring inclisiran to the physician or if it would be sold by the clinic, he added.

While a MedCo spokesperson said preference may be high for an injection given by a healthcare professional as part of routine appointments, inclisiran could then also be administered by the patient themselves as seen with Repatha and Praluent, said Dr Robert Eckel, director of the Lipid Clinic, University of Colorado Hospital, Aurora, US.

Teaching patients how to use Repatha and Praluent’s auto-injector was not an access barrier, and this could be the case with inclisiran’s prefilled syringe, said Underberg, Budoff and Dr Howard Weintraub, clinical assistant professor with the Department of Medicine at the New York University School of Medicine, US.

While Underberg noted clinicians may be resistant to teaching patients, company patient support services could be established to take this role said Eckel and Dr Robert Hegele, professor of medicine, Western University, Ontario, Canada.

Weintraub noted he prefers to prescribe Repatha because Amgen’s patient support featured nurses who visit patients, while Praluent support services have waned over time. However, there is a risk the patient may forget to use inclisiran, Hegele said, with Underberg adding a visit to the clinician would ensure each dose is taken.

$1,000 price difference to competitors, physician education could drive access

Another way to drive inclisiran prescriptions is to have a price cheap enough that prior authorisation required by insurance companies should be noticeably more straightforward, Underberg said. Weintraub and Eckel agreed inclisiran could be priced around $4,000 a year, with Eckel noting the $1,000 price difference between it and competitors could be enough for inclisiran access to be noticeably easier.

Praluent’s list price is $5,850 annually, which matches Repatha when it lowered its price in October 2018. Both had initial list prices of around $14,000 annually upon FDA approval in 2015. This price drop was welcome as it has made an impact on the ease of medication pre-authorisation, said Weintraub, Budoff and Dr Steven Nissen, chairman of the Department of Cardiovascular Medicine at the Cleveland Clinic in Ohio, US. However, this price decrease has yet to be reflected on patient copays or coinsurance, Underberg said.

Clinician perception is that there is still significant paperwork needed to access Repatha and Praluent, Underberg added. Securities and Exchange Commission (SEC) filings show Repatha’s third-quarter 2018 sales were $120 million, increasing to $159 million in the fourth-quarter of 2018 after the price drop. Sanofi and Regeneron did not respond to a request for comment.

To further improve inclisiran’s uptake chances, a drive to educate clinicians about inclisiran is needed, Weintraub and Eckel said. Lipidologists who primarily see hypercholesteremia patients are more inclined to prescribe PCSK9-based therapies, in contrast to general practitioners and some cardiologists, Underberg said. Pre-commercialisation work is ongoing to support education for health care professionals and patients, the MedCo spokesperson said.

Phase III inclisiran trial likely to be positive but behind in data race

That said, Repatha, Praluent and inclisiran have comparable efficacy/

safety profiles so far, supporting the likelihood of a positive Phase III inclisiran program, said Underberg, Eckel and Weintraub. If Phase II data are replicated in Phase III, it would be approvable, they agreed. Inclisiran’s Phase II data show dramatic improvement in LDL-C levels, Budoff added.

The 501-patient Phase II ORION-1 trial (NCT02597127) data show the two-dose 300mg inclisiran group saw the greatest LDL-C reduction, with 48% experiencing below 50mg/dL at Day 180 (Kausik R, et. al, N Engl J Med 2017; 376:1430–1440). The three Phase III trials all have 300mg doses. The most common adverse events included myalgia, headache, fatigue and nasopharyngitis, and incidence did not differ significantly between the inclisiran and placebo groups.

Nonetheless, Repatha and Praluent have more efficacy/safety data than inclisiran, so Phase III inclisiran data are important to highlight similarities among the three therapies, Underberg, Weintraub and Nissen said. As a long-acting therapy, inclisiran’s safety data are relatively more important even though they are all PCSK9-based therapies because inclisiran accumulates in the body, Budoff noted.

Although unexpected, if inclisiran efficacy data do not mirror Repatha and Praluent, it could be due to nuanced differences in their mechanisms, Underberg and Hegele said. While Repatha and Praluent bind to extracellular, circulating PCSK9, inclisiran works intracellularly, Hegele explained. Clinicians who appreciate this nuance may have some hesitance in switching to inclisiran, Underberg said. However, inclisiran’s different small interfering RNA therapy approach is what leads to infrequent dosing, the MedCo spokesperson said.

by Reynald Castaneda in London.

Reynald Castaneda is a Senior Reporter for Pharmaceutical Technology parent company GlobalData’s investigative journalism team. A version of this article originally appeared on the Insights module of GlobalData’s Pharmaceutical Intelligence Center. To access more articles like this, visit GlobalData.