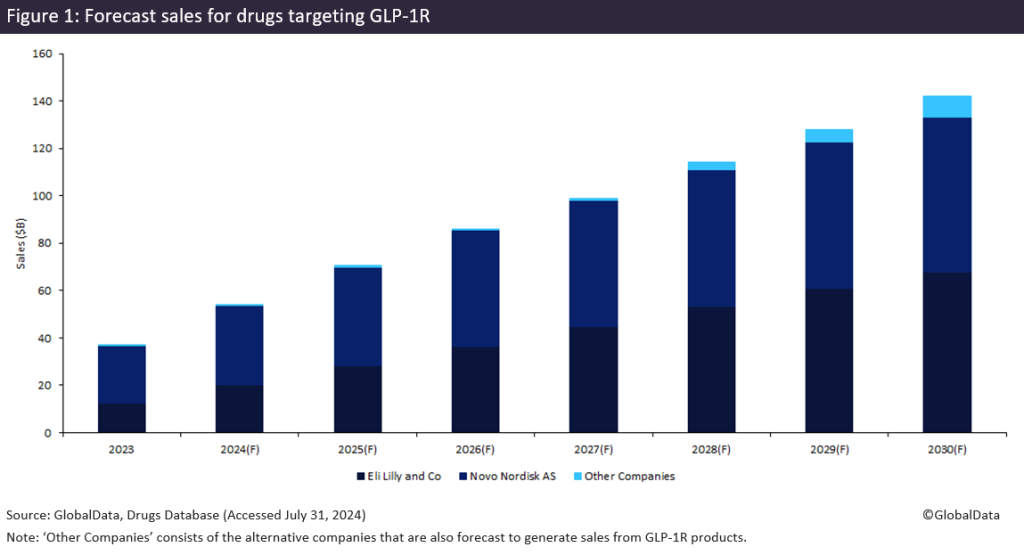

Glucagon-like peptide-1 receptor (GLP-1R) products [a class of incretin mimetic medicines for the treatment of type 2 diabetes and obesity] generated more than $37 billion in 2023 alone, cementing their place as one of the most lucrative therapies. By 2030, sales for this drug category are forecast to grow, reaching an estimated $142 billion. Novo Nordisk and Eli Lilly are poised to dominate the market, collectively capturing 94% of the total 2030 GLP-1R sales, placing them far ahead of any and all competitors in this category.

The popularity of GLP-1R drugs has exploded in recent years. Due to their abilities to effectively treat metabolic-related disorders such as obesity and type 2 diabetes, the 11 approved drugs in this category generated $37.2 billion in 2023. Novo Nordisk and Eli Lilly accounted for nine of these approved products in that year, and encompassed 99% of the sales. Successful GLP-1R products in 2023 included Novo Nordisk’s Ozempic and Wegovy, which generated $13.9 billion and $4.6 billion respectively, as well Eli Lilly’s Trulicity and Mounjaro, which generated $7.1 billion and $5.1 billion.

As obesity rates rise and trust in GLP-1R products grows, sales for drugs targeting the receptor are forecast to increase four-fold from 2023, generating $142 billion in 2030. The market dominance of Novo Nordisk and Eli Lilly is expected to persist, with these two companies ultimately capturing 94% of GLP-1R sales in 2030.

In 2023, the approved GLP-1R market comprised 11 products from four companies. By 2030, the market is expected to expand to 35 approved products from 16 companies.

Despite vast increases in the number of products and competitors expected to enter the GLP-1R market, sales attributed to 14 of those companies – other than Eli Lilly and Novo Nordisk – are forecast to generate only $8.8 billion in 2030. This is 15 times less than the combined valuation of the two leading companies. Novo Nordisk and Eli Lilly are predicted to account for only 57% of these 35 products on the market. Amgen, the company ranked third in terms of GLP-1R sales in 2030, is forecast to generate only $3 billion, driven entirely by the product maridebart cafraglutide, which is currently in Phase II trials for type 2 diabetes and obesity.

Eli Lilly and Novo Nordisk will continue to dominate in this category

By 2030, Eli Lilly is expected to overtake Novo Nordisk and become the leading company in terms of GLP-1R sales, with $67.7 billion. Eli Lilly is estimated to market the two top-selling GLP-1R products in 2030, with Mounjaro forecast to generate $27.4 billion and Zepbound forecast to generate $27.3 billion. Novo Nordisk follows closely behind, with Ozempic generating $22.4 billion of the company’s $65 billion portfolio. Combined, the GLP-1R portfolios for these companies are forecast to generate $133 billion in 2030, 94% of the total market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe already popular GLP-1R market is expected to burgeon over the next seven years, with 35 products generating $142 billion in 2030. Despite the estimated presence of 16 companies in the market, Eli Lilly and Novo Nordisk are estimated to capture a staggering 94% of sales, highlighting their dominance in the GLP-1R category.