In an expanded version of the sales forecast from GlobalData’s June 2022 publication, Cardiomyopathies: Global Drug Forecast and Market Analysis, the global cardiomyopathies market is expected to grow from $3.07bn last year to $9.63bn in 2031. The Cardiomyopathies: 68-Market Analysis and Sales Forecast report covers a total of 68 markets across Africa, Asia-Pacific (APAC), Europe, Latin America (LATAM), the Middle East and North America. This extrapolation leverages data from GlobalData’s World Markets Healthcare and PharmOnline International databases to expand the number of markets in GlobalData’s patient-based sales forecast model from seven major markets (7MM) to 68 markets (68M).

Based on the previous 7MM report, growth in the cardiomyopathies market was primarily attributed to the market release of Bristol Myers Squibb’s Camzyos (mavacamten) and the upcoming launch of Cytokinetics’ aficamten, both of which are myosin inhibitors indicated for the management of obstructive hypertrophic cardiomyopathy (HCM). Prior to the development of Camzyos and aficamten, obstructive HCM has not been the target of clinical trial development, so these two therapeutics would benefit a neglected patient population.

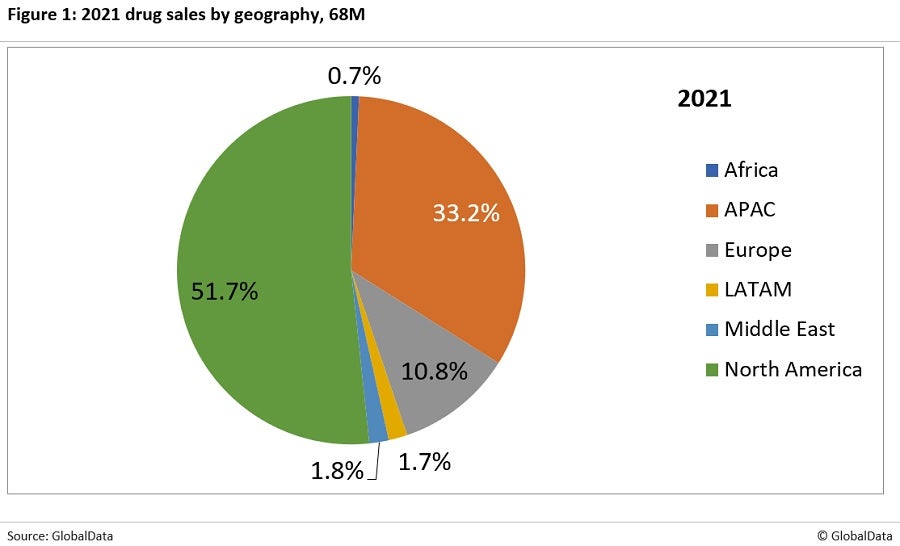

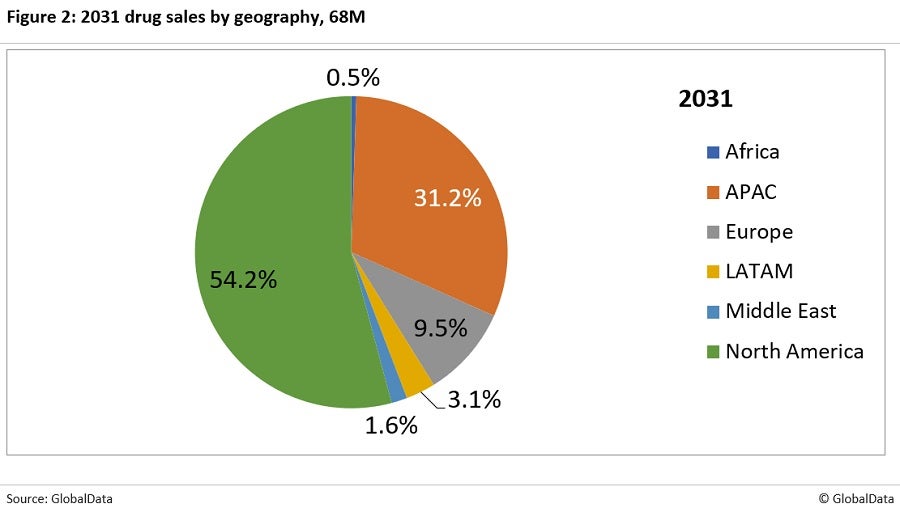

According to the 68M update, North America is expected to contribute most significantly to the cardiomyopathies market across the forecast period, accounting for 51.7% and 54.2% of sales in 2021 and 2031 respectively. The US is set to dominate the cardiomyopathy landscape because of the country’s high prevalence of dilated cardiomyopathy (DCM) relative to the other markets in the 7MM, as well as the higher price tag on US-marketed therapeutics. The second highest contributing market is APAC, generating 33.2% of global cardiomyopathies sales in 2021 and 31.2% in 2031. This is primarily due to the high volume of drug sales in China, which totalled $789.05m in 2021 and are projected to reach $2.24bn in 2031.

The figures below summarise forecast cardiomyopathy market growth across the 68M from 2021 to 2031.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData