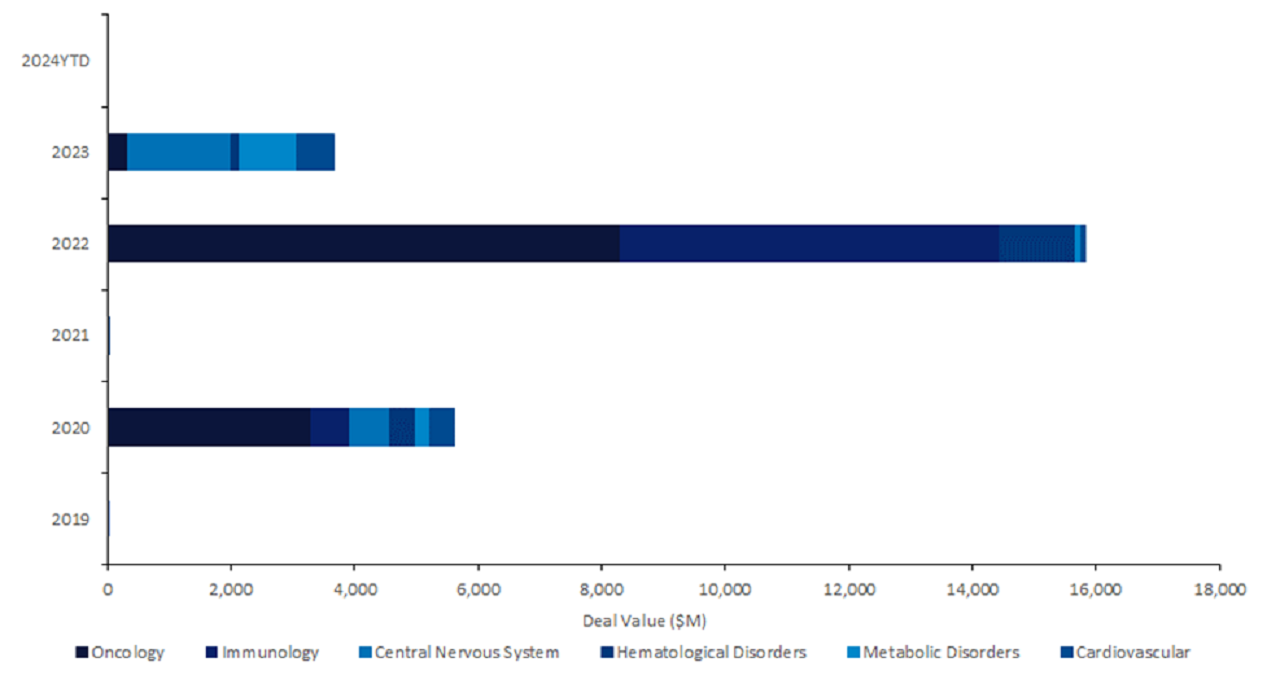

Licensing agreements for innovator drugs utilising clustered regularly interspaced short palindromic repeats (CRISPR) technologies saw oncology, immunology, and central nervous system as the top three therapy areas by total deal value with a combined $21bn over the past five years.

Furthermore, haematological disorders saw almost three times more licensing agreement deal value in 2022 compared to 2020, reaching a total deal value of $1.8bn in the past five years (Figure 1), as reported by GlobalData’s Pharma Intelligence Center Deals Database.

This highlights the growing importance of advancements in CRISPR for haematological disorder therapies.

In December 2023, the US Food and Drug Administration’s approval of Casgevy, the first CRISPR and CRISPR-associated protein 9 (Cas9) genome editing therapy developed by Vertex Pharmaceuticals and CRISPR Therapeutics for sickle cell disease and beta thalassemia represented a major milestone in gene therapy.

Casgevy precisely edits DNA in blood stem cells by utilising CRISPR/Cas9 technology, involving taking the patient’s bone marrow stem cells and enhancing their expression of fetal haemoglobin before reintroducing these edited stem cells back into the patient.

This restores healthy haemoglobin production in patients with sick cell disease and beta thalassemia, effectively alleviating the symptoms of these diseases.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFigure 1 shows innovator drugs harnessing CRISPR systems saw 182% growth in total licensing agreement deal value from $5.6bn in 2020 to $15.8bn in 2022, according to GlobalData’s Pharma Intelligence Center Deals Database.

Oncology represented more than half of the total deal value for the top three therapy areas with $11.9bn, followed by immunology with $6.7bn, and central nervous system with $2.2bn, according to GlobalData’s Pharma Intelligence Center Deals Database.

Pharma giants such as Lily and Sanofi have recently partnered with companies developing CRISPR-based technologies.

Last year, Prevail Therapeutics, a subsidiary of Lily, secured exclusive rights to Scribe Therapeutics’ CRISPR X-Editing (XE) technologies for $1.57bn. This licensing agreement, aimed at developing in vivo therapies directed to specified targets known to cause serious neurological and neuromuscular diseases, stands as the largest CRISPR-based deal of the year.

Concurrently, Sanofi expanded its collaboration with Scribe in July 2023, with a deal worth up to $1.24bn, focusing on leveraging Scribe’s XE genome editing technologies for the development of in vivo therapies, particularly sickle cell disease and other genomic disorders.

Moreover, Lily’s expertise in cardiometabolic diseases prompted the company to partner with Beam Therapeutics in October last year.

This agreement, valued at up to $600m, involved acquiring rights held by Beam in Verve Therapeutics, a gene-editing company focused on single-course gene editing therapies for cardiovascular disease.

This includes Verve’s programmes targeting PCSK9 and ANGPTL3, both set for clinical initiation this year.

CRISPR technology is revolutionising targeted gene therapies for various unmet diseases by precisely targeting diverse genomic sites.

This advancement in precision medicine offers hope for more tailored treatments and improved patient outcomes.

Furthermore, the growing number of CRISPR-based therapies in clinical trials is expected to fuel significant interest and drive further progress in this field.

Update: The tenth paragraph has been updated to reflect the correct value and nature of the deal between Prevail and Scribe. A previous version incorrectly stated the deal was worth $1.65bn.