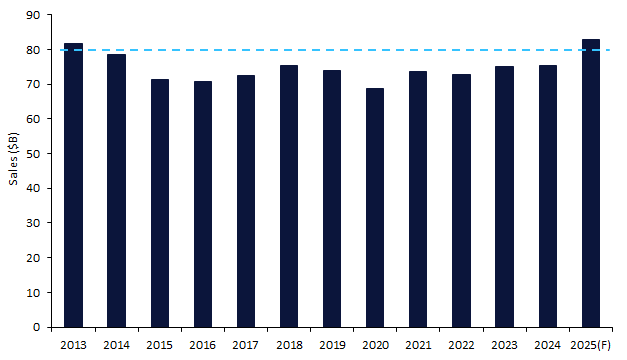

In 2025, the central nervous system (CNS) market is forecast to surpass $80bn in sales for the first time since 2013, marking a significant turnaround after a decade of stagnation. This positions CNS as the fifth fastest-growing therapy area in 2025. This resurgence is largely driven by multiple sclerosis (MS) therapies and psychiatric drug innovation, with Roche’s Ocrevus (ocrelizumab) and Novartis’s Kesimpta (ofatumumab) playing pivotal roles.

The expected fast growth of the CNS market in 2025 reflects renewed pharmaceutical interest and scientific advancements in the space. A growing focus on neuroimmunology and neurodegeneration is reshaping the landscape, overtaking the traditional dominance of dopamine and serotonin pathways in CNS drug development. Ocrevus, an anti-CD20 monoclonal antibody for MS, is expected to maintain its market leadership in 2025, generating sales of $8.1bn and accounting for nearly 10% of total CNS market sales.

The CNS market’s decade-long stagnation was driven by the high cost, complexity, and risk of drug development, which led many pharmaceutical companies to deprioritise the area in favour of more lucrative and predictable markets like oncology, diabetes, and cardiovascular disease. Major failures in Alzheimer’s disease (AD) and amyotrophic lateral sclerosis (ALS), where companies such as Eli Lilly, Roche, and Biogen collectively spent billions on unsuccessful trials, dissuaded further investment. Meanwhile, regulatory hurdles, limited understanding of psychiatric disorders, and unpredictable clinical outcomes made neuropsychiatric drug development unattractive for big pharma, leaving only smaller biotech firms and academic institutions to pursue innovation. This pullback left a void in novel treatments across the CNS landscape.

Figure 1: Sales by key therapy area CNS sales, 2013–2025

According to GlobalData’s Sales and Forecast Database, CNS sales are projected to increase by 8% from 2024 to 2025, showing the strongest year-over-year growth in over a decade. This growth is driven by strong forecast sales of two anti-CD10 monoclonal antibodies for MS, Ocrevus and Kesimpta. Both drugs have demonstrated high efficacy for controlling relapsed multiple sclerosis (RMS) without major safety concerns, while Ocrevus also benefits primary progressive multiple sclerosis (PPMS) patients. The $82.8bn forecast for 2025 represents a return to pre-2013 levels, emphasizing the renewed strength in the sector.

Additionally, psychiatric drug innovation is now playing a key role in the sector’s recovery. The renewed interest in N-methyl-D-aspartate (NMDA) receptor modulators for depression and the resurgence of psychedelic-assisted therapies, which had long been dismissed due to legal and scientific challenges, signal a shift away from conventional serotonin and dopamine- targeted approaches. These emerging therapies offer potential breakthroughs for psychiatric conditions, such as treatment-resistant depression and post-traumatic stress disorder (PTSD), strengthening the market’s long-term outlook.

Beyond MS and psychiatry, AD therapies represent a key driver of future CNS growth. The approval of anti-amyloid monoclonal antibodies, such as Eisai/Biogen’s Leqembi (lecanemab) in 2023 by the FDA, marked a new chapter in AD treatment, albeit with commercial and regulatory hurdles. Continued investment in tau-targeting and neuroinflammation-focused drug development could further solidify CNS as a high-value market segment in the coming years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataWith sales exceeding $80bn for the first time in over a decade, 2025 marks a turning point for CNS therapeutics. The market is shifting toward high-value neurology assets, reflecting biopharma’s growing interest in long-term market sustainability. This pivot is expected to drive sustained investment in neurodegeneration and neuroimmunology, positioning CNS as a key growth area beyond 2025. As competition in the CNS space intensifies, close monitoring of emerging therapies, including next-generation psychiatric drugs, AD treatments, and novel MS assets will be essential in assessing long-term market sustainability and future growth potential.