The chronic angina pectoris drugs space boasts well-established pharmacologic agents that have been in regular use for years or even decades. The first-line management of chronic angina (stable, microvascular, and variant) is dominated by the widespread use of generics including short-acting nitrates, beta-blockers, and calcium channel blockers. Among the second-line agents, only one drug has had a noticeable impact on the angina market, namely Gilead’s Ranexa (ranolazine), which held market exclusivity in the US until 2019. Following its launch in the US in 2006, it became the first novel drug for treating angina to enter the US market in 20 years. As such, it is evident that this market has long been overlooked by drug developers and chronic angina therapies have remained largely unchanged for more than a decade. Despite their expected minimal penetration, the current pipeline therapies are expected to generate substantial revenue and drive growth due to their high annual cost of therapy, curtailing the impact of the expiring patent protections of current therapies.

Clinical development activity in the space has recently picked up speed in the US. A prominent R&D strategy identified by GlobalData is the investigation of cell- and gene-based therapeutic modalities that promote angiogenesis, the formation of new blood vessels from pre-existing vessels, in order to increase blood supply to areas of the myocardium that are ischemic. The newly developed vessels could then potentially restore blood supply, lessen angina symptoms, and improve patient prognosis. This reflects a shift away from traditional antianginal therapies that only treat symptoms of the disease, instead moving toward medical therapies that aim to revascularize obstructed arteries. These include angiogenic growth factors (proteins or genes) and cells that are delivered to the heart in an attempt to stimulate myocardial angiogenesis. Such approaches have been under investigation for the past two decades, but no product of this type has reached the market to date, despite several seemingly promising drug candidates. Key opinion leaders (KOLs) interviewed by GlobalData noted that a gene- or cell-based treatment with an expected expensive high annual cost of therapy (ACOT) will likely have difficulty penetrating the market in the US, especially before any long-term and lasting treatment effect is demonstrated.

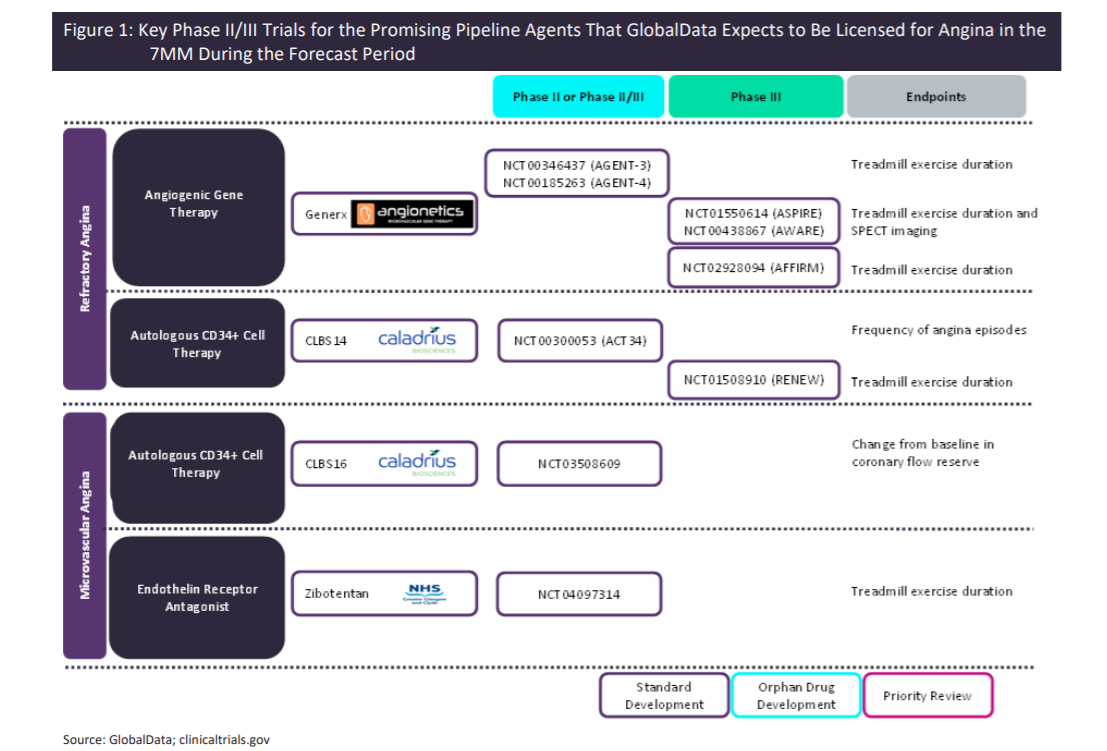

Refractory and microvascular angina is a significant focus for this type of product development, with late-stage pipeline products targeting each of these patient groups as an initial indication. GlobalData has identified three late-stage therapies targeting these groups, of which two are in Phase III and one is in Phase II in US trials. Caladrius Biosciences has two autologous stem cell therapies for therapeutic angiogenesis in refractory and microvascular angina. Angionetics has a non-viral based gene delivery for medical revascularisation that is targeting patients with myocardial ischemia and refractory angina caused by coronary artery disease.

The figure below outlines the key Phase III/Phase IIb trials for the promising late-stage pipeline agents that GlobalData expects to be licensed for the treatment of angina pectoris in the seven major markets (US, France, Germany, Italy, Spain, UK, and Japan) during the forecast period. While the potential launch of these late-stage pipeline agents will increase the number of pharmacological treatment options that can be offered to patient populations with high unmet need, such as microvascular and refractory angina patients, only a fraction of these patients may end up benefiting from them due to challenges associated with gaining favourable reimbursement due to their anticipated high ACOT.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData