In December 2023, Vertex (US) and CRISPR Therapeutics’s (Switzerland and US) Casgevy (exagamglogene autotemcel) was approved in the US for the treatment of sickle cell disease (SCD), making it the first FDA-approved gene therapy to employ clustered regularly interspaced palindromic repeat (CRISPR)-based gene editing. Seven months later, the drug has started expanding its markets as it makes its progress around the world. GlobalData has reviewed Casgevy’s launch sequence and compared it to that of other haematological agents and gene therapies, including bluebird bio‘s (US) Lyfgenia (lovotibeglogene autotemcel), a gene therapy for the treatment of SCD that was approved by the US FDA on the same day as Casgevy.

Casgevy has launched in three markets so far

Casgevy is an autologous haematopoietic (blood) stem cell-based gene therapy modified using CRISPR/Cas9 to target the BCL11a gene. In December 2023, the drug was approved by the FDA for the treatment of SCD in patients ages 12 years and older with recurrent vaso-occlusive crises (VOCs). Its approved indications then expanded to include transfusion-dependent β-thalassemia (TDT) in patients ages 12 years and older in January 2024. The European Commission then approved the drug for the same indications in February 2024.

Casgevy first launched in the US, followed by Luxembourg five months later, and then Bahrain in June 2024. When compared to the average launch sequence of haematological agents that fall under the Anatomical Therapeutic Chemical (ATC) code B06AX, these drugs typically launch in the US first, followed by the United Arab Emirates and Brazil. The average launch sequence of antineoplastic cell and gene therapies (ATC code: L01XL) begins in the US, followed by major European markets such as France and Germany. It is not uncommon for these products to launch in the US first because of market size and the country’s regulatory environment. Following that launch, Middle Eastern markets appear to then be favoured by haematological agents. Gene therapies may deviate from the traditional launch strategy if they are approved as haematological agents.

The next market that Casgevy could launch in is France, as the drug has already been granted authorisation under the French early access scheme in January 2024 and now awaits pricing. Meanwhile, Lyfgenia has only launched in the US.

Lyfgenia’s average price per unit (USD) is 1.4 times higher than Casgevy’s at launch

According to GlobalData, 19 gene therapies and gene-modified cell therapies have been marketed in the US. Of those 19 treatments, Casgevy is one of seven gene therapies and gene-modified cell therapies to have launched on the US market with an average price per unit that is above $1m. The figure below summarises those gene therapies with an average price per unit greater than $1m at launch based on their wholesale acquisition cost (WAC). Lyfgenia and Casgevy are competing treatments for sickle cell disease, but Lyfgenia launched at a price per unit that is approximately 1.4 times higher than Casgevy’s average price per unit.

Despite these high price tags, the estimated average annual cost of managing SCD in adults using these gene therapies as monotherapy is aligned with other products already on the market for the indication. For example, Chiesi’s Ferriprox (deferiprone), an iron chelating agent, has an annual average cost (including wastage) of roughly $3.2m, which is close to the average annual cost (including wastage) of Lyfgenia at $3.1m and greater than that of Casgevy at $2.2m.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

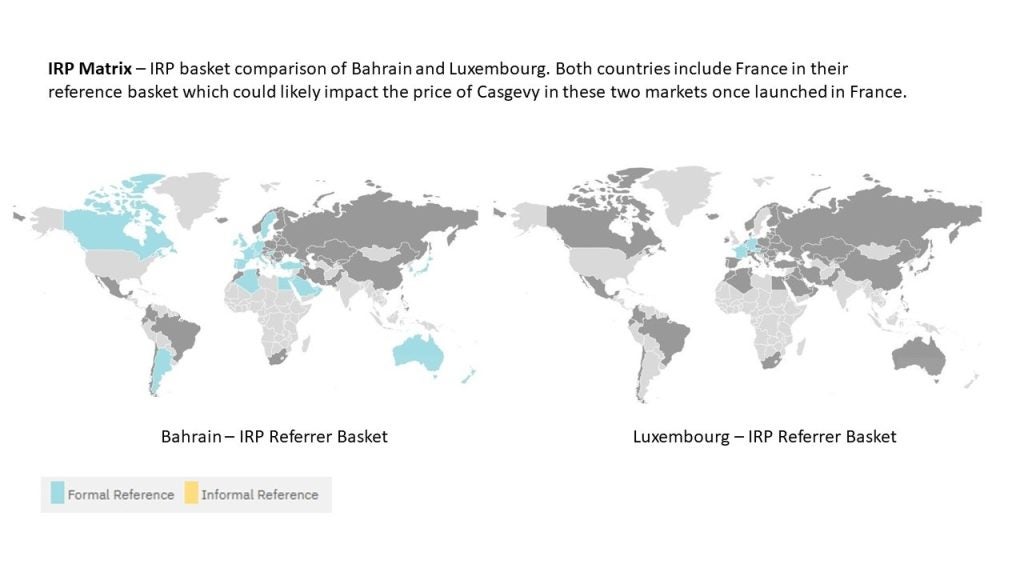

By GlobalDataCasgevy’s launch in France could impact prices in Bahrain and Luxembourg

In France, Casgevy was granted early access authorization in January 2024 in patients ages 12–35 years with TDT who were eligible for haematopoietic stem cell transplants. This decision by the Transparency Commission (TC) was based on a lack of appropriate treatments currently available for the disease and the presumed innovation the drug would bring to the indication compared to clinically relevant comparators. As part of entering France’s early access scheme, known as the temporary authorisation system (autorisation temporaire d’utilisation, ATU), the drug has an opportunity for greater pricing flexibility before its early access expires and it enters the traditional pricing and reimbursement pathway. Once a price is available, this will likely influence its price in markets where Casgevy has already launched, such as Bahrain or Luxembourg, since these markets include France as part of their basket of countries for international reference pricing (IRP) purposes, but exclude the US where a price is already available.

With Casgevy and Lyfgenia now being among some of the most expensive treatments on the market, questions have arisen regarding how these large price tags may create barriers to access for patients in a disease space that already sees limited treatment options. Future launches and sequence optimisation may not only be defined by where pricing flexibility can be achieved and risk-sharing agreements can be arranged but also by infrastructure availability allowing for the rollout of these products.

This article is produced as part of GlobalData’s Price Intelligence (POLI) service, the world’s leading resource for global pharmaceutical pricing, HTA and market access intelligence integrated with the broader epidemiology, disease, clinical trials and manufacturing expertise of GlobalData’s Pharmaceutical Intelligence Center. Our unparalleled team of in-house experts monitor P&R policy developments, outcomes and data analytics around the world every day to give our clients the edge by providing critical early warning signals and insights. For a demo or further information, please contact us here.