Chimeric antigen receptor T-cell (CAR-T) therapeutics have emerged as a dominant cancer treatment within cell and gene therapies (CGT). The CAR-T landscape is dominated by blood cancers, which account for more than half of all CAR-Ts in the active pipeline and make up nine out of the top 10 CAR-T indications. Industry leaders such as Bristol Myers Squibb are at the forefront of this revolution, driving advancements that can redefine treatment paradigms for blood cancers such as B-cell acute lymphocytic leukemia.

CAR-T therapeutics are a leading type of T-cell immunotherapy, accounting for more than half of the approvals in the oncology CGT landscape. This therapeutic modality involves genetically engineering autologous or allogeneic T-cells to express a chimeric antigen receptor so they actively recognise and destroy cancerous cells. Currently, 13 CAR-T therapies have received regulatory approval. Among these are Gilead’s Yescarta (axicabtagene ciloleucel), which gained FDA approval in 2017, and Immuneel Therapeutics’ Qartemi (varnimcabtagene autoleucel), which was approved in India in January 2025. Like all other approved CAR-Ts, Yescarta and Qartemi are indicated for blood cancers. The dominance of blood cancers in CAR-T products extends to the pipeline products, with 903 (52%) of the 1,729 CAR-Ts in development targeting blood cancers.

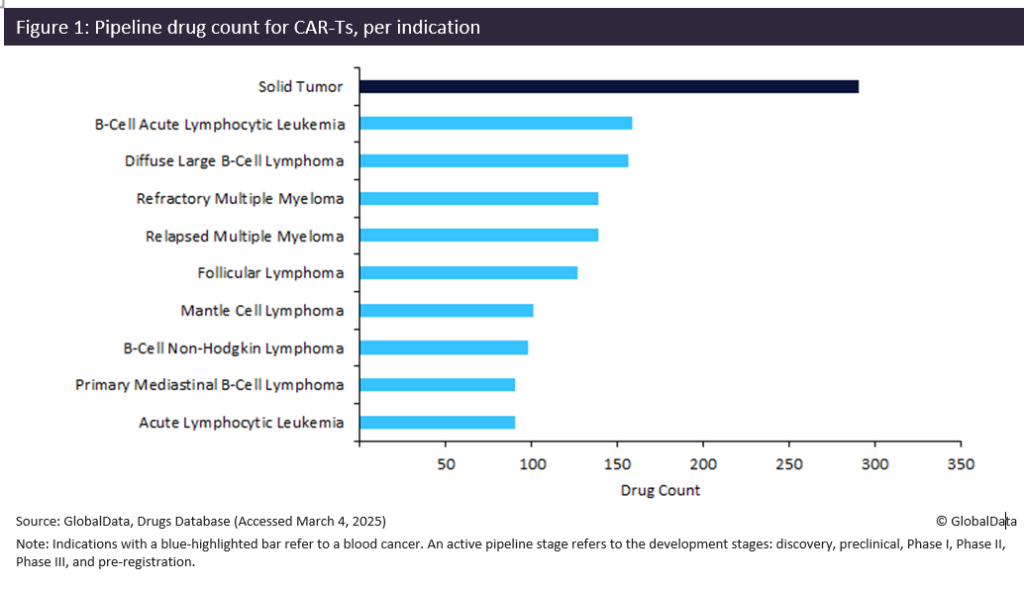

Figure 1 shows that nine out of the top 10 indications for CAR-Ts are blood cancers. Lymphomas dominate this landscape, with five indications. The remaining blood cancers are evenly split between leukaemias and multiple myelomas. While solid tumour is the leading indication, CAR-Ts have had limited commercial or clinical success in this area.

With 159 products, B-cell acute lymphocytic leukaemia is the leading blood cancer for pipeline CAR-Ts. This is the most common type of cancer in children and is difficult to treat due to relapses or resistance to standard treatments. CAR-Ts have revolutionised treatments for this cancer type, with key drugs such as Novartis’s Kymriah (tisagenlecleucel), which received US Food and Drug Administration (FDA) approval in 2017, demonstrating complete remission in a significant percentage of patients. CAR-Ts have quickly developed importance within B-cell acute lymphocytic leukemia, as three out of the five FDA-approved products for this indication are CAR-Ts.

In addition to encompassing the top two blood cancers by pipeline CAR-T count, B-cell acute lymphocytic leukaemia and diffuse large B-cell lymphoma also feature the most advanced pipeline CAR-Ts for products awaiting their first approval. In China, Chongqing Precision Biotech’s pCAR-19B is in pre-registration for B-cell acute lymphocytic leukaemia, and the South Korean regulatory authority is reviewing Curocell’s anbalcabtagene autoleucel for diffuse large B-cell lymphoma.

Bristol Myers Squibb is the current leader in the CAR-T landscape with two marketed products: Abecma (idecabtagene vicleucel), which is approved for multiple myeloma, and Breyanzi (lisocabtagene maraleucel), which is indicated in a range of lymphomas and leukaemias. There are developing 14 CAR-Ts for their first approval in a blood cancer. Other leading companies with CAR-T products in development include Shenzhen Geno-Immune Medical Institute. This China-based institute is actively developing 14 CAR-Ts, including eight in Phase II.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCAR-T therapeutics have revolutionised the treatment of blood cancers. Given the high number of pipeline CAR-Ts, GlobalData expects that there will be more approvals for blood cancers such as B-cell acute lymphocytic leukaemia and diffuse large B-cell lymphoma in the coming years. As companies such as Bristol Myers Squibb and Shenzhen Geno-Immune Medical Institute continue advancing their CAR-T pipelines, GlobalData expects CAR-Ts to continue to expand their influence in blood cancer treatments.