Despite a difficult investing environment, major well-capitalised contract manufacturing organisations (CMOs) have been involved in recent acquisitions, as big pharma and private equity alike highly value the manufacturing capabilities and expertise these companies bring to the table.

These high-value deals will alter the competitive balance between CMOs, and this activity will continue into 2024.

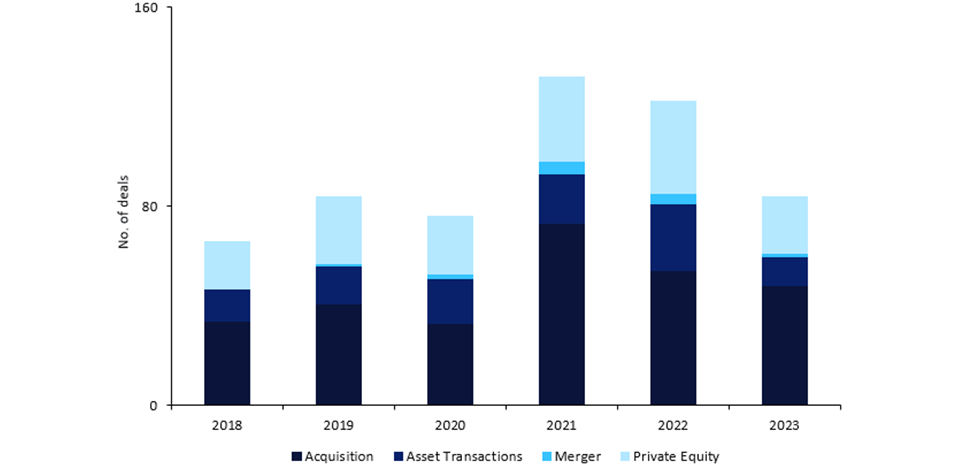

In 2023, there were 84 mergers or acquisitions (M&As) of CMOs and their facilities, a 31% decrease from 2022.

These deals involved a wide variety of manufacturing services, including active pharmaceutical ingredient and dose manufacturing, packaging, and analytical services.

Morgan Stanley predicts a major increase in 2024 deal volume after the large dip in 2023, suggesting large European biopharma companies may be on the hunt for deals given their strong balance sheets.

Catalent (Somerset, US) announced in February that it would be acquired by Novo Holdings (Hellerup, Denmark), the owner of Novo Nordisk (Bagsvaerd, Denmark), for $16.5bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe news shocked the industry.

Mergers of this scale provoke anticompetitive concerns and will affect the capacity of the broader CMO industry.

The deal will also profoundly affect the competitive landscape for obesity treatments: Novo Holdings will sell three of Catalent’s fill-finish sites (Anagni, Italy; Indiana, US; and Brussels, Belgium) to Novo Nordisk, boosting production capabilities and scale for Novo’s obesity treatments and providing a major competitive advantage.

Lonza (Basel, Switzerland) announced in March 2024 plans to acquire Roche’s (also Basel) biologics manufacturing plant in California, US, for an upfront payment of $1.2bn.

In June 2023, Roche disclosed its plans to close the legacy Genentech (South San Francisco, US) Vacaville facility.

As well as the deal payment, Lonza also will invest around $561m to renovate the facility and increase capabilities at the site to support mammalian biologics therapies.

The Roche drugs currently produced at the site will be made by Lonza at first and then phased out as the site takes on clients.

The largest CMO deal of 2023 closed in October when Advent International (Boston, US) and Warburg Pincus (New York, US) acquired Baxter International‘s (Deerfield, US) BioPharma Solutions business for $4.3bn.

The business then became a standalone CDMO operating under the name Simtra BioPharma Solutions (Bloomington, US).

Simtra BioPharma Solutions manufactures 80 biosimilar and innovator drugs approved in the US, UK, or EU, including J&J’s (Brunswick, US) blockbuster drugs Stelara and Darzalex/Faspro.

PE companies target CMOs because they require large amounts of capital and can deliver returns within a short amount of time.

CMOs are revenue-generating and therefore a safer investment option for PE businesses than drug development companies, which rely on unpredictable clinical trial results.

Private equity companies now own many of the leading CMOs such as Recipharm (Stockholm, Sweden), Cambrex Corp (Rutherford, US), and PCI Pharma Services (Philadelphia, US).

Permira Fund (London, UK) acquired Cambrex in 2019 and EQT IX Fund (Stockholm) bought Recipharm in 2021.

PE companies acquired smaller CMOs in 2023 such as Porus Laboratories (Hyderabad, India) and Quality Chemical Industries (Kampala, Uganda), a company previously owned by Cipla (Maharashtra, India).

PE-backed CMOs will find they have a lot more financial support to add to their service offerings and value.

CMO M&A activity declined in 2023

In 2023, M&A activity in the contract manufacturing industry declined compared to 2021-22.

High inflation and interest rates along with an uncertain business environment have disincentivised investment.

However, compared to the lower deal numbers in 2018-2020, last year appears robust.

Figure 1 (from an upcoming GlobalData publication called M&A in the Contract Manufacturing Industry: Implications and Outlook – 2024 Edition) shows trends related to mergers, acquisitions, and private equity deals involving CMOs; it also looks at facility acquisitions (referred to as asset transactions).

The figure shows that deal activity generally increased during 2018-2022 before a major decline in 2023.