Biotech initial public offerings (IPOs) surged in Q1 2024, with eight completed IPOs raising a total of $3.72bn, six times more than the $621m raised in Q4 2023. This resulted in Q1 2024 having a higher biotech IPO value raised than any quarter in 2023, according to GlobalData’s Pharma Intelligence Center Deals Database. An IPO occurs when a private company offers its shares to the public and, upon completion, becomes a publicly traded company listed on a stock exchange.

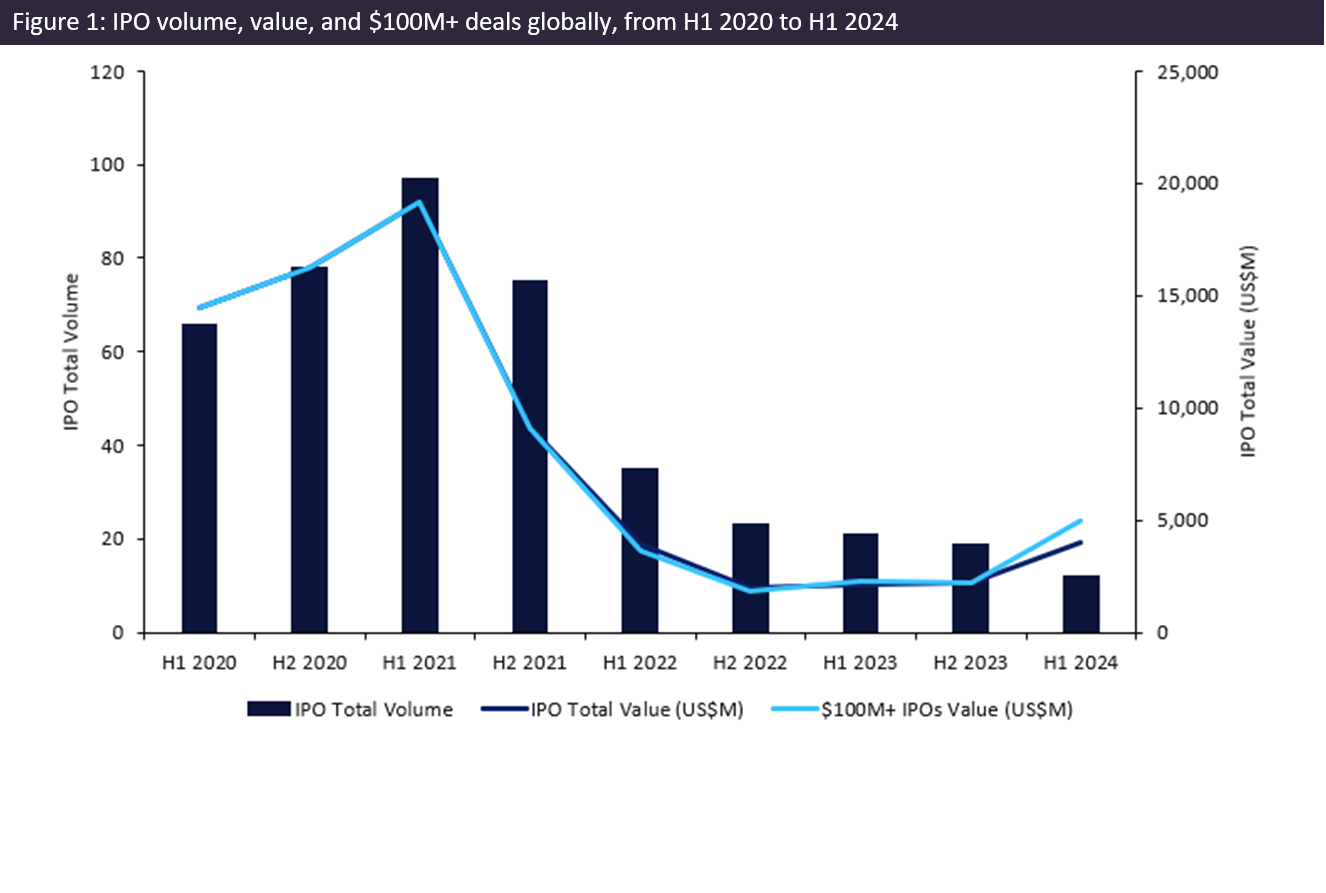

The uptick in completed biotech IPO raising in Q1 2024 follows a two-year decline in completed IPOs from $30.8bn in 2020 to $5.9bn in 2022 and $4.4bn in 2023. High interest rates in 2022 and 2023 led to a decline in biotechs going public due to reduced investment as investors prioritised existing portfolios over new opportunities, prompting many companies to delay their IPOs until market conditions improved.

This increase in IPO value has set a robust pace for the year, possibly reflecting pent-up demand following the two-year slump in IPO raises. The first biotech IPO completed in Q1 2024, and the largest to date, was clinical-stage CG Oncology, which raised $437m for the first armed oncolytic virus therapy, CG-0070. Although the volume of completed IPOs declined again in Q2 2024, companies with strong clinical data that previously struggled to secure private funding may now view the successes of completed IPOs from the start of 2024 as an opportunity to pursue their own public offerings.

In H1 2024, six completed IPOs raised more than $100m, together worth nearly $5bn. This is more than double the high-value offerings seen in H1 2023, which had five completed IPOs worth $2.2bn. These high-value completed IPOs, coupled with increased venture funding, sparked renewed optimism among investors. In 2024, biotech companies located in Switzerland, the US, and India reported the highest total IPO raises with $2.5bn, $1.5bn, and $273m, respectively. Meanwhile, the recent shake-up of regulations governing Britain’s listed companies, prompted by reforms from the Financial Conduct Authority, aims to loosen listing requirements on the London Stock Exchange. This initiative seeks to revitalise Britain’s capital markets and enhance London’s global competitiveness post-Brexit. These changes could create new investment opportunities for UK investors and potentially position London as a rival to financial hubs like New York and the EU, fostering innovation and growth.

The completion of biotech IPO raises in the first half of 2024 marks a positive shift after a prolonged period of downturn. Not only has this resurgence reflected renewed investor optimism but also created new opportunities for companies with strong clinical data. The success of those biotechs that went public during the first half of the year may encourage more to go public in the latter half of the year, though investors remain cautious while market conditions continue to stabilize.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData