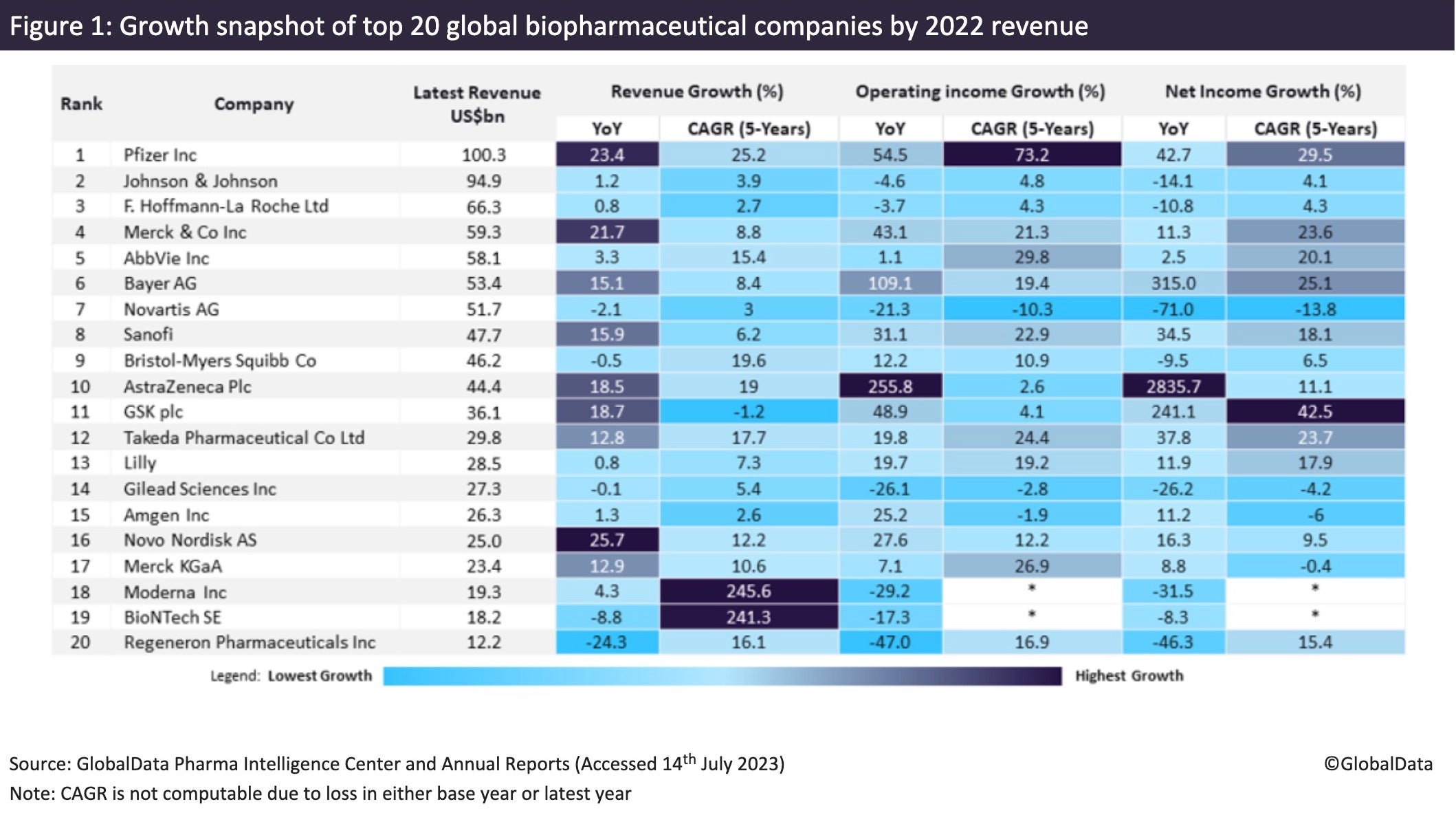

2022 was an exceptional year for biopharmaceutical companies, with notable success for those with Covid-19 vaccines. 15 of the top 20 companies reported a 5.2% growth in aggregate revenue to $868.9bn from 2021 to 2022, with Novo Nordisk, Pfizer and Merck & Co reporting year-on-year (YoY) revenue growth of 25.7%, 23.4% and 21.7% (figure 1, above), according to GlobalData’s Pharma Intelligence Centre companies database.

Pfizer was in first place with a revenue of $100.3bn and growth of more than $19bn over 2021, driven by the strong sales of its BioNTech-partnered Covid-19 vaccine, Comirnaty, which achieved global sales of $37.8bn, and its antiviral treatment, Paxlovid, which reported $18.9bn in 2022, according to GlobalData’s Pharma Intelligence Centre drug sales database. However, the US pharmaceutical firm is poised to face a patent cliff in the latter part of the decade and lose market exclusivity for several blockbuster drugs, including their anticoagulant Eliquis and the oncology drugs Ibrance and Xtandi.

Novo Nordisk’s top revenue growth was attributed to sales in its diabetes and obesity care franchises. The blockbuster type 2 diabetes drug, Ozempic, recorded sales of $8.45m in 2022 and is expected to achieve a global analyst consensus sales forecast of $17.1m by 2029, according to GlobalData’s drugs database.

Merck & Co (MSD)’s growth in revenue was primarily due to the sales of its immunotherapy oncology drug, Keytruda, and its Covid-19 drug, Lagevrio. According to GlobalData’s report, Pharmaceutical Drugs Development Annual Review, Sales and Forecast, Key Trends, and Competitive Analysis-2022, Keytruda and Lagevrio witnessed sales growth of 22% and 497%, respectively, generating $20.9bn and $5.7bn in drug sales revenue in 2022. The company is currently seeking FDA approval for Keytruda as a perioperative treatment for early-stage lung cancer aimed at reducing the risk of disease recurrence, progression or death.

BioNTech and Novartis recorded marginal year-on-year (YoY) revenue declines of 8.8% and 2.1%, respectively, in 2022. Lower sales for their Covid-19 vaccine worldwide contributed to BioNTech’s revenue decrease in 2022. However, both BioNTech and Pfizer are currently awaiting regulatory review and approval from the FDA for their Omicron XBB.1.5 Covid-19 vaccine, which may help boost their revenues.

Nine of the top 20 companies demonstrated a positive compound annual growth rate (CAGR) exceeding 10% between 2018 and 2022, with Moderna (245.6%) and BioNTech (241.3%) maintaining their positions as frontrunners on the list with more than 200% CAGR thanks to their Covid-19 vaccine franchises.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAstraZeneca (255.8%), Bayer (109.2%) and Pfizer (54.5%) had more than 50% YoY operating income growth in 2022, fueled by increased cash flows, strong divisional performance and higher revenues with reduced in-process research and development (IPR&D) expenses, respectively. On the other hand, Moderna (-29.5%), Gilead Sciences (-26.1%), and Novartis (-21.3%) reported greater than 20% declines in their operating profits in 2022.

AstraZeneca (2835.7%), Bayer (315%), and GSK (241.1%) had above 100% YoY net profit growth. AstraZeneca’s growth was driven by an increase in total comprehensive income of $2.4bn, including actuarial gains of $1.1bn. Bayer’s growth was attributed to strong divisional sales, with GSK’s growth due to the inclusion of gains from the demerger of the Consumer Healthcare business to form Haleon.

Seven players reported YoY declines in profitability, with Novartis (-71%), Moderna (-31.5%) and Gilead Sciences (-26.2%) reporting more than 25%. YoY declines are due to Novartis’s divestment from Roche and Moderna’s operational income decline amid reduced demand for Covid-19 vaccines. Gilead Sciences’ marginal decline in revenue saw a decrease in operating income (-26.1%) and net income (-26.2%) primarily due to in-process research and development (IPR&D) expenses of $2.7bn related to assets acquired from Immunomedics and $406m related to the termination of Gilead’s collaboration with Everest for the development of Trodelvy, as well as increased R&D expenses in 2022.

The top biopharmaceutical companies that developed effective vaccines for Covid-19 during the pandemic have continued to reap success. However, the biopharmaceutical industry continues to face ongoing challenges, including inflationary pressures and the loss of exclusivity for major products. The Inflation Reduction Act, passed by the US Congress in August 2022, allows Medicare to negotiate lower prescription costs and limit price increases exceeding inflation. This has raised concerns, as it may potentially impact the future of innovative drug development for biopharmaceutical companies.