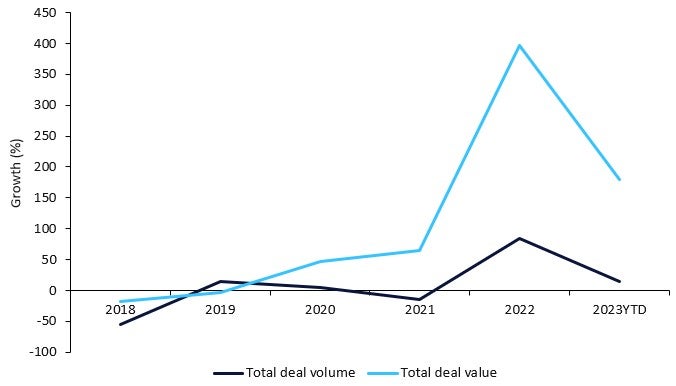

Antibody-drug conjugates (ADCs) saw a 400% growth in total licensing agreement deal value from 2017 to 2022 and reached a peak of $16.6bn in 2022, according to GlobalData’s Pharma Intelligence Center Deals Database.

ADCs combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs to target and eliminate cancer cells. Due to their specificity, ADCs play a pivotal role in combating cancer, with a growing number of Antibody-drug conjugates marketed over the past two decades in addition to those promising candidates advancing into late-stage clinical trials. Biopharmaceutical companies are collaborating on ADC drug development, and while becoming increasingly attractive to top players within the pharma industry, there are challenges.

According to GlobalData’s Pharma Intelligence Center Deals Database, 150 licensing agreement deals involving Antibody-drug conjugates were struck between 2018 and 2023YTD, with 40% (59 deals) in preclinical as the most advanced stage of development at the time of the deal. Oncology remained the top therapy area involving ADC drugs over the last five years, reaching a peak in 2022 with 36 licensing agreement deals. Biopharmaceutical companies are building upon the success of those previously launched ADC drugs as they advance towards the next generation of ADCs.

ADCs remain on trend in 2023

In the first half of 2023, of the 19 licensing agreement deals disclosed, nine were at the preclinical stage of development, with a total deal value of $2.3bn.

In January 2023, the biotech company Synaffix, which has its headquarters in the Netherlands, signed a licensing agreement with Amgen valued at up to $2bn. Amgen will gain access to Synaffix’s ADC technologies for research and commercial licenses for four candidates at the preclinical stage in oncology. The companies’ collaboration is currently the biggest preclinical ADC licensing deal of the year.

Meanwhile, the Antibody-drug conjugates drugmaker Seagen had multiple licensing agreements with Merck & Co., Sanofi, Bristol-Myers Squibb, and AbbVie. The company has an advanced Antibody-drug conjugates portfolio with five marketed drugs: Adcetris, Aidexi, Padcev, Tivdak, and Tukysa. In 2021, the company engaged in a strategic collaboration with RemeGen, resulting in a billion-dollar deal aimed at the development and commercialization of a novel HER-2-targeted ADC, disitamab vedotin (Aidexi), worth up to $2.6bn. Aidexi is now a marketed product. In March 2023, Pfizer also joined the ADC field with the announcement to acquire Seagen for $43bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIncreasing development within Antibody-drug conjugates may lead to potential biosimilar competition for ADC therapies. However, the complex design of ADCs poses a greater challenge for biosimilar rivals. The lack of biosimilar competitors could in turn provide Antibody-drug conjugates drugmakers with more pricing flexibility and foster new deals with major players in the biopharma space.