The use of stimulants for attention deficit hyperactivity disorder (ADHD) treatment is increasing. Despite this, three out of the four late-stage pipeline agents in Phase III development within the seven major markets (7MM): France, Germany, Italy, Japan, Spain, the UK and the US) have non-stimulant properties. The lower abuse potential of these drugs is emphasised by developers, but without displaying efficacy comparable to marketed stimulants, pipeline non-stimulants will struggle to penetrate the stimulant market share even if approved.

ADHD is a neurodevelopmental disorder characterised by age-inappropriate, extreme and impairing levels of inattention and/or hyperactivity and impulsivity. It is an extremely clinically heterogeneous disorder with high rates of comorbidity with other childhood-onset psychiatric disorders. Diagnosis typically follows either the American Psychiatric Association’s Diagnostic and Statistical Manual of Mental Disorders (Fifth Edition; DSM-5/DSM-5-TR [text revised edition]) or the International Classification of Diseases (11th revision; ICD-11). While once thought to be limited to childhood, 30% to 50% of children diagnosed with ADHD continue to have problems into adulthood, resulting in between 2% and 5% of adults having ADHD.

Within the 7MM, other than patients below the age of six years or those presenting with mild ADHD, the first line and gold-standard therapy is stimulants – amphetamines and methylphenidates, including generic versions of both. Although these stimulants are similar in terms of behavioural and physiological effects, they differ in their mechanism of action. Methylphenidate is a norepinephrine-dopamine reuptake inhibitor but amphetamine has additional activity releases dopamine and norepinephrine from the pre-synaptic neuron.

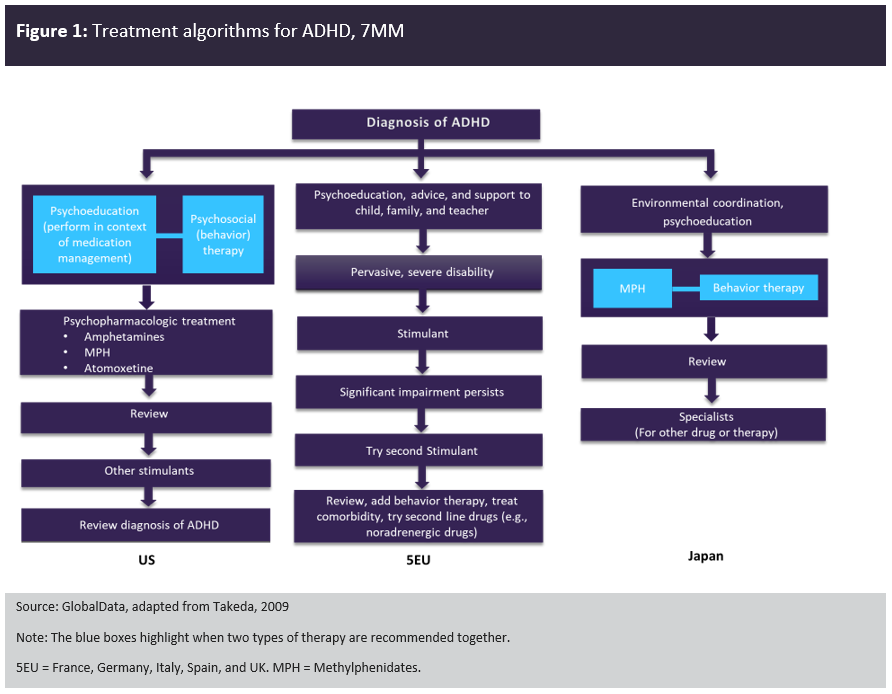

Historically there has been hesitancy among patients, parents and even among prescribers around the use of stimulants for the treatment of ADHD in children and adolescents (an age range of six to 17 years), especially towards amphetamines and Ritalin (a methylphenidate brand), and particularly in Japan. Principal causes for concern included abuse potential and stimulant adverse events such as sleep disturbance and appetite suppression. Thus far, non-stimulants have not proven to be the answer to these concerns. There are four non-stimulants currently marketed in at least one of the 7MM: guanfacine, clonidine, atomoxetine and viloxazine, with guanfacine and atomoxetine the most widespread. Mechanisms of action vary significantly between non-stimulants, from alpha 2 adrenergic receptor agonists to noradrenaline transporter inhibitors. All show lower efficacy in the treatment of ADHD than stimulants. As a result, they retain a market share and a place in treatment algorithms only as second-line therapies most frequently used for individuals who do not respond or cannot tolerate stimulants or for whom stimulants would be counter-indicated.

However, some non-stimulants show side-effect profiles similar to those of stimulants. For example, sleep disturbance and decreased appetite have been reported as adverse events resulting from both clonidine and atomoxetine, while viloxazine carries a boxed warning about suicidal thoughts and behaviours. In addition, key opinion leaders (KOLs) interviewed by GlobalData noted that hesitancy around stimulant use is waning as studies have now come out suggesting favourable health outcomes even with long-term stimulant use. They note that stimulant use for ADHD treatment is on the rise, with some prescribers even feeling that the abusability of stimulants is frequently overestimated. This argument is given more weight by the availability of numerous long-acting stimulants that have a lower abuse potential than short-acting formulations. The relaxation in attitudes around stimulant use for the treatment of ADHD can also perhaps be seen in the 2019 approval of Elvanse/Vyvanse (lisdexamfetamine dimesylate – an amphetamine prodrug) in Japan, the market with the most stringent regulations around stimulants in ADHD treatment, as noted in GlobalData’s 2016–2024 ADHD market forecast (GDHC125PIDR). Despite this, there seems to be significant emphasis on the reduced abuse potential of the ADHD pipeline agents.

Figure 1 compares the treatment algorithms for ADHD in the 7MM. Across the 7MM, stimulants are the first-line pharmacological therapy, with Japan having the most stringent regulations, meaning that Vyvanse (a prodrug) is the only approved amphetamine product for the treatment of ADHD. Non-stimulants are considered second-line therapies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

Three out of the four late-stage pipeline agents currently in Phase III development within the 7MM have non-stimulant properties: Axsome Therapeutics’ solriamfetol, Otsuka Pharmaceutical’s centanafadine and Neurocentria’s L-threonate magnesium salt. The lower abuse potential of solriamfetol and centanafadine is emphasised by developers. However, without displaying efficacy comparable to marketed stimulants or reduced side effects compared to atomoxetine and guanfacine (the most widely approved non-stimulants in the 7MM), solriamfetol and centanafadine could struggle to penetrate the market even if approved. In that situation, a better alternative strategy to penetrate the saturated ADHD market would be to target key unmet needs in ADHD treatment such as improving compliance, providing coverage into the evening without affecting sleep, or undertaking head-to-head studies to refine the position of the agent in the treatment algorithm.