With the majority of EU countries closing down their borders, imposing country-wide lockdowns, and the UK government expecting the coronavirus crisis to peak in Britain between late spring and early summer, the Covid-19 outbreak could force the Brexit transition period to be extended as the peak of the coronavirus crisis is expected to overlap with the trade agreement negotiation deadlines.

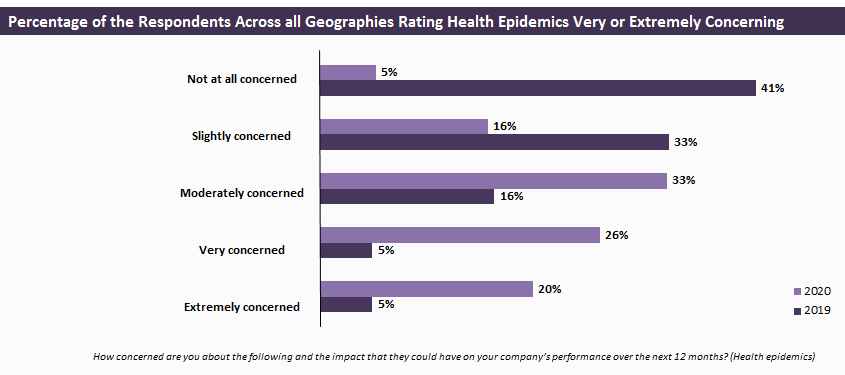

In 2020, Brexit will remain as one of the top industry concerns; however, it will be upstaged by the recent coronavirus outbreak, which has started to take its toll on the global economy and financial markets. GlobalData’s latest annual Healthcare Industry Business Confidence Report 2020 reveals that during February–early March 2020, 95% of global healthcare industry respondents stated that they were concerned about the impact that health epidemics could have on their company’s performance, up by 36% from last year’s figures. Moreover, 23% of respondents were very or extremely concerned about supply and demand gaps—likely tied to the coronavirus outbreak. Brexit, which was ranked as one of the most concerning issues in the 2019 Healthcare Industry Business Confidence Report (33%), saw a drop of more than 17% in 2020, most likely due to the UK remaining in the EU single market at least until the end of the year as a part of the transition period agreement.

While the UK’s Prime Minister, Boris Johnson, is determined that there will be no change in plans to get the UK out of the EU by the end of the year, Brexit and trade agreement talks may not be top priorities for the EU and the US. Despite the UK government’s reluctance to be a “rule-taker” and make any binding commitments to align fully with the EU’s regulations, alignment to the Europe Medicines Agency (EMA) could be the most rational way to expedite drug approvals and access. While a post-Brexit UK will be free from the EU regulations and can take back control over its domestic affairs, finances, and regulations, if a drug such as the Covid-19 vaccine is developed outside the UK, Britain will likely have to join the queue of other non-EU countries in order to obtain the Covid-19 vaccine after the EU does.

The coronavirus outbreak has also uncovered fragilities in global manufacturing efforts, where China and India have emerged as major players in recent years. However, China experienced a dip in drug production during the coronavirus lockdown and India announced plans to keep dozens of medications that the country produces on reserve. The global drug supply chain issues are heightened by countries such as the US pressing its pharmaceutical companies to move towards domestic manufacturing and the UK government banning the parallel export of more than 80 drugs, including the ones that are being used to treat Covid-19 patients in China, citing they could be needed for UK patients if the outbreak continues. This move by the UK government is not a new one, as the country took similar measures in October–November 2019 and placed restrictions on certain drugs in anticipation of Brexit-related shortages.

The overall economic impact of the coronavirus outbreak on the UK economy and global supply chains remains unclear and according to the former UK’s Chancellor of the Exchequer, Phillip Hammond, the coronavirus could pose an even greater risk to the economy than a no-deal Brexit. Since the outbreak began, the FTSE 100 has fallen about 30% and the UK has cut interest rates to an all-time low of 0.1% in an attempt to stabilise the economy.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData