California-based Amunix Pharmaceuticals has raised $73m in the Series A financing round. The funding was led by Boston-based Omega Funds; other investors include Frazier Healthcare Partners, Longitude Capital, Venrock and Polaris Partners.

Due to the funding, Omega Funds founder and managing director Otello Stampacchia, Longitude Capital founder and managing director David Hirsch and Frazier Healthcare partner James Brush will join Amunix’s board of directors.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

This financing adds to a $40m upfront payment Amunix received from Roche in January 2020 as part of a licensing agreement related to Amunix’s XTEN technology platform. As a result of this agreement, Amunix may be eligible for up to $1.5bn in milestone payments.

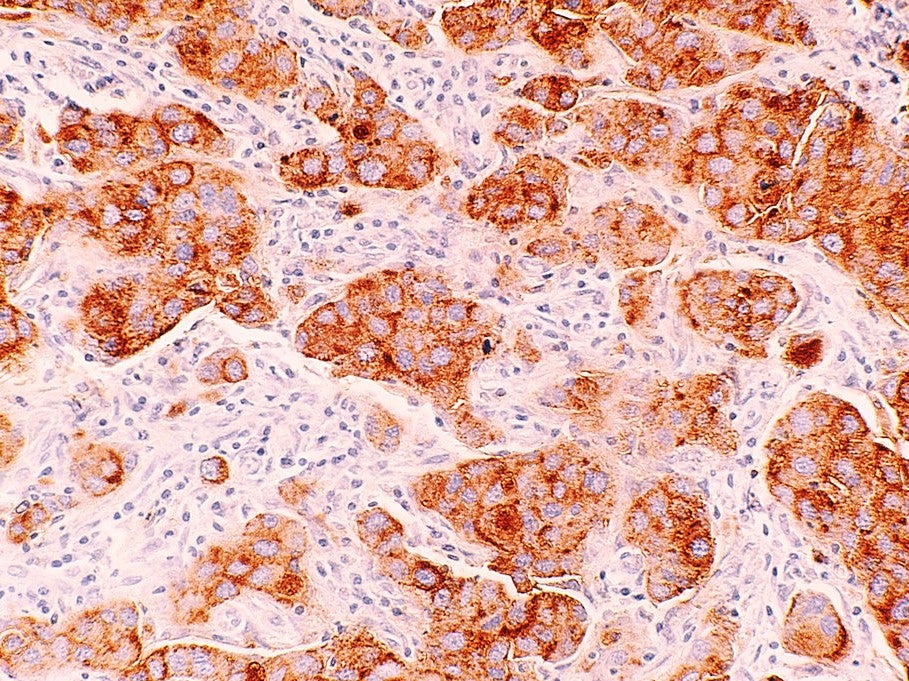

Amunix plans to use this combined $113m of funding to advance its lead development candidate AMX-818, which is a novel T cell engager (XPAT) targeting HER2+ solid tumours, as well as to progress its other early stage XPAT programmes and to initiate drug discovery of novel cytokine drugs.

Amunix CEO Angie You commented: “The completion of our Series A financing marks a critical milestone for Amunix, as the investment affords us a significant financial runway to advance our novel pipeline of T cell engagers and cytokines targeting a spectrum of solid tumours.

“Biologic immune activators hold tremendous untapped promise to help many cancer patients achieve better outcomes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“We are focused on making this promise a reality by leveraging our clinically validated prodrug platform to deliver T cell engager and cytokine therapies that combine potency with an augmented safety profile and unique ability to evade an undesirable immune response.

“Our XPAT T cell engager platform holds the potential to deliver off-the-shelf therapies capable of redirecting T cells in the body to fight solid tumors.”

Stampacchia added: “We are delighted to have successfully led this financing for Amunix, especially in the current market environment.

“We are glad to have attracted a syndicate of sophisticated, long-term investors who are familiar with this ever more important therapeutic modality.

“We see in Amunix’s next-generation XPAT T cell engager platform a great potential to address the biggest hurdle to bringing the benefits of this class to solid tumour cancers patients: on-target off-tumour toxicity.”