VaxGen opened a new biopharmaceutical manufacturing facility in South San Francisco, California, US in June 2003. The facility had 17,000ft² of floor space for the manufacture of protein therapeutics, vaccines and monoclonal antibodies, using recombinant bacterial fermentation and mammalian cell cultures.

The plant is situated adjacent to an existing VaxGen research and development facility and was to be used initially to manufacture VaxGen’s AIDS and anthrax vaccine candidates.

The company was awarded a US government contract for the development of a recombinant anthrax vaccine; 75 million doses of the vaccine would have been worth around $877m in revenue to the company. Problems with the stability of the vaccine led to the FDA cancelling clinical trials and finally the government contract from Project Bioshield was cancelled in December 2006.

After that, the company stopped development of its recombinant anthrax vaccine and cut all the people working on it. The technology was sold to Emergent BioSolutions which has continued work to develop the vaccine, which is based on two patents held by the US Army. In August 2008, VaxGen received a $1m milestone payment from Emergent BioSolutions related to the generation of non-clinical data demonstrating the immunopotency and improved stability of the vaccine.

This caused the value of the company’s shares to plunge from around $16 to just over $2. The company has also had problems with the AIDS vaccine it was developing; it proved to be a non-starter.

VaxGen generated $96.6m from the sale of its Celltrion shares in January 2007. The shares were worth around $51.3m.

In December 2007, VaxGen announced that it was to merge with Raven Biotechnologies, a private company working in monoclonal antibodies. VaxGen had the cash and Raven had the new technology. Raven already had a deal with Wyeth to develop certain applications for the commercial market.

However, VaxGen called off the deal in April 2008 when it realised that its own shareholders would not support the merger. VaxGen shareholders would have owned about 51% of the new combined company. Vaxgen lent Raven $6.3m as a bridging loan, which was repaid in August 2008 when the merger deal fell through.

Vaxgen laid off 17 of its remaining 22 employees, including the chief financial officer Matthew Pfeffer, to save money.

The Vaxgen board then tried to liquidate the company by selling its main asset, the biopharma manufacturing plant in the Bay area of South San Francisco. The facility was booked at a value of around $8.5m.

In July 2010, the company merged with diaDexus, a diagnostics company focused on developing and marketing patent-protected in vitro diagnostic products. The merged company was renamed diaDexus on 1 November 2010.

The merged company is yet to make a decision on VaxGen’s South San Francisco facility. It’s lease is due to expire in December 2016, while the lease of diaDexus’s South San Francisco facility will expire in June 2011.

Contractors and finance

The San Francisco facility was constructed and outfitted by Fluor Enterprises . The facility and installations cost $11m. Validation was completed in early 2004. Some of the facility validation was carried out by VaxGen QA, although Fluor was the main validation contractor responsible for the majority of utility and process systems.

Facilities at the plant

The VaxGen biologics manufacturing plant was designed to manufacture biopharmaceuticals under cGMP. The two independent bioreactor suites include: 1,400l (1400-L ABEC bioreactor), 1,000l, 200l and 20l (20-L Applikon) capacities as well as downstream processing, filtration and purification facilities. There is also space for two more 1,000l reactors.

The bioreactor suites occupy some 17,000ft², while an additional 30,000ft² is available to support production, process development and quality control operations and also to allow for additional expansion of bioreactor capacity when it is required.

The process equipment at the plant has Allen-Bradley PLC control systems and is network-enabled for flexibility of monitoring production processes.

Piped utilities include clean dry air, carbon dioxide, nitric oxide and oxygen to support both mammalian and bacterial cell culture processes. There are also duplicate plant steam boilers that can be run simultaneously or in a lead/lag configuration to support production.

There are redundant systems for most of the utilities, including two RO/DI units, each generating 7 gallons DI per minute with 12,000l purified water storage capacity, and two clean steam and WFI units, each generating up to 700l WFI and up to 1,100lb of clean steam per hour per system, with 6,000l of WFI storage capacity. The single-pass HVAC system (100% exhaust) prevents room cross-contamination.

Other separation facilities include an Alpha Laval Disc Stack BTPX-205 steam-sterilisable centrifuge, which allows for cell separation at up to 1,200l/hour. Harvested product can be polished with Millipore and Cuno depth filtration systems and stored in a steam-sterilisable 1,500l Feldmeier tank. There are tangential-flow filtration and chromatography skids available along with two Millipore ultrafiltration systems, with an operating range from five to 200ft².

The facility is equipped with four programmable Millipore chromatography skids with column capacities ranging from 5l to 185l, and flow rates of up to 10l/minute. Separate buffer preparation, equipment cleaning and sterilisation areas have validated equipment in place, including a 2,000l Feldmeier solutions prep tank. The facility also has cleanroom facilities and a 2,000ft³ validated 2–8°C walk-in cold room and a 1,800ft³ validated walk-in cold room in the QC laboratories.

The plant has the capacity to produce 100 million doses of vaccine per year.

Anthrax vaccine

The facility’s first product would have been its anthrax vaccine candidate. By the end of 2007 the first 25 million doses of vaccine for the stockpile were supposed to be delivered.

But as the company was testing the vaccine it was noticed that it was being broken down too rapidly. This was because of an unexpected interaction with an adjuvant, which was meant to increase the vaccine’s effectiveness. The contract with health and human sciences was completely and irrevocably cancelled.

Smallpox vaccine and AIDS vaccine production

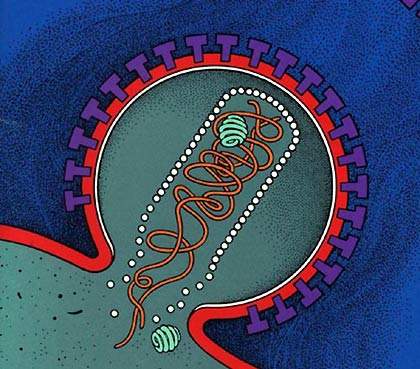

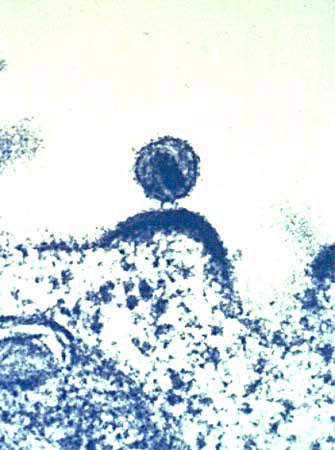

VaxGen also had an important candidate for an AIDS vaccine, a protein, gp120, which had problems in Phase III clinical trials. This trial eventually failed and the vaccine provided no protection. In addition, VaxGen also acquired the rights from Chemo-Sero-Therapeutic Research Institute (Kaketsuken), a Japanese company, for a safer smallpox vaccine. The smallpox vaccines could still be produced at the San Francisco plant.

Joint venture partners

The development of the facility was part of a major joint venture that included Celltrion. Celltrion is a partnership between VaxGen and South Korean Nexol Corporation, Korea Tobacco & Ginseng Corporation (KT&G) and J Stephen and Co Ventures.

The joint venture included a much larger plant for biologics manufacture, which was completed in Incheon, South Korea in 2006. The whole venture attracted an investment of $120m.

VaxGen operated the plant to develop and produce its own products, and has also been used to train Celltrion personnel in US cGMP biologics manufacture as part of a technology transfer agreement with Celltrion.

The VaxGen contribution toward the joint venture included manufacturing technology originally developed at Genentech and improved at VaxGen and also expertise and training. VaxGen has not had to contribute any cash or equity to the project. However, the company sold its Celltrion shares for over $50m.