Price slashing last year by cholesterol-lowering PCSK9 drug developers is expected to improve affordability and promote uptake of inhibitors in 2019.

Cholesterol-lowering drugs: price war

There are two PCSK9 inhibitors currently marketed for dyslipidemia patients: Sanofi and Regeneron’s Praluent (alirocumab) and Amgen’s Repatha (evolocumab).

Since their US launch in 2015, the major barrier to the adoption of PCSK9 inhibitors has been their high price tag. In response to this, Sanofi and Regeneron halved the US net price of Praluent from $14,000 to $7,000 in 2018, which has allowed the drug to be listed on the Express Scripts national formulary.

Amgen cuts price of Repatha

Amgen followed suit and lowered the price of biweekly Repatha down to $5,850 a year from $14,000. Amgen also plans to lower the cost of once-monthly Repatha. Questions remain about whether the improvement in patient outcomes justifies the high price point of PCSK9 inhibitors, but these price reductions will undoubtedly fuel their uptake moving forward.

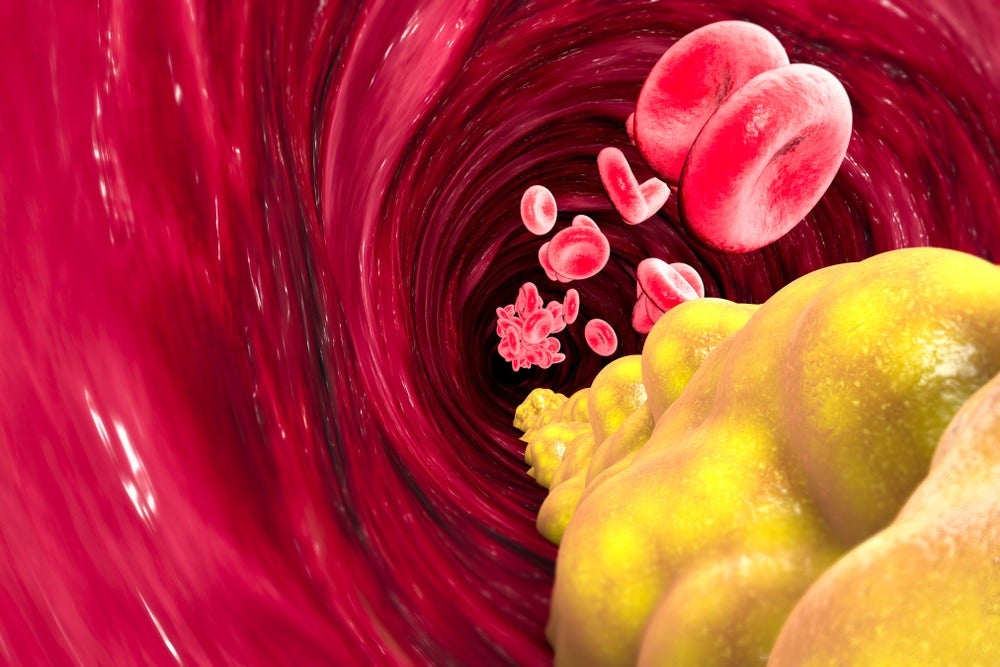

PCSK9 inhibitors have also suffered low uptake due to payer restrictions. When regulatory bodies approved PCSK9 inhibitors for a relatively broad proportion of dyslipidemia patients, payers reacted by placing strict requirements on who is eligible to use them. Although efficacious and cost-effective lipid-lowering statins are available, a proportion of patients with dyslipidemia cannot reach recommended levels of low-density lipoprotein cholesterol (LDL-C).

PCSK9 inhibitors have largely been limited to patients who are unable to lower LDL-C levels with conventional lipid-lowering therapies.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataPraluent has the edge

The highly anticipated results of the Odyssey trial, a large cardiovascular (CV) morbidity and mortality outcomes study evaluating Praluent, were released in 2018.

In addition to showing a similar reduction in major adverse CV events as that seen with Repatha in the CV outcomes Fourier trial, treatment with Praluent was also associated with a 15% reduction in the risk of all-cause mortality when compared to placebo. This reduction in the risk of all-cause mortality was not observed in Fourier, giving Praluent an edge over its main competitor.

Inclisiran’s administration advantage

There is also another PCSK9 targeting therapy in the pipeline. The Medicines Company is developing inclisiran, a small interfering ribonucleic acid in Phase III clinical trials. In order to bolster inclisiran’s initial uptake and help it compete against Praluent and Repatha, the company has considered undercutting competitor prices. However, only a minimal price cut is expected, as inclisiran might have an administration advantage against its competitors since it could be administered once or twice per year.

Throughout 2017 and 2018, PCSK9 inhibitor developers continued to improve drug administration and file for new indications to promote use in high-risk patients, such as once-monthly dosing for Praluent, as well as new CV indications for Praluent and Repatha.

2019 outlook: Patent battles and uptake monitoring

Looking forward to 2019, Phase III trial results are expected for the ongoing inclisiran studies, with results expected in the second half of 2019. Additionally, Amgen will continue to fight legal battles with Sanofi and Regeneron concerning patent infringement allegations.

In January 2019, Amgen suffered a setback after the US Supreme Court declined to consider an appeal to a decision made by the US Court of Appeals for the Federal Circuit that allowed Praluent to remain on the market. Last, one of the most anticipated developments in 2019 will be monitoring the uptake and sales of Praluent and Repatha following the price cuts made in 2018.

GlobalData expects that the uptake of these two PCSK9 inhibitors will increase considerably during 2019 and beyond.