Biosimilar uptake in the US has been far slower than previously anticipated. Much of the delay is due to patent litigations dragging out biosimilar launch dates. However, even among biosimilar products that have been brought to market, the rates of adoption remain low.

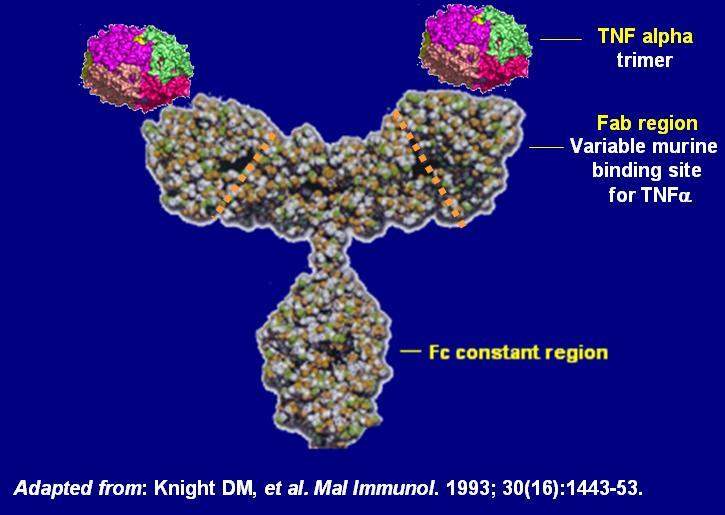

In late June, the Pacific Research Institute (PRI) released a report that sought to evaluate what type of savings the US health care system might be missing out on as a result of slow biosimilar uptake. The report contains a case study of J&J’s anti-tumor necrosis factor (anti-TNF) inhibitor, Remicade (infliximab), and its two biosimilars, Pfizer’s Inflectra and Merck’s Renflexis, both of which were approved and launched in the last two years.

Assuming biosimilars took on 50% of the infliximab market share, the report estimated annual savings for both commercial and national health care systems to be over 8%—totaling between $412M and $465M per year. These numbers are striking and certainly fuel arguments for greater biosimilar adoption. However, GlobalData notes that there are certain limitations to the study’s methodology that should be considered before drawing over-arching conclusions.

Although numerous studies have demonstrated that Remicade and its biosimilars have comparable safety and efficacy, the uptake of infliximab biosimilars has remained low. According to figures in the PRI report, this was less than 2% in 2017. An important impediment to biosimilar adoption has been a lack of significant savings.

While generic small molecules are often discounted by over 75%, biosimilars, being more expensive to develop and produce, typically receive a discount of 15% to 30%. Normally, even these modest discounts would shift significant market share toward biosimilars. However, many companies are able to protect their original biologics from competition through biological contracting practices—rebates and discounts on biologics agreed upon directly and confidentially with payers. This practice makes it very difficult for outside parties to evaluate the actual costs of drugs to the healthcare system.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMethodology for the PRI study

To account for these biological contracting practices, the PRI study used a value called the average sales price (ASP) in its calculations. ASP is equal to the manufacturer’s total sales of a drug in a calendar quarter, divided by the total number of units sold. Although ASP source information is not directly available to the public, the Centers for Medicare & Medicaid Services (CMS) uses manufacturer-provided data to publish a similar value called the “Medicare payment limit” for each therapeutic product.

Once the statutory 6% mark-up is removed, this price is considered a good proxy for ASP. It should be noted that the ASP data used to establish the Medicare payment limit is two quarters behind; for example, the Medicare payment limits for Q1 2017 are based on ASPs from Q3 2016.

Though imperfect, the ASP offers a more accurate view of what payers are actually being charged for drugs. For example, in Q3 2016, though the Wholesale Acquisition Cost (WAC) for recently launched Inflectra was almost 20% lower than Remicade ($946.28 vs. $1167.82), the ASP was actually almost 20% higher ($956.52 vs. $775.64). Interestingly, since that time, the ASP of biosimilar infliximab has steadily dropped and as of Q1 2018 was, on average (including both Renflexis and Inflectra), $168 less than the reference product for every 100mg vial.

Using the ASP, the report demonstrates that, depending on the assumed biosimilar market share, switching to biosimilars could save national and commercial health insurance providers between 1.5% and 15% on infliximab spending per year, totalling hundreds of millions of dollars in savings.

Potential savings for the US healthcare system

In comparison to when they were first launched, the ASP for infliximab biosimilars is about 15% less than that of the reference biologic. This suggests that increased biosimilar adoption could mean huge savings for the US healthcare system. It also pegs historical market and regulatory barriers as the main factors impeding these savings. However, there is still some important data missing. The PRI report cleverly used ASPs derived from Medicare payment limit values to capture the “true” pricing of Remicade and its biosimilars.

However, GlobalData notes that this value does not necessarily account for the effects of all rebates and discounts. For example, in the practice of pharmaceutical bundling, favourable coverage of one product – say a reference biologic – may earn a payer rebates on other therapeutic products sold by the same company. This type of rebate is not captured in the ASP. The accuracy with which biological contracting practices are captured in the ASP remains uncertain and must be considered in the financial evaluation of biosimilar adoption.