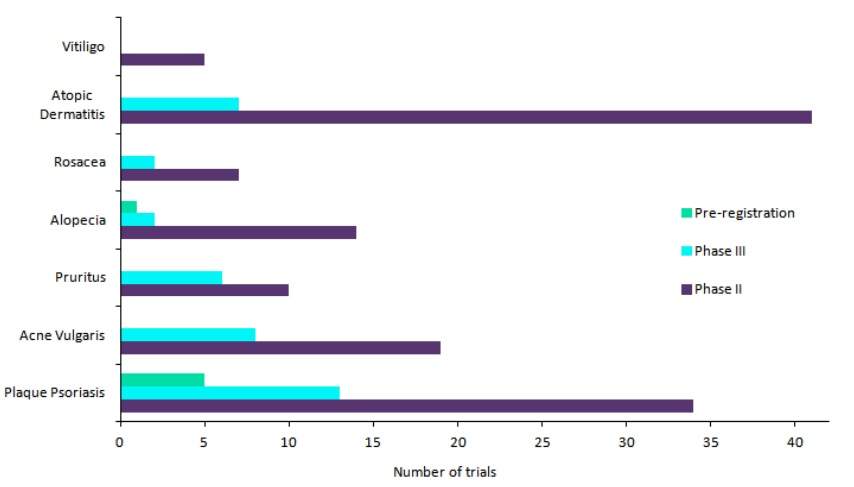

Dermatology has recently become a point of interest for pharmaceutical innovation. Considering the total number of clinical trials in Phase II, III, and Pre-Registration stages, the already-crowded plaque psoriasis market remains the industry’s top favourite dermatology indication (see Figure 1).

Following closely behind is atopic dermatitis (AD), another hotbed of clinical development marked by the presence of interleukin (IL) inhibitors and oral Janus kinase (JAK) inhibitors in late-stage development. The third indication in line is acne vulgaris, a market that has historically lagged behind in innovation but now boasts of a number of first-in-class therapies in development.

Figure 1: Top dermatology indications based on the number of late-stage clinical trials. Credit: GlobalData.

It is not surprising that the top three indications present as lucrative opportunities for pharma companies, as they have high disease prevalence. GlobalData estimates that the 2018 diagnosed prevalence of plaque psoriasis across the 7MM (7MM: US, France, Germany, Italy, Spain, UK, and Japan) is around 20 million cases, that for atopic dermatitis is around 35 million cases, while for acne vulgaris it is estimated to be around 78 million cases.

However, the reason behind the recent interest of pharmaceutical companies in other, lesser-known dermatological diseases such as alopecia, pruritus, and vitiligo is less obvious. Although they are much less prevalent than the top three indications, as evidenced by the fact that the 2018 diagnosed prevalence of alopecia across the 7MM is around 7 million cases, these markets do present significant unmet needs, and therefore hold substantial opportunities for new drug development.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn addition, biologic manufacturers are also exploring niche segments within established diseases in dermatology as an indication expansion strategy, as seen with the recent approval of AbbVie’s Humira (adalimumab) for pustular psoriasis in Japan and the FDA approval of Novartis’ Cosentyx (secukinumab) for scalp psoriasis.

For more insight and data, visit the GlobalData Report Store – Pharmaceutical Technology is part of GlobalData Plc.