Atopic dermatitis (AD) is a widespread, chronic inflammatory skin condition that can affect patients of all ages and is the result of a complex interplay of environmental, immunological, genetic, and pharmacologic factors. Prior to the approval of Regeneron Pharmaceuticals/Sanofi’s Dupixent in 2017, the AD market had been stagnant and the pipeline for drugs in late-stage development was lacking. However, recent developments have reignited interest in AD treatments, especially as the estimated drug-treated population may grow to over 25,100,000 people by 2033 within the seven major pharmaceutical markets (7MM: US, France, Germany, Italy, Spain, UK, and Japan), as per leading data and analytics company GlobalData’s estimates.

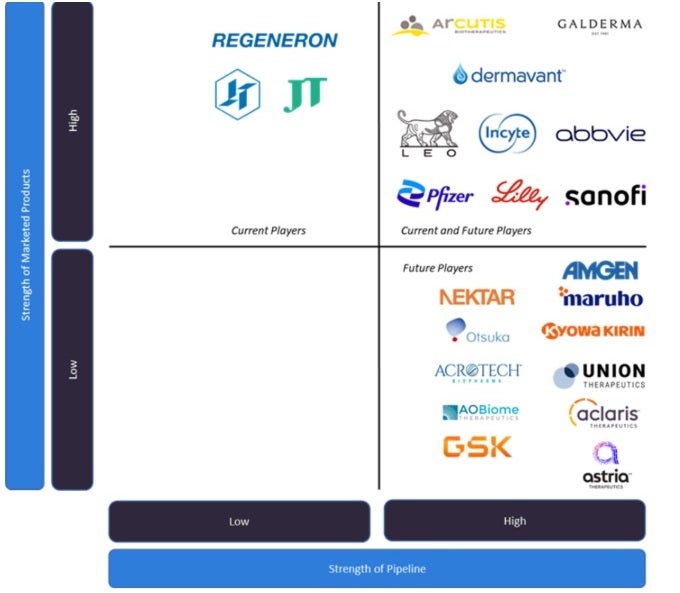

AD is a growing market with an impressive pipeline of new products from current and future players in the field (Figure 1). The AD space was previously dominated by broad-acting immunomodulatory agents, which are now being slowly replaced by more targeted agents. This shift is likely due to a better comprehension of the pathophysiology behind AD and the approval of several new systemic agents. These new agents include the following:

- Dupixent is a first-in-class interleukin (IL)-4/IL-13 dual inhibitor that was approved across the 7MM in 2017.

- Eli Lilly’s Olumiant is a first-in-class Janus kinase (JAK)1/2 inhibitor that was approved across the EU and Japan in 2020.

- AbbVie’s Rinvoq is a JAK1 inhibitor that was approved across the 7MM in 2021.

- Pfizer’s Cibinqo is a JAK1 inhibitor that was approved across the 7MM in 2021.

- LEO Pharma’s Adtralza/Adbry is an IL-13 inhibitor that was approved across the 7MM in 2021.

- Eli Lilly’s Ebglyss is an IL-13 antagonist that was approved across the 7MM in 2023.

- In addition to systemic agents, topical agents have also been approved. These agents include the following:

- Pfizer’s Eucrisa is a first-in-class phosphodiesterase 4 (PDE4) inhibitor that was approved in the US and EU in 2016, but was subsequently withdrawn from the EU prior to its launch.

- Incyte’s Opzelura is a first-in-class topical JAK1/2 inhibitor that was approved in the US in 2021.

- Otsuka Pharmaceutical’s Moizerto is a PDE4 inhibitor that was approved in Japan in 2021.

- Arcutis Biotherapeutics’ Zoryve was approved in the US in 2024.

- Galderma Laboratories’ Nemluvio was approved in the US and Japan in 2024, and was approved in the five major European markets (France, Germany, Italy, Spain, and UK) in 2025.

The major drivers of growth in the AD market include the increase in treatment options for all age groups and severities, the high diagnosed prevalence of AD, high treatment rates across all markets in the 7MM, the high annual cost of therapy (ACOT) expected for novel agents such as biologics and JAK inhibitors, and the novel mechanisms of action that will be entering the market and thus increasing the available therapeutic options for patients. Additionally, barriers to patient uptake that have been identified within the AD market include the high anticipated ACOT of pipeline agents, the pipeline topical JAK inhibitors entering a competitive topical therapy landscape, and the increasing competition in the IL inhibitor market.

Key unmet needs in the AD landscape include the lack of personalised treatments through improved diagnostic methods, the high cost of current therapy options, the limited therapeutic options for chronic hand eczema, and better long-term disease control and management. Sanofi/Regeneron’s Dupixent has transformed the space and improved the quality of life for moderate-to-severe patients, and this gap of limited drugs available is continuing to close as many more therapies have been and will continue to be introduced during the first half of the 2023-2033 forecast period. As there are many promising pipeline agents in late-stage development for AD, GlobalData expects developers to address some of these unmet needs in the next decade and beyond. Pipeline agents that will be introduced in the next ten years include the systemic drug classes OX40 inhibitors (Amgen/Kyowa Kirin’s rocatinlimab, Sanofi’s amlitelimab, Astria Therapeutics’ telazrolimab), IL inhibitors (LEO Pharma’s anti-IL-22 telazorlimab, GSK’s anti-IL-18 GSK1070806, Nektar’s anti-IL-2R complex rezpegaldesleukin), and oral PDE4 inhibitors (Union Therapeteutics’ orismilast). Other topical therapies in the pipeline include AOBiome’s bacterial therapy B-244, Aclaris Therapeutics’ JAK1/3 inhibitor, Arcutis Biotherapeutics’ PDE4 inhibitor Zoryve, and Dermavant’s aryl hydrocarbon receptor agonist Tapinarof.

With the current pipeline and marketed products in the AD space, GlobalData anticipates that the 7MM AD market will experience significant growth during the forecast period, with sales expected to increase from $8.5bn in 2023 to $22.4bn in 2033, representing a ten-year compound annual growth rate of 10.2%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData