Clinical operations teams can expect a tremendous return on investments in artificial intelligence (AI) in the next 5–10 years, according to speakers from pharmaceutical and biotech companies and investors speaking at SCOPE 2025 in Orlando, Florida, on 4-5 February 2025. Experts participating in the conference’s Clinical Trial Innovation, Venture, and Partnering stream shared that they are increasingly using AI to streamline, support, and enhance their clinical operations.

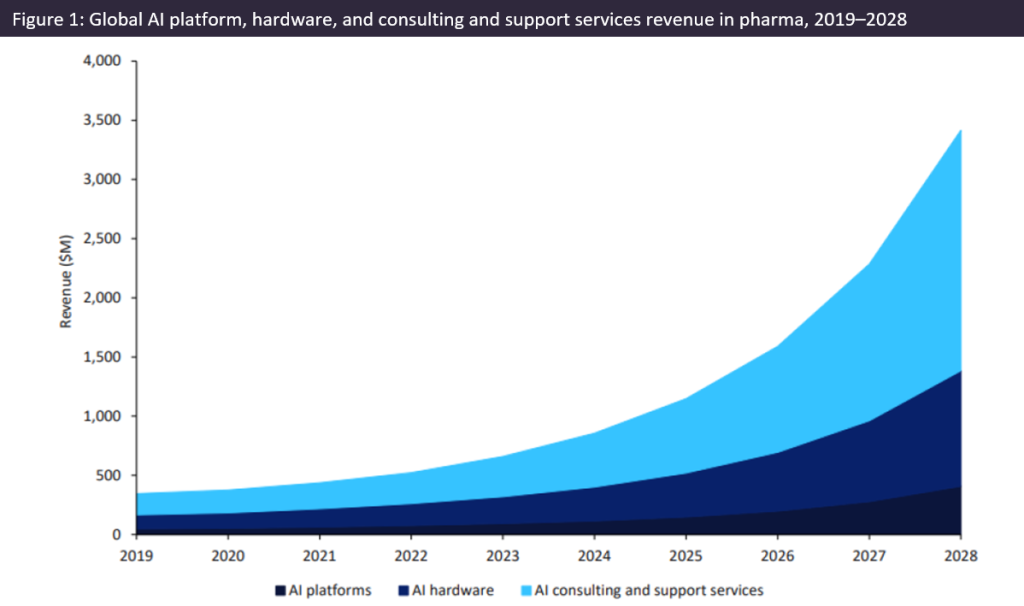

According to GlobalData forecasts, the pharmaceutical industry is expected to spend over $407m on AI platforms by 2028, up from $46.9m in 2019, representing a compound annual growth rate (CAGR) of 24.1% (Figure 1). Companies will spend more on AI consulting and support services than on AI platforms and AI hardware, with estimates at over $2bn by 2028, up from $178.9m in 2019, representing a CAGR of 27.5%.

However, investors cautioned that all stakeholders within a company must first adopt AI, and that AI must pass through regulatory checkpoints. The investor panel at SCOPE highlighted Tempus AI (Chicago, Illinois), as a success story in the pharmaceutical space for the adoption of AI. Tempus is a healthcare technology company that uses AI to collect and analyse molecular, clinical, and genomic data. At the beginning of the year, it introduced new generative AI capabilities for its AI assistant, Tempus One, which now uses the company’s proprietary large-language learning model (LLM) to advance data-driven support in clinical care and research.

According to GlobalData’s Company Filing Analytics, Tempus AI shared that it “plan[s] to continue to invest in technology personnel to support [its] Platform and new algorithm development”. GlobalData’s Job Analytics reports a 74% increase in AI hiring trends in the past month for the company.

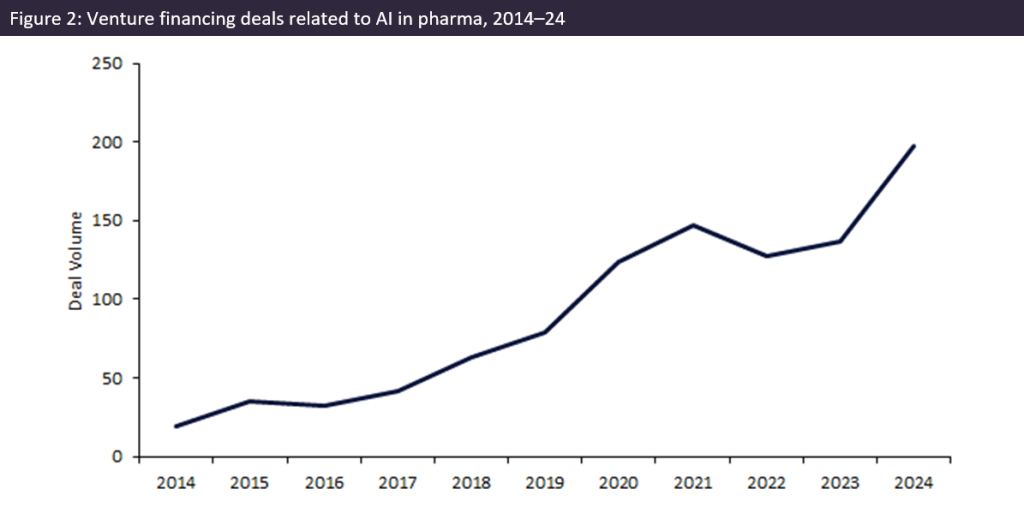

Although investors stated that the industry is coming out of a ‘biotech funding winter,’ they noted that there is still a need to find new ways to decrease drug development costs, and that technologies such as LLMs can bring down the cost of development. According to GlobalData’s Deals database, pharmaceutical venture financing deals related to AI have increased 44% from 2023 to 2024, and 55% from 2022 to 2024 (Figure 2).

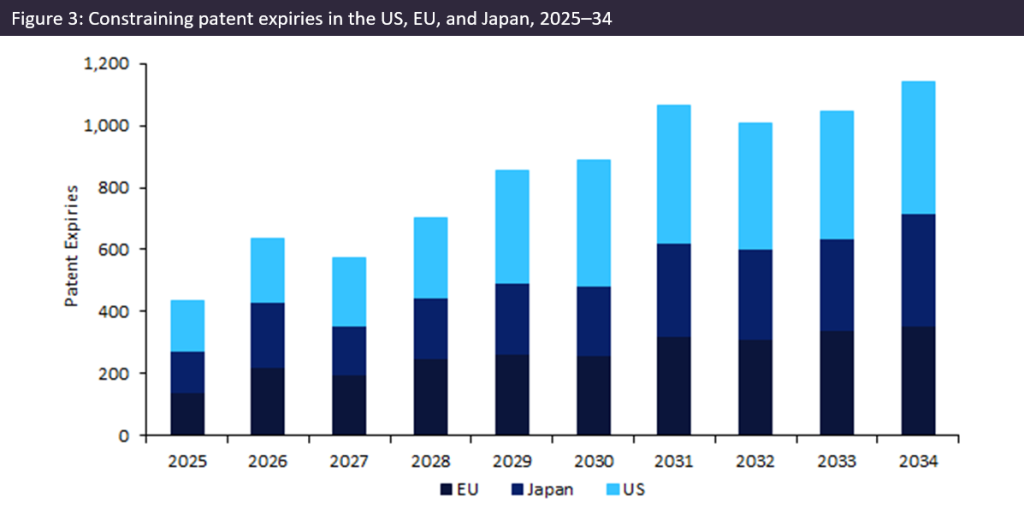

Aside from the push for innovation to decrease costs, large pharmaceutical companies are recognising that there is also a need to increase efficiency in clinical trials, with this need exacerbated by a significant drug patent cliff in 2026–27, according to investors at SCOPE.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s Catalyst Calendar reports that 1,210 constraining patent expiries are expected for the US, EU, and Japan in 2026 and 2027. By 2034, 1,142 constraining patents will expire in the US, EU, and Japan (Figure 3). The number is expected to increase over the next decade, highlighting the capacity problem in drug development. AI is the solution to this throughput problem, according to key opinion leaders at SCOPE.

To address this capacity problem in drug development, speakers at SCOPE also suggested creating more capacity through better patient recruitment and clinical operations—where site enablement and clinical data innovation were noted as areas of investment for venture capitalists. Advancements in AI and other technologies can speed up long patient recruitment timelines and resolve issues, such as missing a demographic of patients in certain zip codes due to limited access or losing patients through poor engagement.

AI-enabled technologies need to be scalable solutions that can be widely used by the pharmaceutical industry. The adoption of technologies that are too siloed may be difficult if one works with multiple vendors. Zachary Taft, CEO of IgniteData (Wilmington, Delaware), shared that there is a “disconnect between CROs and pharmaceutical [companies], where the technology needs to be implemented into preexisting systems in a way that is vendor-agnostic.” Investors and other key opinion leaders also noted that AI-enabled solutions need to be able to integrate seamlessly into a company’s current infrastructure or day-to-day. “We’re not just building platforms anymore. We’re building an ecosystem,” stated Brian Martin, a senior research fellow at AbbVie (Chicago, Illinois).