US President Donald Trump kicked off his second term with a series of directives aimed at the US National Institutes of Health (NIH), signalling headwinds in securing NIH grant funding for biopharmaceutical research and development (R7D). NIH Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) grants involving innovator drugs totalled over $1.4bn between 2020 and 2025 year to date, according to leading data and analytics company GlobalData’s Pharma Intelligence Center Grants Database.

The US NIH is the largest funder of biomedical research globally, providing federal government funding to US-based early-stage small businesses through its SBIR and STTR programmes to drive innovation with a focus on commercialisation. Biotech startups rely on government grants to fund early-stage biopharmaceutical R&D, where attracting venture capital is challenging unless a clear return on investment is evident.

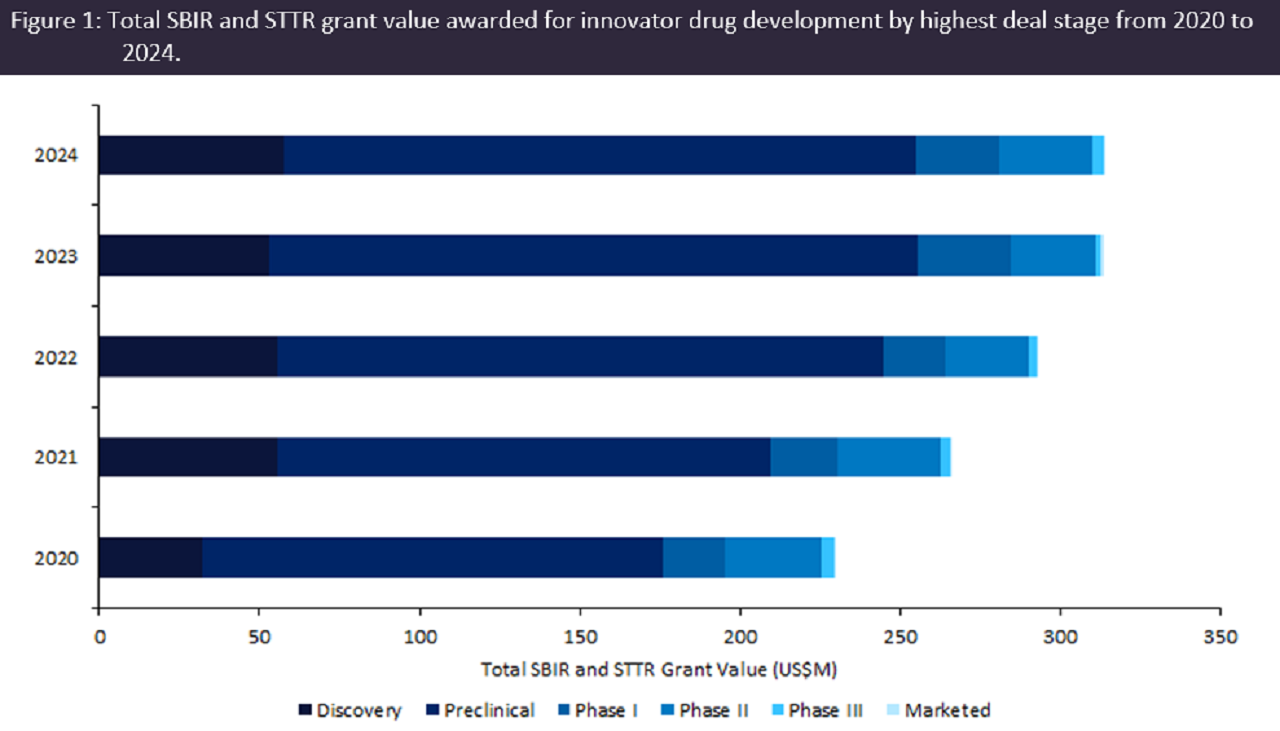

According to GlobalData’s Pharma Intelligence Center Grants Database, SBIR and STTR grants involving innovator drugs witnessed sustained year-over-year growth, with a 37% increase in total grant value from $237m in 2020 to $326m in 2024. Over 80% of SBIR and STTR grants were awarded for drugs at the preclinical and discovery stages of development, amounting to over $1.1bn between 2020 and 2024 (Figure 1), reflecting the support SBIR and STTR grant funding provides to early-stage R&D.

Infectious disease was the top therapy area for preclinical and discovery-stage SBIR and STTR grants with a total grant value of $295m from 2020 to 2024, followed by the central nervous system therapy area with $241m. In September 2024, Amplo Biotechnology secured $3m in SBIR grant funding to advance its DOK7-targeting gene therapy to treat congenital myasthenic syndromes.

On 8 February 2025, NIH announced a $4bn cut to overhead funding for biomedical research by reducing the indirect cost rate to 15%. This decision follows other restrictions imposed on NIH, including abrupt cancellations of grant review panels without reschedule, delaying access to grant funding. These actions could postpone NIH-funded clinical trials and create cash flow issues for biotech companies that rely on NIH grant funding, which may force them to scale back drug development.

Similarly, the Trump administration issued a 90-day funding freeze and stop-work order for the United States Agency for International Development (USAID), disrupting USAID-funded clinical trials globally.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn a now-rescinded memorandum ordering a broader federal funding freeze, the Trump administration communicated its intent to redirect federal spending away from grant programmes that do not align with Trump’s ideological agenda. This signals greater stringency in the allocation of NIH grants, with grant applications referencing diversity in preclinical and clinical drug development facing additional scrutiny. Furthermore, Robert F Kennedy Jr – Trump’s appointed head of the US Department of Health and Human Services – previously commented on plans to shift research away from infectious diseases, which may lead to a downturn in NIH funding for such drugs.

Trump’s recent federal funding cuts and freezes could have profound consequences for innovation in the biopharmaceutical industry by delaying or halting global R&D and drug approvals, further hindering global patient access to essential treatments.