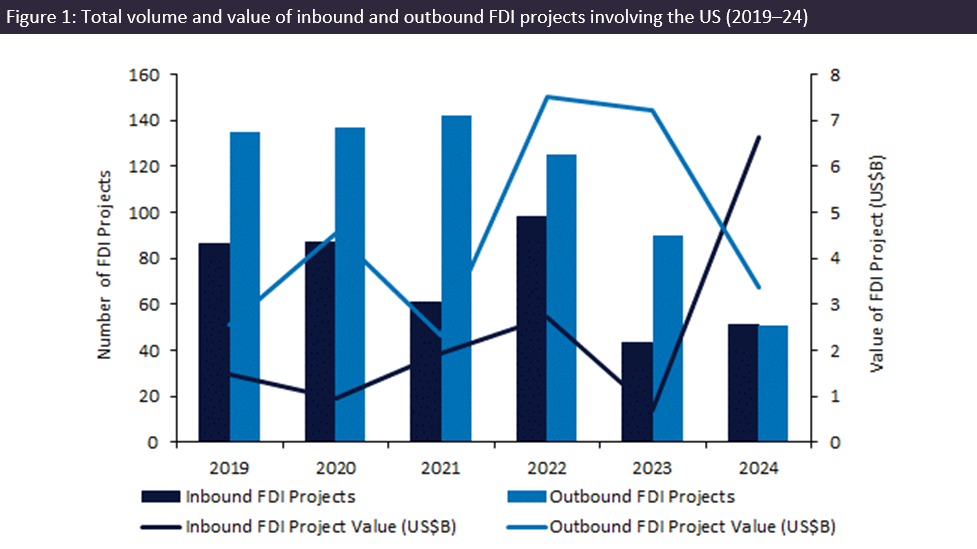

The pharmaceutical industry is bracing for potentially major disruptions following US President Donald Trump’s announcement of new tariffs on imported goods – 25% on Canada and Mexico, both paused for 30 days, and 10% on China – with the potential for expansion to additional countries. These measures threaten to worsen drug shortages, increase prices, and force manufacturers to reevaluate their market strategies. Foreign direct investment (FDI) refers to an investment made by a company or investor in a business or corporation located in another country, typically involving acquiring ownership, establishing operations, or expanding facilities. In the pharmaceuticals and healthcare sector, outbound value from the US decreased by 53% ($3.4bn in 2024, while inbound value to the US increased by 837% ($6.6bn), according to leading data and analytics company GlobalData’s FDI Database. This indicates a decline in US biopharmaceutical companies’ investments in the countries where most of their drug manufacturing and clinical trials are typically conducted. In turn, investors remain concerned about the potential impact of these tariffs within the biopharmaceutical industry and supply chain.

These tariffs could lead to higher drug prices for patients in the US and drug supply shortages and could force manufacturers to find alternative markets. Given the US healthcare system’s reliance on a global supply network that is in need of reform along with the current high drug prices, these tariffs could further put a strain on drug pricing. As a major supplier of active pharmaceutical ingredients and an emerging pharmaceutical innovation hub, China’s role is critical in the global supply network. Furthermore, generic and biosimilar drug manufacturers, which often operate with tight profit margins, may struggle with additional costs.

GlobalData’s FDI Database reports that there was a 787% rise in Europe’s inbound FDI to the US ($5.4bn) from 2023 to 2024 while Canada experienced a complete decline in outbound FDI from the US, dropping from $1.1bn in 2023 to zero. Despite trade tensions, the Trump administration aims to incentivise companies to establish manufacturing facilities within the US, boosting domestic investment. However, tariffs on key trading partners such as Canada, Mexico, and China could erode the cost benefits of outsourcing, forcing US companies to reassess their international expansion strategies.

With growing uncertainty in the trade environment, investors may delay new investments until policies become clearer and monitor how other countries react to Trump’s tariffs before making further commitments. While Trump has signalled that he may announce similar tariff measures on the EU, he suggested that a trade deal with the UK could be possible, although the UK remains at risk of being drawn into the broader trade conflict.

These tariffs could have profound consequences for the pharmaceutical industry, driving inflation, worsening drug shortages, and limiting patient access to treatments. It remains to be seen how biopharmaceutical companies will react to the implementation of the proposed tariffs, which may lead to the relocation of drug manufacturing and clinical trials back to the US or to other tariff-free countries. However, the full extent of the measures remains uncertain and the industry’s response is still currently unknown.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData