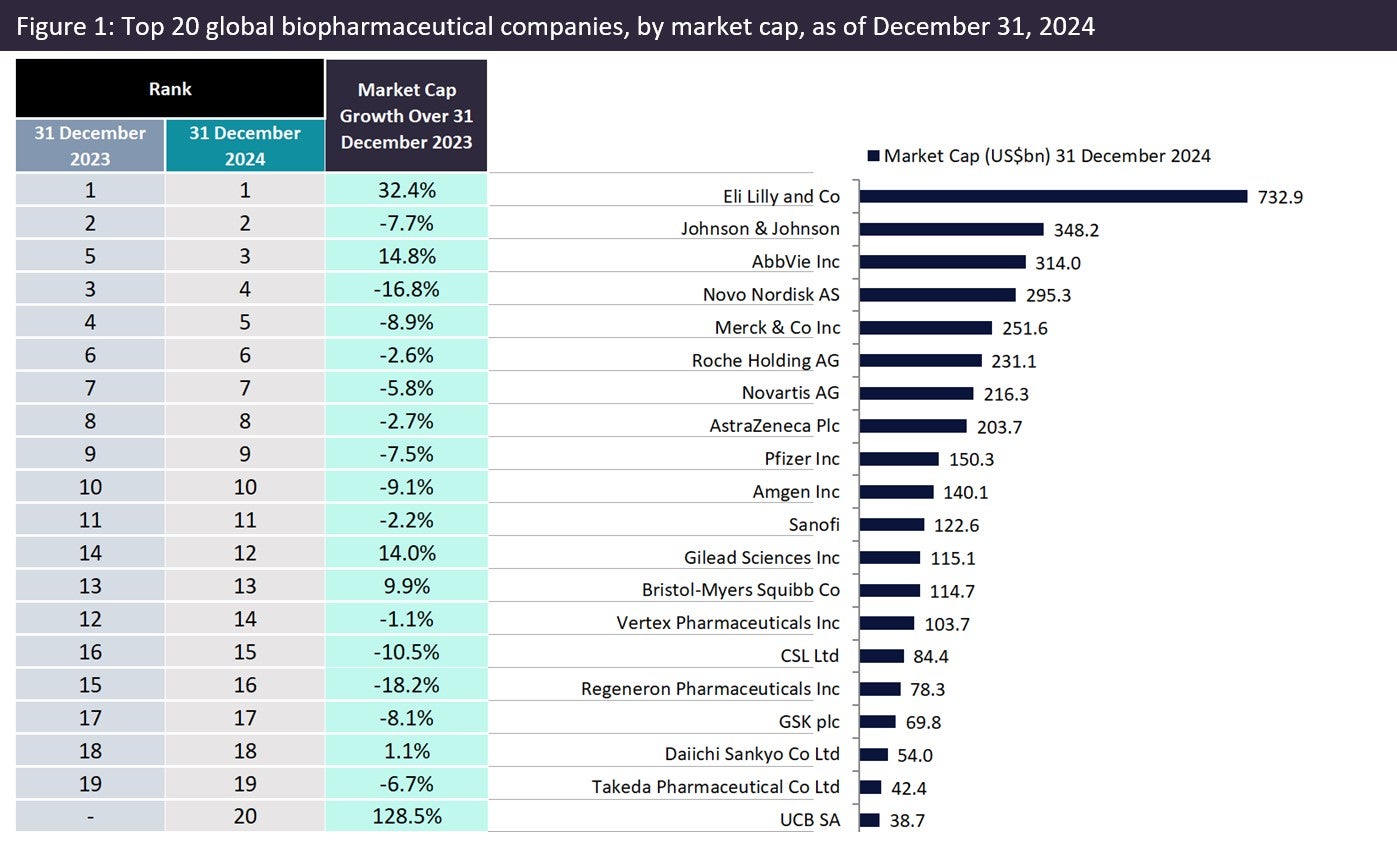

The top 20 biopharmaceutical companies experienced mixed performance in 2024 amid a dynamic landscape influenced by US Federal Reserve interest rate cuts, Medicare policy concerns over President Donald Trump’s second term, and uncertainty from Robert F Kennedy Jr’s anti-vaccine stance. Despite these challenges, their total market capitalisation rose by 1.7%, from $3.6tn in December 2023 to $3.7tn in December 2024, according to GlobalData, a leading analytics and research firm.

Eli Lilly achieved the largest market capitalisation growth of 32.4% to $733bn in 2024, driven by strong demand for its weight-loss drugs, Mounjaro (tirzepatide) and Zepbound (tirzepatide). However, in October, Eli Lilly reported slower-than-expected Q3 sales, with Mounjaro generating $3.11bn globally and Zepbound generating $1.26bn in the US, according to GlobalData’s Drugs Database in the Pharma Intelligence Center. Despite this, recent results from the SURMOUNT-5 Phase 3b trial revealed that Zepbound delivered a 47% greater relative weight loss compared to rival Novo Nordisk’s Wegovy (semaglutide), further intensifying competition in the weight-loss market.

AbbVie’s market capitalisation grew by 14.8% in 2024, fueled by its acquisitions of ImmunoGen in February and Cerevel Therapeutics in August, totalling $19bn. These strategic moves bolstered AbbVie’s oncology and neuroscience portfolios, with the company reporting a strong Q3 performance. Global net revenue from its oncology portfolio reached $1.687bn, marking an 11.6% increase, while its neuroscience portfolio generated $2.363bn, reflecting a 15.6% growth on a reported basis.

Gilead Sciences achieved a 14% increase in market capitalisation due to the recently submitted a new drug application to the FDA for lenacapavir, a twice-yearly injectable HIV-1 caspid inhibitor for the prevention of HIV as pre-exposure prophylaxis. Data from the Phase III PURPOSE 1 and PURPOSE 2 trials demonstrated lenacapavir’s superior HIV prevention efficacy compared to Gilead’s once-daily oral Truvada (emtricitabine + tenofovir disoproxil fumarate). Additionally, Gilead secured accelerated FDA approval for Livdelzi (seladelphar), a peroxisome proliferator-activated receptor oral agonist, for the treatment of primary biliary cholangitis. These milestones further strengthen Gilead’s position in HIV treatments and liver disease therapeutics.

UCB was a new entrant among the top 20 biopharmaceutical companies, doubling its market capitalisation from $16.9bn in 2023 to $38.7bn in 2024. This growth was largely attributed to the success of its blockbuster drug, Bimzelx (bimekizumab). Initially approved by the FDA for plaque psoriasis in October 2023, Bimzelx has since gained approvals for three additional indications: psoriatic arthritis, non-radiographic axial spondyloarthritis, and ankylosing spondylitis. These approvals have significantly broadened the drug’s potential in treating various inflammatory diseases. Furthermore, UCB has enhanced patient convenience by introducing single-injection administration options in the US.

Novo Nordisk experienced a 16.8% decline in market capitalisation in 2024, largely driven by results from the Phase III REDEFINE 1 trial for its next-generation weight-loss drug, CagriSema (cagrilintide + semaglutide). The trial revealed that participants lost an average of 22.7% of their body weight over 68 weeks, falling short of the company’s anticipated 25% target. This outcome sparked concerns about Novo Nordisk’s ability to maintain a competitive edge in the rapidly expanding obesity and diabetes drug market. However, the company’s Q3 results for 2024 showed a 16.21% increase in global sales of Wegovy and Ozempic (semaglutide), reaching $6.8bn in Q3, as reported by GlobalData’s Drugs Database in the Pharma Intelligence Center.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCSL witnessed a 10.5% decline in market capitalisation in 2024, following its acquisition of Vifor Pharma in August 2022. While the acquisition was intended to diversify CSL’s portfolio of vaccines and blood plasma products, the company has reported that Vifor’s portfolio is facing commercial and regulatory challenges, including reimbursement bundle issues for its pruritus drug, Korsuva (difelikefalin).

The biopharmaceutical industry’s mixed performance in 2024 highlights the growing uncertainty driven by shifting policies and regulatory pressures. Key concerns have emerged regarding Trump’s second term, with renewed scrutiny on drug pricing, inflationary trends, and evolving FDA approval processes creating headwinds for the sector. These challenges have heightened apprehensions across the industry as companies navigate a complex landscape marked by economic instability and policy unpredictability. As the sector looks toward 2025, its outlook remains unclear, with stakeholders and investors closely monitoring potential regulatory shifts and their implications for innovation.