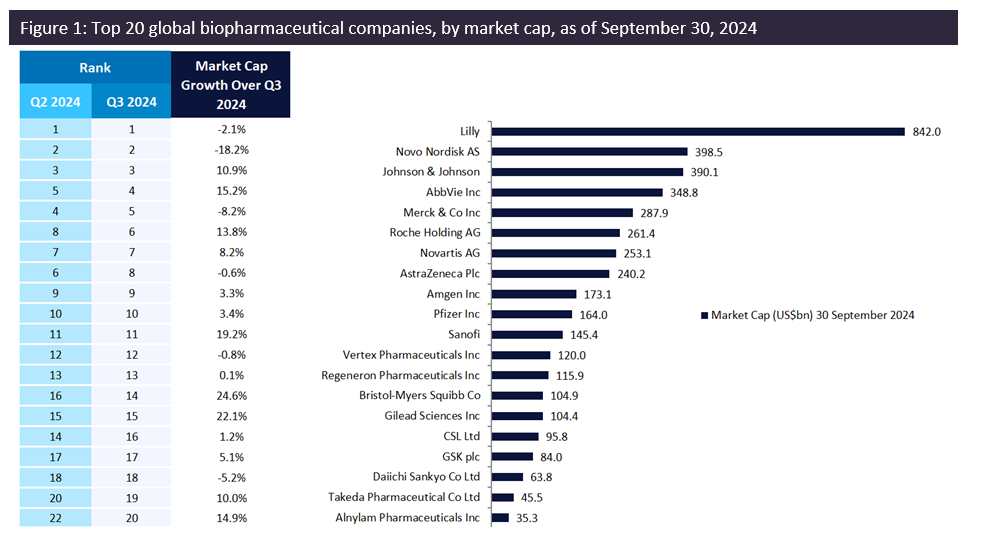

The top 20 biopharmaceutical companies demonstrated signs of recovery during the third quarter (Q3) of 2024 as investor optimism improved following the interest rate cuts by the US Federal Reserve in September 2024. These companies reported a total market capitalisation increase of 2%, from $4.2trn on 30 June 2024 to $4.3trn on 30 September 2024, reveals GlobalData, a leading data and analytics company.

Bristol Myers Squibb (BMS) witnessed the largest growth in market capitalisation of 24.6% to $105bn in Q3 2024, fuelled by robust pipeline progress and the US Food and Drug Administration (FDA) approval of its antipsychotic drug Cobenfy for the treatment of schizophrenia in September 2024. Cobenfy is forecast to achieve drug analyst consensus global sales of $2.4bn by 2030, according to GlobalData’s drugs database. Furthermore, Bristol Myers Squibb signed a $3.5bn licensing agreement with Prime Medicine to develop ex vivo T-cell therapies using Prime’s gene-editing reagents based on its PASSIGE technology, bolstering its cell and gene-therapy pipeline.

Gilead Sciences’ market capitalisation growth of 22.1% was driven by the FDA accelerated approval of its peroxisome proliferator-activated receptor oral agonist Livdelzi for the treatment of primary biliary cholangitis, along with the approval of its antibody-drug conjugate Trodelvy in Japan for the treatment of hormone receptor-/human epidermal growth factor receptor 2- breast cancer. These approvals strengthen its liver diseases portfolio, which includes Vemlidy for hepatitis B, Epclusa for hepatitis C, and Hepcludex for hepatitis D, as well as expand Gilead Sciences’ oncology presence in Japan.

Sanofi reported a 19.2% increase in market capitalisation due to the strong performance of its blockbuster drug Dupixent in Q2 2024 for the treatment of atopic dermatitis, asthma, chronic rhinosinusitis with nasal polyposis, eosinophilic oesophagitis, and prurigo nodularis. Dupixent’s European Medicines Agency and FDA approvals for the treatment of chronic obstructive pulmonary disease, received in July and September 2024, respectively, further fuelled Sanofi’s market capitalisation growth.

AbbVie and Alnylam Pharmaceuticals witnessed comparable market capitalisation growth, with AbbVie reporting 15.2% and Alnylam Pharmaceuticals 14.9% over Q3 2024. AbbVie’s growth was driven by the success of its immunology blockbuster drugs – Humira, Skyrizi, and Rinvoq – with reported sales of $2.8bn, $2.7bn, and $1.4bn, respectively, in Q2 this year. Meanwhile, Alnylam Pharmaceuticals’ growth was primarily due to its RNA interference drug vutrisiran having met its primary endpoint of reduced all-cause mortality and recurrent cardiovascular events in the Phase III HELIOS-B trial for ATTR amyloidosis with cardiomyopathy, positioning the company in the top 20 global biopharmaceutical companies by market capitalisation in Q3 2024.

Roche’s market capitalisation growth of 13.8% was driven by FDA approvals for two key products in September 2024: Ocrevus Zunovo, the first twice-yearly ten-minute subcutaneous injectable for the treatment of relapsing and progressive multiple sclerosis, and Tecentriq Hybreza, a subcutaneous programmed death-ligand 1 (PD-L1) inhibitor for oncology indications. Tecentriq Hybreza is currently the only approved subcutaneous PD-L1 inhibitor on the market.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataNovo Nordisk witnessed an 18.2% decline in market capitalisation in Q3 following the FDA’s rejection of the Biologics License Application filing for its once-weekly Awiqli, which is currently approved in the EU, Canada, Australia, Japan, and Switzerland. Novo Nordisk’s glucagon-like peptide-1 agonist rival, Eli Lilly, had also reported a decline in market capitalisation of 2.1%. Despite this, Lilly and Novo Nordisk maintained their leading positions on the list, owing to the continued success of their weight loss and diabetes drugs Mounjaro/Zepbound (Lilly) and Ozempic/Wegovy (Novo Nordisk).

Merck & Co registered a market capitalisation fall of 8.2% over Q3 2024 due to an unexpected sales decline for its human papillomavirus vaccine cancer vaccine Gardasil in China. Despite this, Merck & Co maintained a strong performance in its Q2 results, driven by a 16% increase in sales of its blockbuster drug Keytruda, which reached $7.2bn.

The biopharmaceutical industry is poised for a recovery, fuelled by multiple FDA approvals leading to a rebound in companies that have seen large declines in market capitalisation in previous quarters such as Gilead Sciences and Bristol Myers Squibb. Interest rate cuts by the US Federal Reserve have enabled industry leaders to drive innovation by advancing their research and development pipelines and entering billion-dollar strategic alliances, which will mitigate the impacts of upcoming patent cliffs.