Looking back over the last 15 years of Alzheimer’s disease (AD) research, it can seem that there’s scant room for hope. There is currently no cure for this debilitating neurodegenerative disease, and the current approved treatments – cholinesterase inhibitors donepezil, rivastigmine and galantamine, and NMDA receptor antagonist memantine – are broadly limited to temporarily alleviating symptoms or slowing down AD progression in some patients.

Despite a decade and a half of R&D and billions of dollars spent on clinical trials, the pharmaceutical industry is struggling to come up with new treatments able to make a material difference to AD progression.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The list of late-stage AD trials reads more like a graveyard than a pipeline. US pharma giant Merck was one of the latest to throw a promising investigational AD drug onto the scrapheap, announcing in February that it was prematurely ending the EPOCH Phase II/III trial of its BACE1 inhibitor verubecestat after an external committee deemed that there was “virtually no chance of finding a positive clinical effect”.

Pfizer withdraws from neuroscience

Even for the pharma industry’s major players, this failure rate is hard to swallow, and large firms are starting to object to throwing good money after bad, no matter what a potential breakthrough could mean for the disease’s nearly 50 million sufferers worldwide. In January, Pfizer announced it was ending new neuroscience research altogether to focus on “areas where our pipeline, and our scientific expertise, is strongest”.

Although the news was discouraging for many in the field, Dr Clare Walton, research communications manager at UK charity Alzheimer’s Society, believes the impact of Pfizer’s withdrawal will be limited by the company having no Phase II or Phase III AD drug candidates in development before its withdrawal. She also disagrees with the assessment of Pfizer’s former head of R&D John LaMattina, who told the Financial Times in January that the company’s withdrawal would likely be followed by similar moves from other companies.

“Actually on the contrary, when Pfizer announced it was withdrawing from neuroscience, quite a few big pharma companies then came out publicly to restate their commitment to the field, specifically Alzheimer’s,” says Walton. “We know a lot of these players that do have compounds in testing have said they are very committed. At the moment, we don’t think that Pfizer’s decision is any indication that it’s going to be a cross-sector decision.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAlzheimer’s: a steep hill to climb

So what are the challenges that make Alzheimer’s such a steep hill to climb from a research perspective? The first and most obvious answer is the complexity of the brain, the least-understood organ in the human body, and the heterogeneity of the disease.

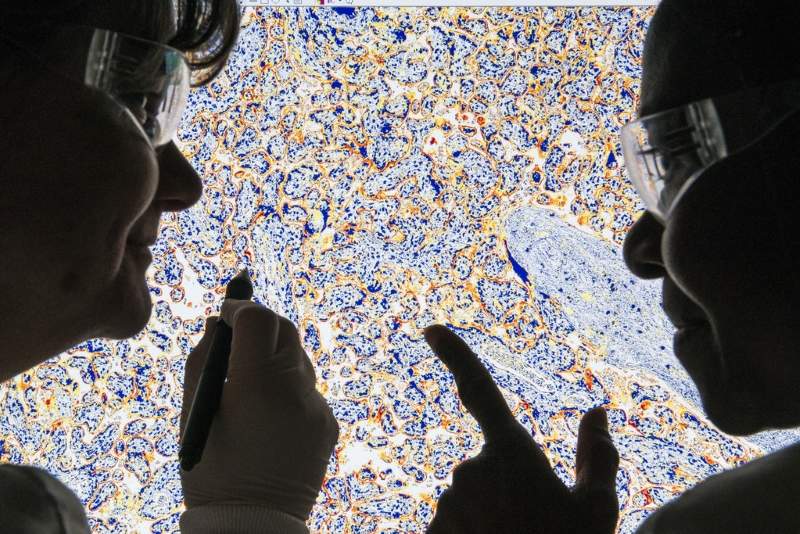

“Historically [Alzheimer’s has] been characterised by cognitive symptoms,” says Walton. “There are obviously a lot of different factors that can impact a person’s cognition, so using behavioural output to identify people has proven difficult, and if you now look at the brain tissue of people who have passed away with a diagnosis of Alzheimer’s, at least 50% of them have mixed pathology. One of the big issues is a lot of the earlier trials were not able to split people up into more homogenous groups, and so obviously the impact of any drugs was diluted.”

On top of the raw research challenges, there is also the expense of running clinical trials. As AD progresses slowly and requires years of patient monitoring to validate the efficacy of investigational drugs, a single Phase III study can cost up to $1bn. Given the brutal economics of AD drug development and the extreme uncertainty of outcome, it’s unsurprising that pharma firms might hesitate before committing a sizeable slice of their R&D budgets.

“You can’t run several programmes of that size, even with a budget like Pfizer’s,” LaMattina told the Financial Times in January. “You can only take one shot, and if you devote a billion dollars to it you’re eating up a large chunk. How many times can these companies take another shot when other parts of science like gene therapy are exploding, and when there’s a desperate need for new drugs to replace opioids? There are many more areas where you can see the goal lines.”

Timing is everything: the amyloid hypothesis

The basis for many of the pharma sector’s recent and current AD trials is the so-called amyloid hypothesis, which contends that Alzheimer’s is caused by a build-up of the protein amyloid in the brain. Anti-amyloid drugs are designed to remove the accumulation of amyloid plaques in the brain, thereby – theoretically at least – mitigating the onset of dementia.

But after a string of high-profile trial failures for drugs that target amyloid, this hypothesis has taken something of a beating. There is no doubt that the amyloid route is firmly rooted in good fundamental science, but there is an increasing feeling that trials of these drugs are targeting AD patients too late in the process, and that targeting amyloid plaques after a patient has shown signs of cognitive decline is already too late.

“There is mounting evidence – of which this is another piece – that removing amyloid once people have established dementia is closing the barn door after the cows have left,” Mayo Clinic professor of neurology Dr David Knopman told Bloomberg after the failure of Merck’s Phase III trial of verubecestat.

So for amyloid-targeting drugs at least, timing is everything. But with cognitive symptoms potentially emerging too late to take action, the race is on to identify dependable biomarkers that can reliably predict AD. Again, the challenges in this area are formidable. Amyloid in the brain or cerebral spinal fluid is one biomarker, but amyloid exists in around a third of people over 65, not all of whom go on to develop the disease.

“We need more specific biomarkers, and I think where research is heading is using different biomarkers in combination, and being able to combine a range of different biomarkers to get a much more predictive score,” says Walton.

Room for hope with diverse AD studies

Despite all the trial failures and gloomy forecasts, there is reason to hope that the next 15 years will see the breakthrough that has been elusive for the past decade and a half. Current industry hopes are riding on Biogen’s anti-amyloid drug aducanumab, which is expected to reveal Phase III trial results in 2019. Walton is cautious, however.

“It’s usually the next one to release that everyone gets excited about,” she says. “There’s a couple of anti-amyloid antibodies in testing, of which aducanumab is probably the one people are most excited about because it has the strongest dose-dependent data showing it can remove amyloid from the brain. So that data is quite encouraging from their Phase II. But we have seen this before with other Phase III amyloid antibodies that have then gone on to fail. So there is hope riding on it, but we will have to wait and see.”

Recent news that Biogen plans to recruit a further 500 patients to its aducanumab trial to help clear up “variability on the primary endpoint” is not a good sign, with some predicting that this indicates that results are not as strong as expected.

Still, more diverse AD studies – not all informed by the amyloid hypothesis – are now being undertaken, and Walton argues it’s unhealthy to focus the majority of R&D efforts on a single target. “The vast majority of trials have been targeting one protein pathway, and obviously that is not the best route to success,” she says.

Repurposed drugs are offering some alternatives, and Alzheimer’s Society is particularly excited about a diabetes drug, liraglutide, which it’s funding for an AD indication. “So far, all the data from the studies has been really positive. So we’re expecting that to end in the next 18 months, and we’re looking forward to seeing how successful that’s been.”

Societally there is much more focus on AD than there has been historically. Regulators are starting to encourage accelerated AD drug development, with the US Food and Drug Administration recently publishing new guidelines that it hopes will smooth the path for treatments that target AD at earlier stages. When looking for a needle in the scientific haystack, a whole society approach is needed, but the potential reward is huge.

“Any one of the drugs that are in testing now could be positive and it would be on the market within five years,” Walton says. “Although that’s unlikely to be a cure, it may be the first treatment that can slow down the disease, and then perhaps we expect similar to what we see in cancer – a combinatorial approach where lots of different drugs come through, attacking the disease from different directions, and together they might be able to have a really transformational effect on the progression of the disease.”