It is common for biopharmaceutical companies that start as private entities to become public companies soon after their key pipeline assets reach the clinical stage of development, in order to unlock the large amount of capital needed to run costly clinical trials.

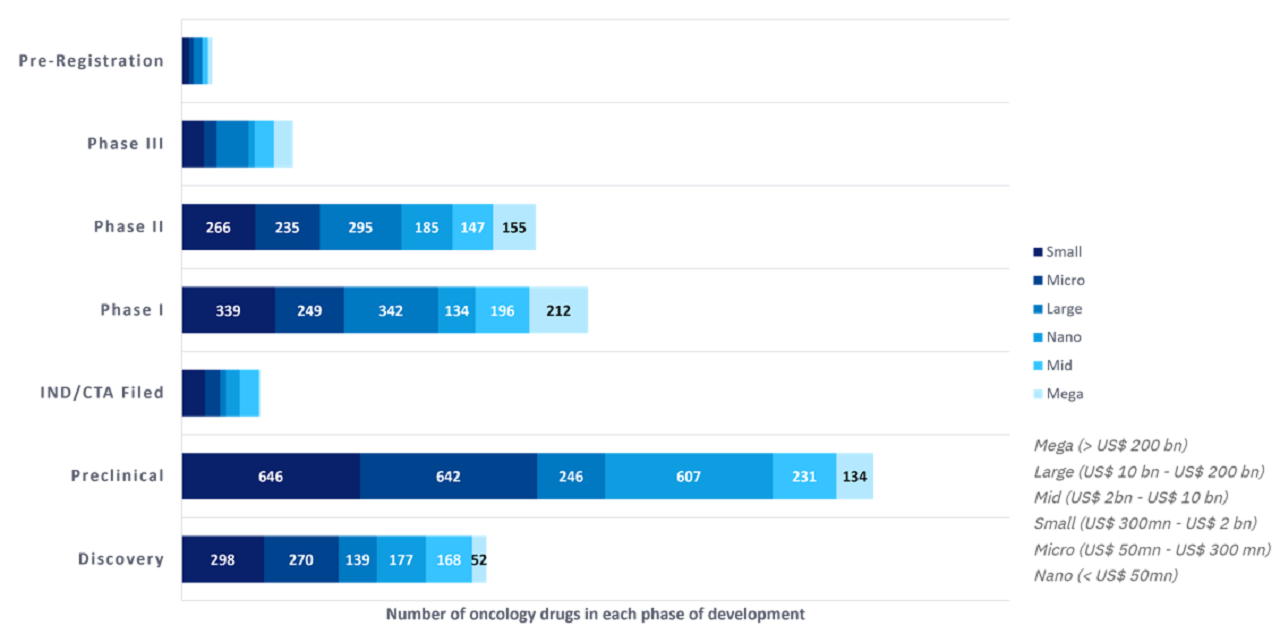

An analysis of GlobalData’s Pharma Intelligence Center shows that small-cap public companies (defined as having a market cap value between $300m and $2bn) are responsible for 1,740, or 24%, of the 7,136 oncology programmes analysed, followed by micro-cap at 21%, and large-cap at 17% (Figure 1).

Mega-cap companies have the smallest number of total oncology programmes, which is not surprising given that there are only eight mega-cap companies in the analysis. Out of all public companies analysed, Bristol Myers Squibb, Roche, and Novartis are the top three developers of oncology drugs.

A limitation of the analysis is that one drug can be present in multiple programmes; for instance, due to label expansion into other cancer types, patient populations, or even geographies.

This means that the total number of programmes does not align perfectly with the number of drugs, and it is widely accepted in the industry that larger companies tend to invest in a larger number of programmes for their most promising assets, resulting in the number of programmes exceeding the number of drugs in the pipeline.

Furthermore, some private companies are subsidiaries of larger public companies, and the subsidiaries are counted separately in the number of programmes.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe 42 large-cap companies analysed lead both the Phase III and the preregistration phases of development, highlighting a concentration of late-stage programmes for these companies.

Amgen, Pfizer, and Takeda are among the leading large-cap companies in terms of their oncology pipelines.

The top three small-cap companies are Biocytogen Pharmaceuticals, ImmunityBio, and Shanghai Henlius Biotech.

The small-cap segment is heavily populated by China-based companies, which represent 35% of the segment, right behind the US’ 38% share of this category.