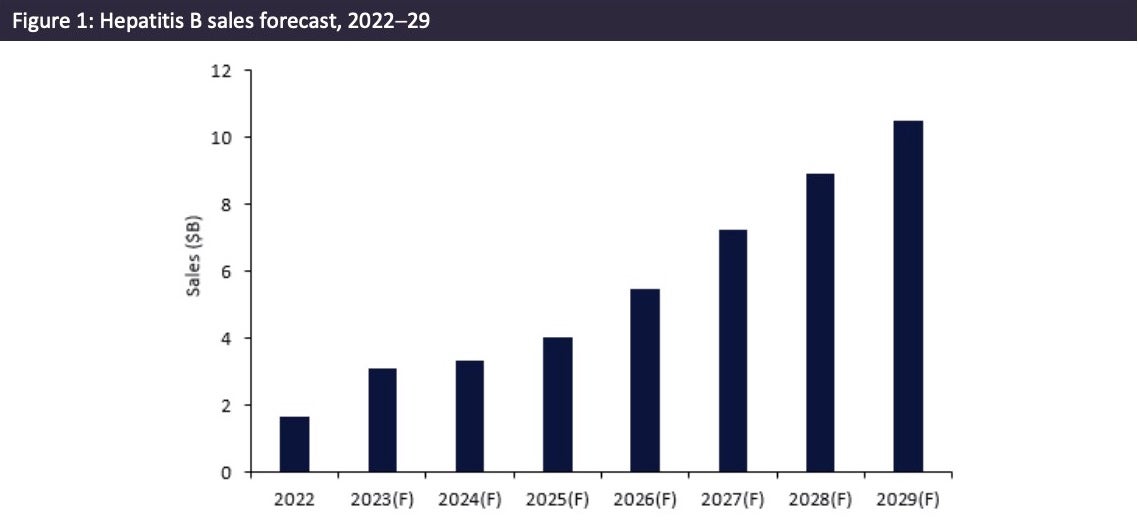

The global prevalence of hepatitis B virus (HBV) infection currently stands at approximately 296 million individuals, with a disproportionate burden of the infection rates in the regions of sub-Saharan Africa and East Asia. According to GlobalData’s drugs database, it is projected that the market for hepatitis B treatments will experience a significant increase over the upcoming six years, with anticipated revenues escalating from $1.6bn in 2022 to a remarkable $10.5bn in 2029. This translates to an impressive compound annual growth rate of 30%.

Hepatitis B is a viral infection that targets the liver, resulting in manifestations of both acute and chronic diseases. It is recognised as a significant worldwide health concern. The market is currently led by Vemlidy, a small molecule reverse transcriptase inhibitor developed by Gilead Sciences, and Zadaxin, a synthetic polypeptide developed by SciClone Pharmaceuticals. These two drugs contributed to 71% of the sales in 2022, demonstrating market dominance. Vemlidy’s and Zadaxin’s projected sales for the year 2023 are estimated to continue rising, reaching $846m and $374m, respectively. Collectively, these two therapeutic agents are anticipated to contribute 40% to the total HBV revenue for 2023. However, a notable shift is expected in the market dynamics by the year 2029 with two drugs currently in the development pipeline forecast to emerge as the leading contenders in terms of sales: EDP-514, a hepatitis B virus core antigen inhibitor developed by Enanta Pharmaceuticals; and Hengmu (tenofovir amibufenamide) a small molecule reverse transcriptase inhibitor, developed by Jiangsu Hansoh Pharmaceutical Group. They are forecast to display revenues of $1.9bn and $813m, respectively, by 2029. In contrast, Vemlidy’s sales are projected to fall to $708m by 2029 at a downward CAGR of 3% between the years 2023 and 2029.

Recently, Enanta Pharmaceuticals announced favourable results from its Phase I trial of EDP-514. The study demonstrated excellent tolerability at various dosages (200mg, 400mg, and 800mg) over a 28-day period, and the compound displayed favorable pharmacokinetics suitable for once-daily oral dosing. These encouraging findings underscore the potential of EDP-514 as a key component in combination therapy to achieve curative outcomes for patients with chronic HBV infections. This substantiates its future sales prospects in the market.

The outlook for the hepatitis B drugs landscape indicates substantial growth and transformation over the coming six years. The projected considerable surge in sales has showcased potential future market leaders whose novel mechanisms of action hold significant promise for patients worldwide, offering hope to improve their quality of life amid the challenges posed by this disease.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData