The pharmaceutical industry continues to be a hotbed of innovation, with activity driven by the evolution of new treatment paradigms, and the gravity of unmet needs, as well as the growing importance of technologies such as pharmacogenomics, digital therapeutics, and artificial intelligence. In the last three years alone, there have been over 633,000 patents filed and granted in the pharmaceutical industry, according to GlobalData’s report on Innovation in Pharmaceuticals: Pancreatic extract-based compositions. Buy the report here.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

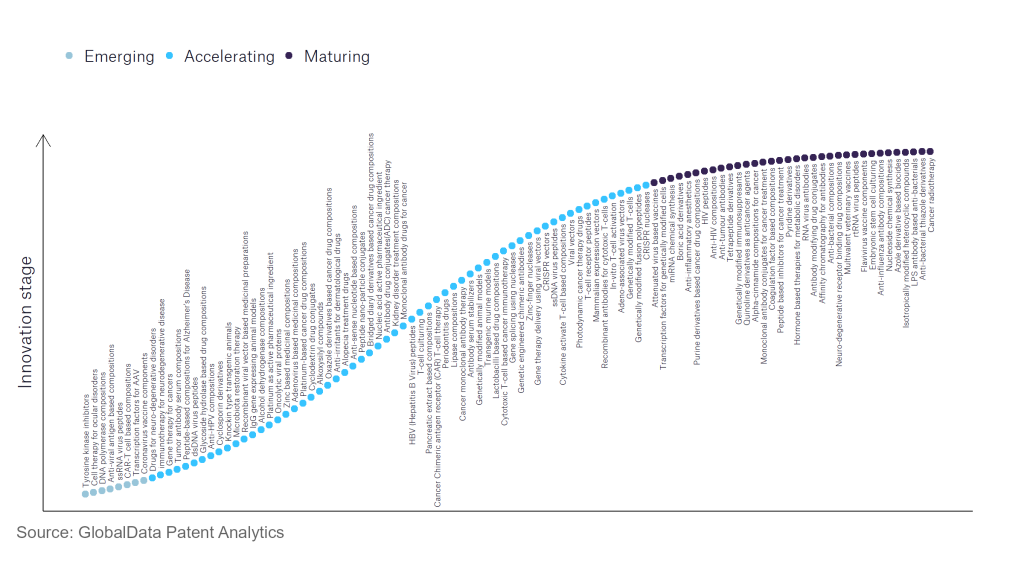

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

110 innovations will shape the pharmaceutical industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the pharmaceutical industry using innovation intensity models built on over 756,000 patents, there are 110 innovation areas that will shape the future of the industry.

Within the emerging innovation stage, cell therapy for ocular disorders, coronavirus vaccine components, and DNA polymerase compositions are disruptive technologies that are in the early stages of application and should be tracked closely. Adeno-associated virus vectors, alcohol dehydrogenase compositions, and antibody serum stabilisers are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are anti-influenza antibody compositions and anti-interleukin-1, which are now well established in the industry.

Innovation S-curve for the pharmaceutical industry

Pancreatic extract-based compositions is a key innovation area in pharmaceutical

Pancreatic enzymes are often used to treat pancreatic insufficiency. Pancrelipase and other pancreatic enzyme products can be administered to at least partially remedy the enzyme deficiency in patients caused by various conditions affecting the pancreas, including pancreatitis and pancreatectomy, as well as diseases such as cystic fibrosis. Pancreatic enzymes can be extracted from the pancreas, artificially produced, or sourced from various other sources, including microbes, plants or other animal tissues.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 50 companies, spanning technology vendors, established pharmaceutical companies, and up-and-coming start-ups engaged in the development and application of pancreatic extract-based compositions.

Key players in pancreatic extract-based compositions – a disruptive innovation in the pharmaceutical industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

ViaCyte is the leading patent filer in pancreatic extract-based compositions. ViaCyte, formerly Novocell and is now being acquired by Vertex, is a regenerative medicine company developing novel cell replacement therapies for the treatment of diabetes to achieve glucose control targets and reduce the risk of hypoglycaemia and diabetes-related complications. Its pipeline product candidates include PEC-Direct (VC-02), which delivers stem cell-derived PEC-01 pancreatic progenitor cells in a non-immunoprotective device to allow direct vascularisation of the cells for treating type 1 diabetes patients; and PEC-Encap (VC-01), which delivers stem cell-derived pancreatic progenitor cells in the Encaptra immunoprotective device for all insulin-requiring diabetes, type 1 and type 2 patients.

ViaCyte is also developing immune-evasive stem cell lines, from its proprietary CyT49 cell line, advancing cell therapy for diabetes and other potential indications. Johnson & Johnson and Takeda Pharmaceutical are the other key patent filers in the pancreatic extract-based compositions space.

In terms of application diversity, Allele Biotechnology and Pharmaceuticals is the top company, followed by Geron and United Therapeutics. By means of geographic reach, Mesoblast holds the top position. Allele Biotechnology and Pharmaceuticals, and Johnson & Johnson stand in second and third positions, respectively.

To further understand the key themes and technologies disrupting the pharmaceutical industry, access GlobalData’s latest thematic research report on Pharmaceutical.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.