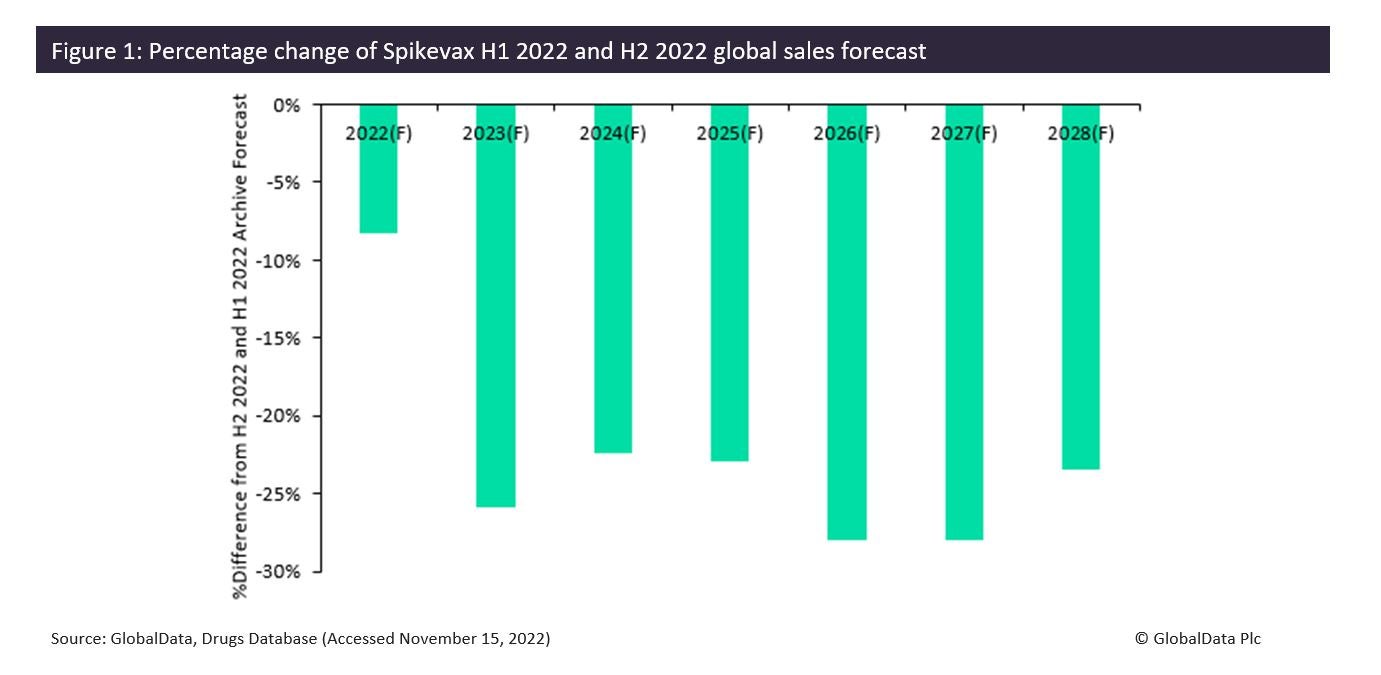

It was an exceptional year for Moderna’s vaccine Spikevax, with forecast sales of $19.5bn in 2022. Despite this, Spikevax’s average annual sales forecast has plummeted by 23% between H1 and H2 2022 according to GlobalData’s Coronavirus Disease 2019 (COVID-19) Sector Forecast reports, due to increasing competition from Pfizer’s Comirnaty, Novavax’s Nuvaxovid, and Covid-19 therapeutics.

Spikevax is an mRNA vaccine that is approved in 20 geographies including the US, EU, and, the UK. The vaccine first gained Emergency Use Approval in December 2020 in response to the Covid-19 pandemic. The vaccine works by encoding spike protein expressed on the surface of coronavirus particles, thus eliciting immunostimulant activity to combat against infection.

Currently, Spikevax is the second bestselling Covid-19 vaccine behind Pfizer’s Comirnaty, which is in the leading position, with forecast sales of $37bn in 2022. Despite this, Spikevax vaccine market share is expected to decline from 30% in 2022 to just 16% by the end of 2028.

As seen in Figure 1, Spikevax annual sales forecasts have dropped by 23% on average between the H1 and H2 2022, GlobalData reports. In 2023, Spikevax sales are expected to fall by 26%, likely due to increased competition from Pfizer’s Comirnaty, which had a strong year, gaining paediatric use approvals for six-month- to 11-year-olds in the US, Canada, and Japan. Furthermore, on 29 June 2022, it was announced that Pfizer won a $3.2bn long-term supply agreement with the US, currently Spikevax’s largest market, which could lead to a loss in market share to Comirnaty in 2023.

Beyond 2023, potential new Covid-19 therapeutics are expected to disrupt the prophylactic vaccine market, with their oral formulations allowing these drugs to be administered at home with little to no medical supervision, with Spikevax being the most impacted. According to GlobalData’s Drugs Database, there are currently 148 therapeutics indicated for Covid-19 in late-stage development, which includes 12 drugs in pre-registration and 136 in Phase III development. One such therapeutic is PBI-0451, which is currently under development by Pardes Biosciences. The therapeutic is expected to be a strong entrant in late 2023, with forecast sales of $2.5bn in 2028.

In the near term, Moderna’s Spikevax will remain a top-selling Covid-19 drug due to Moderna’s existing supply agreements with the EU and Canada. However, in the medium to long term, Spikevax could struggle to compete with direct competitors Comirnaty and new entrants such as Covid-19 therapeutics, which has led to the decline in Spikevax’s forecast sales.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData