Osteoarthritis (OA) is a slowly progressive joint disease that is a major cause of disability and pain among the elderly, second only to cardiovascular disease. The OA space is characterised by a high level of unmet clinical need driven by the limited effectiveness of currently available analgesics and the lack of disease-modifying OA drugs (DMOADs). The current standards of care (SOCs) in OA focus on symptom management and are made up of generic pharmaceuticals, including nonsteroidal anti-inflammatory drugs (NSAIDs), opioids, antidepressants and intra-articular (IA) injections. There are no disease-modifying drugs currently approved for OA.

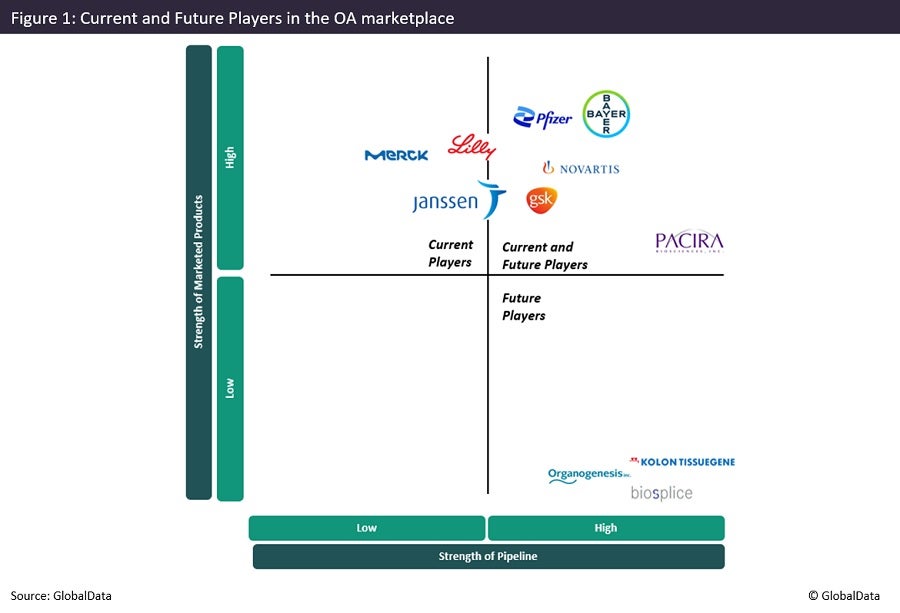

With the treatment paradigm consisting mainly of off-label generic therapies, a few companies dominate the disease space. Notable key players in the NSAID OA market are Novartis with Voltaren (diclofenac) and Bayer with naproxen. Eli Lilly is another key player in the OA market due to duloxetine. But while these products will continue to play a role in the OA treatment market, continued sales erosion is expected due to generics. Similarly, key players in the opioid OA market, such as Janssen with Ultram, are also expected to see a reduction in sales due to reduced opioid prescriptions worldwide.

Major guidelines recommend IA injections in the form of corticosteroids and hyaluronic acid, especially in the knee and hip. As such, IA injections represent a significant share of the OA market. Key players in this segment are Pfizer with Medrol and Merck with betamethasone acetate and betamethasone sodium phosphate. These products will, however, face significant competition from newer products such as Zilretta (Pacira BioSciences), as well as novel analgesics such as lorecivivint (Biosplice Therapeutics).

Crucially, the anticipated launch of new DMOAD pipeline therapies in the next few years (2022–31) will likely significantly change the OA market. As such, companies currently developing DMOAD therapies such as Kolon TissueGene and Organogenesis Holdings will likely be future players in the OA market. Overall, the OA space remains a lucrative opportunity for drug developers due to the high prevalence of OA and the unmet need for a DMOAD that addresses the underlying disease instead of simply pain relief.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData