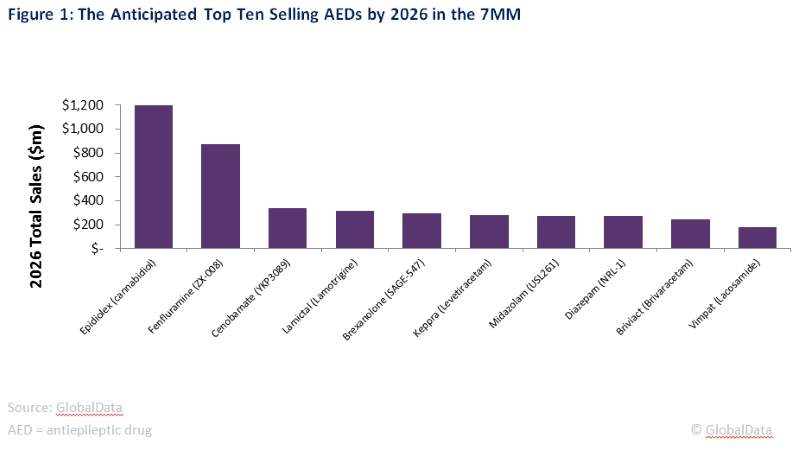

Figure1: the anticipated top selling AEDs by 2026 in the 7MM

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

AED = antiepileptic drug

According to GlobalData’s upcoming report 'PharmaPoint: Epilepsy', the 2016 market was worth $6.11bn in the seven major pharmaceutical markets (7MM), with more than 20 antiepileptic drugs (AED) on the market.

The late-stage pipeline has six new products including novel classes and reformulations, which have been developed to address longstanding unmet needs in the market. These pipeline products are expected to be the major drivers of growth in the epilepsy market, and by the end of the forecast period for 2016, all six are anticipated to make it into the top ten selling AEDs, as seen in Figure 1.

By 2026, the two top selling AEDs are expected to be GW Pharmaceutical’s Epidiolex (cannabidiol) and Zogenix’s flenfluramine, with Epidiolex expected to reach blockbuster status in 2024. Both of these drugs have shown efficacy in patients that suffer from rare, orphan epilepsy syndromes, particularly Lennox-Gastaut Syndrome (LGS) and Dravet Syndrome.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataEpidiolex and flenfluramine will be premium-priced. If these drugs are successful in these patient populations, it is likely GW Pharmaceutical and Zogenix will apply for label expansions, allowing them to be used in a broader spectrum of patients.

SK Biopharmaceutical’s cenobamate is forecast to become the third highest-selling AED in the epilepsy space by the end of the forecast period. This drug is aimed specifically at refractory patients who have failed to respond to anywhere from one to three AEDs. This population represents 30% of epilepsy patients, which means that the drug will have a considerable patient pool. However, the price of cenobamate must be low enough to keep it competitive with other branded AEDs, which will limit its sales.

The remaining three drugs in the pipeline are expected to generate up to $300m each by 2026 because they partly address some longstanding unmet needs in the epilepsy market. Neurelis and Upsher-Smith Laboratories are both developing nasal sprays for the treatment of acute repetitive seizures (ARS). This formulation is favorable to the rectally administered Diastat and buccal midazolam, and thus is expected to increase compliance in patients.

SAGE Therapeutics’ brexanolone is being indicated for patients suffering from super refractory status epilepticus (SRSE). While this is patient population is particularly small, the high annual cost of therapy (ACOT) will drive sales. If successful in this patient population, SAGE will likely look for a label expansion that allows brexanolone to be used earlier in the treatment algorithm.

The remaining four drugs anticipated to be top sellers in the epilepsy space are branded versions of recently marketed drugs, specifically Union Chimique Belge’s Keppra (levetiracetam), Vimpat (lacosamide) and Briviact (brivaracetam), and GlaxoSmithKline’s Lamictal (lamotrigine). While all of these are expected to have their patents expire by the end of the forecast period, physicians are still likely to prescribe them, as these four branded drugs have been shown to have the best efficacy profiles out of the currently marketed AEDs.

Related Reports

GlobalData (2017). Expert Insight: Takeda and Ovid to Co-develop Drug for Rare Pediatric Epilepsies, January 2017, GDHC1176EI

GlobalData (2016). Expert Insight: Results from Ganaxolone Phase II Clinical Trials Shows Promise in Treating Rare Form of Pediatric Epilepsy, October 2016, GDHC1134EI

GlobalData (2016). Expert Insight: Epidiolex Moves Closer Toward Satisfying the Urgent Need for a Novel Therapy for Childhood Epilepsy, April 2016, GDHC01048EI

GlobalData (2017). PharmaPoint: Epilepsy – Global Drug Forecast and Market Analysis to 2026, to be published, GDHC154PIDR