Within six months of launching, Switzerland-based biotech FoRx Therapeutics has closed its seed funding round with €10m raised. The round was led by the venture capital (VC) arms of two big pharma companies, Merck group and Novartis, as well as Omega Funds. Pfizer Ventures and Life Science Partners also joined the financing. These five investors have all supported the company since its launch.

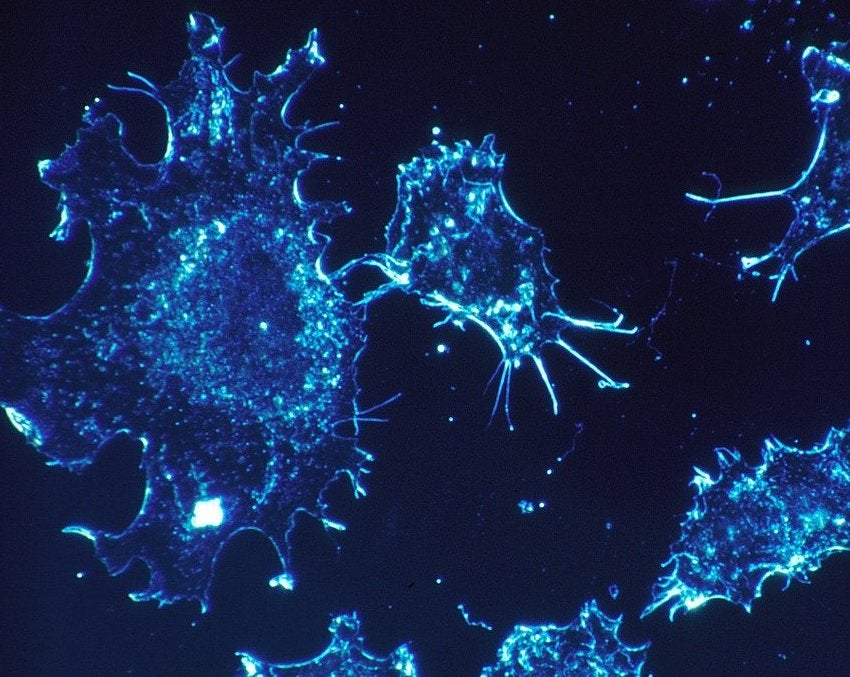

FoRx is based on the ground-breaking work of the University of Geneva’s Thanos Halazonetis. He discovered novel DNA repair pathways, such as break-induced replication (BIR), that enable cancer cells to overcome DNA replication stress (DRS) and which are absent in normal, healthy cells.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

“Inhibition of BIR has been shown to reduce cancer progression in mouse models, but has no effect on normal mice, suggesting few adverse effects,” Halazonetis explains. “Therapeutic candidates would thus be expected to have a highly differentiated safety profile and very high specificity for cancer cells.”

This novel targeting approach fits with an emerging trend in oncology: developing drugs against targets that are applicable across various tumour types. This differs from standard-of-care therapies, such as PARP1 inhibitors, which are only “effective in the subset of cancers that have inactivating mutations in the BRCA1 and BRCA2 genes,” Halazonetis notes.

He adds that the seed funding FoRx has raised is going to be used to “perform screening assays and to develop and optimise leads towards investigational new drug approval” to advance any promising therapies into clinical trials.

Attracting the interest of big pharma

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataM Ventures, the venture arm of the Merck group, invests from a €400m evergreen fund into “companies and technologies in highly novel spaces that may be of future strategic fit to the mother organisation,” principal Therese Maria Liechtenstein says.

FoRx fits this bill because Halazonetis’s research on DRS suggests an ‘Achilles’ heel’ of cancer cells and these targets improve upon the DNA damage response (DDR) approach, which has been a focus of the Merck group’s oncology research. Liechtenstein concludes: “We’re excited to see the company develop these therapeutic concepts from bench eventually to patients.”

Novartis Venture Fund (NVF) managing director Florian Muellershausen explains his company’s reasons for investing in FoRx: “In oncology, we are focusing on novel and differentiated ideas from innovative founders. FoRx is especially attractive, as targeting of the break-induced repair pathway will have broad applicability across a range of cancer types, while most other synthetic lethal approaches go after cancers with one very specific oncogenic driver.”

More than just investment

Importantly, investment from big pharma VC wings represents more than just financial support for biotechs.

Muellershausen notes that FoRx rents lab space from the Novartis campus in Basel, Switzerland; this has allowed NVF to play “a very active role in creating the company and supporting operations”, which is something the investor plans to continue as FoRx continues its journey towards “becoming an established player in the oncology biotech landscape”.

Liechtenstein notes that M Ventures offers longer-term support due to its evergreen investment approach. Early on, this could be with business strategy or research and development plans, but can also involve stewarding start-ups to maturity through an initial public offering, merger or acquisition.

“[FoRx] is specifically supported by one of the M Ventures Entrepreneurs In Residence – Andreas Goutopoulos – thereby ensuring that the company has world-class chemistry expertise right from the get-go,” Liechtenstein says.

Making deals in a pandemic

Rather than seeing the coronavirus pandemic as a deterrent for investment into emerging biotechs, Liechtenstein notes that for M Ventures, the global outbreak is a powerful reminder of the importance of investing in early-stage clinical research.

“The challenging situation created with Covid-19 is a strong incentive and a reminder to us all on how important healthcare is, and that scientific innovation is needed in all fields of medical care,” she says. “We continue supporting and investing in the biotech ecosystem as M Ventures as before, creating and progressing drugs and technologies that can provide paradigm-changing benefits to patients.”